Bitcoin’s Stability Tests Market Theories as Key Metric Hits New Phase

- Bitcoin’s VDD multiple drops below 0.75 as long-term holders retain coins despite prices holding above $105,220 in early 2025.

- Daily active addresses stabilize between 71K-89K; transaction volumes show baseline activity, indicating organic network usage over speculation.

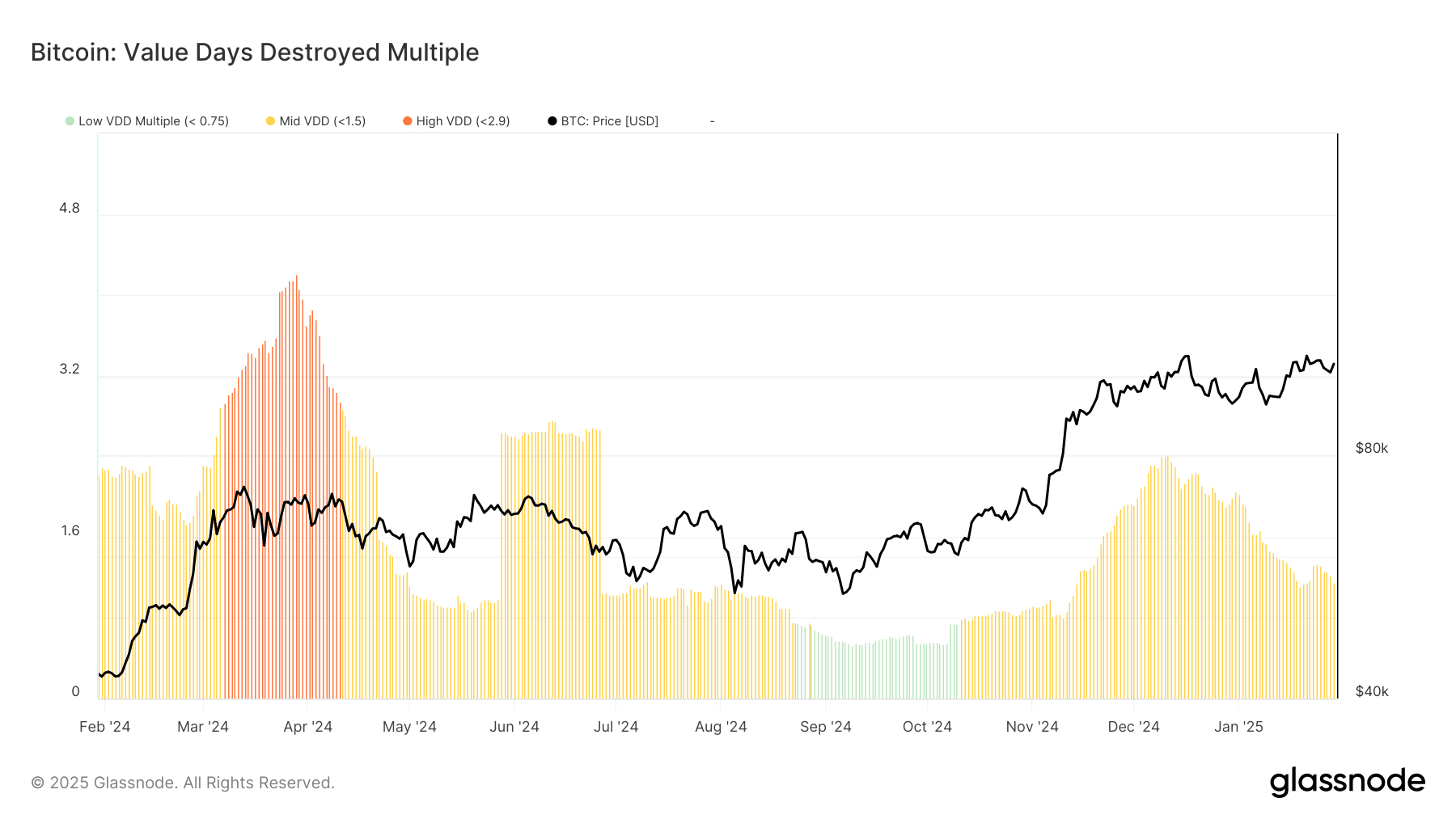

Bitcoin’s Value Days Destroyed (VDD) multiple, a metric tracking coin movement patterns, has fallen below 0.75 in early 2025. This marks a contrast to April 2024, when the metric exceeded 2.9.

