Celer Network (CELR) Testing Falling Wedge Resistance: Could a Breakout Trigger a Rally?

Date: Sat, Feb 01, 2025, 05:13 AM GMT

In the past 24 hours, the cryptocurrency market has seen a surge in altcoins, fueled by Ethereum’s breakout and a decline in Bitcoin’s dominance, which now stands at 58.74%.

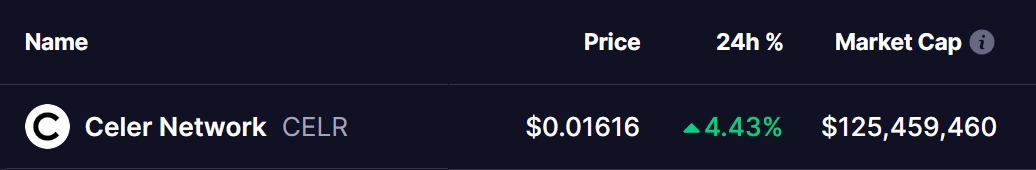

Following the altcoins momentum, Celer Network (CELR), are also gaining traction, showing noticeable upward momentum.

Source: Coinmarketcap

Source: Coinmarketcap

Crypto analyst Jonathan Carter has provided a detailed technical breakdown, suggesting that the token could be on the verge of significant breakout.

Analyst Insight

Technical analysis suggest that CELR is on the verge of a bullish reversal, with the price currently testing the resistance of a falling wedge pattern on the 6-hour chart. Crypto analyst Jonathan Carter highlights that this setup could lead to a breakout, pushing CELR towards higher resistance levels if buying pressure continues to build.

Celer Network (CELR) 6H Chart/Source: @JohncyCrypto (X)

Celer Network (CELR) 6H Chart/Source: @JohncyCrypto (X)

Currently, CELR is trading at $0.016. If CELR breaks above the wedge resistance, the next targets are $0.0175, $0.0192, $0.0210, $0.0230, and $0.0250. The 100-day moving average (MA) at $0.0160 serves as the immediate barrier that needs to be cleared for further upside.

On the downside, if CELR fails to break out, the price could pull back towards the support zone near $0.0138, where buyers are likely to step in and defend the price from further decline.

Technical Indicators Supporting the Breakout

The Relative Strength Index (RSI) is recovering from oversold conditions, suggesting increasing bullish momentum. Additionally, the trading volume near resistance is rising, indicating growing interest from traders who anticipate a breakout. If CELR manages to maintain this upward momentum, a strong price rally could follow.

Final Thoughts

With Ethereum’s breakout boosting the altcoin market and Bitcoin dominance declining, sentiment is turning bullish. If CELR successfully breaks out of the falling wedge, it could join the broader market rally and post significant gains in the coming days. Traders should watch for a decisive move above resistance, as this could confirm the start of a strong uptrend.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report | Detailed Analysis of Sign Protocol & Sign Market Value

Pudgy Penguins Token PENGU Makes 100% Gains Amid Meme Coin Mania

Solana (SOL) on Verge of Critical Downfall, Bitcoin (BTC) Eyeing $100,000, XRP: Sleeping or Skyrocketing?