Despite the decline, Bitcoin’s price remains above $105,220, suggesting long-term holders are retaining assets rather than selling during price increases. The VDD measures the ratio of coin dormancy periods to transactional activity, with lower values indicating reduced movement of older coins.

Source: Glassnode

Source: Glassnode

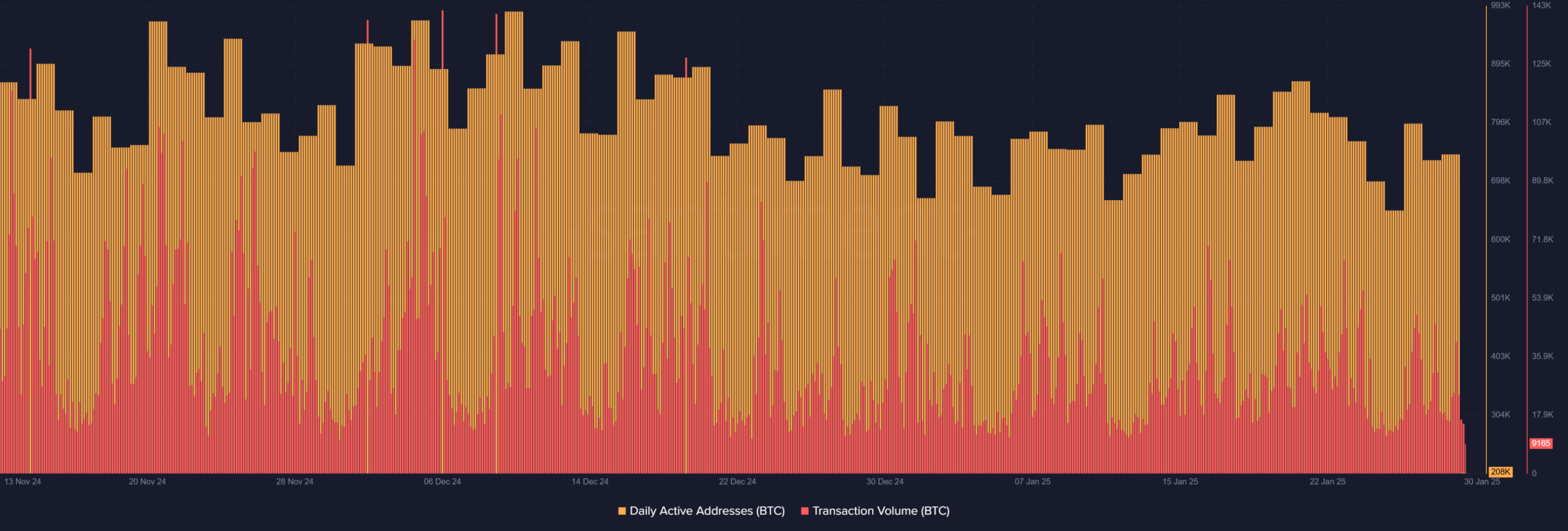

Network activity supports this observation

Daily active addresses fluctuate between 71,000 and 89,000, while transaction volumes show consistent baseline levels. This stability implies routine usage rather than speculative trading.

Source: Santiment

Source: Santiment

The correlation between active addresses and transaction volumes has tightened, reinforcing the idea of organic network engagement. Such patterns often align with mature market phases, where participants prioritize holding over frequent trading.

Bitcoin’s technical indicators add context to its price

The cryptocurrency trades at $105,220.36, a 1.42% daily gain. Its 50-day moving average sits at $99,251.53, above the 200-day average of $77,341.17. This signals bullish momentum , as shorter-term trends outpace longer-term ones.

Source: Tradingview

Source: Tradingview

The price stability above $100,000, paired with subdued VDD readings, points to accumulation behavior among long-term investors . Historically, similar conditions have preceded upward price trends.

Long-term holders appear confident, as evidenced by reduced coin circulation. However, steady active address counts suggest ongoing participation, potentially from new entrants. This balance between retention and engagement creates a foundation for price durability. ETHNews analysts note that low VDD multiples often coincide with periods where supply tightens, which can amplify price reactions to shifts in demand.

Looking ahead, Bitcoin’s trajectory may depend on external factors. Regulatory developments, macroeconomic conditions, and technological upgrades could influence behavior. For now, the network’s technical health and investor discipline provide a buffer against volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report