Crypto Whales’ $500 Million Exodus Puts Pressure on XRP’s Price Stability

Despite whale sell-offs, XRP remains stable above $2.95. Can long-term holders and whale accumulation push it past its $3.40 all-time high?

XRP is attempting to form a new all-time high (ATH), but its price action remains volatile. The altcoin has repeatedly tested the $2.95 support level, struggling to maintain upward momentum.

While whale selling has contributed to the uncertainty, long-term holders (LTHs) are playing a key role in preventing a steep decline.

XRP Whales Move To Sell

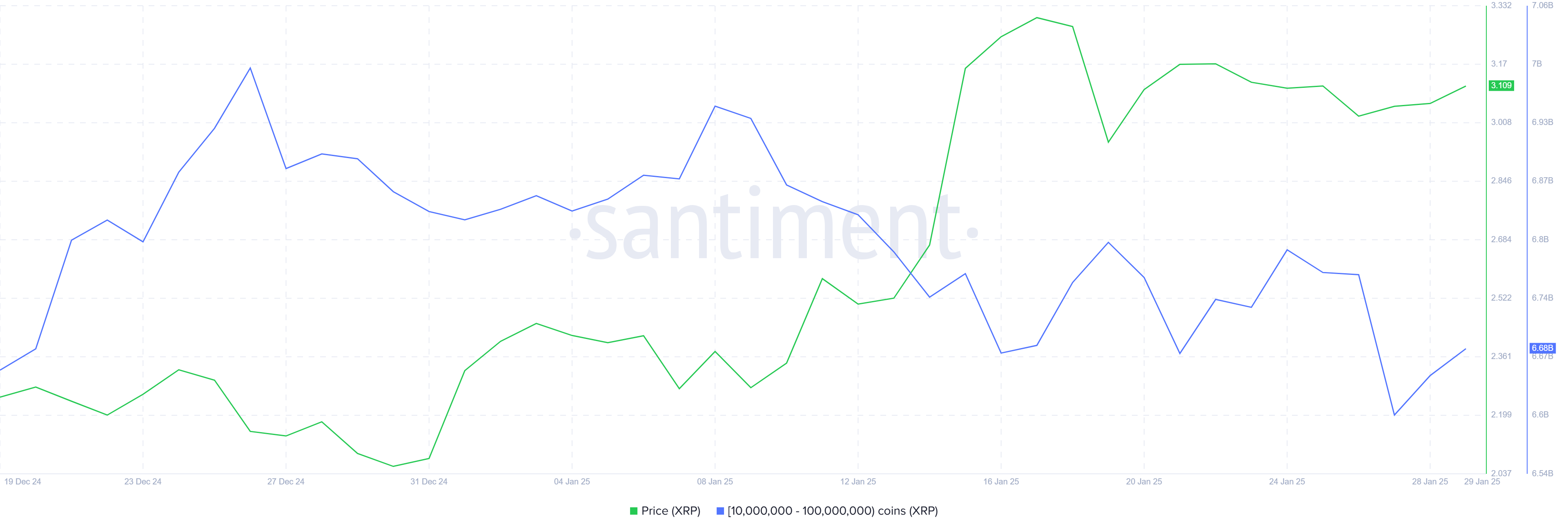

Whale addresses holding between 10 million and 100 million XRP sold approximately 160 million tokens in a single day this week. The total value of these transactions was nearly $500 million, highlighting the growing concern among large holders regarding XRP’s inability to sustain a rally. The lack of upward momentum has led some whales to take profits rather than hold their positions.

However, the selling pressure may be short-lived. Some of these whales have begun reacquiring XRP, signaling renewed confidence in the asset’s long-term potential. If this trend continues, it could provide the necessary support for XRP to reclaim key resistance levels and attempt another push toward its ATH.

XRP Whale Holding. Source:

Santiment

XRP Whale Holding. Source:

Santiment

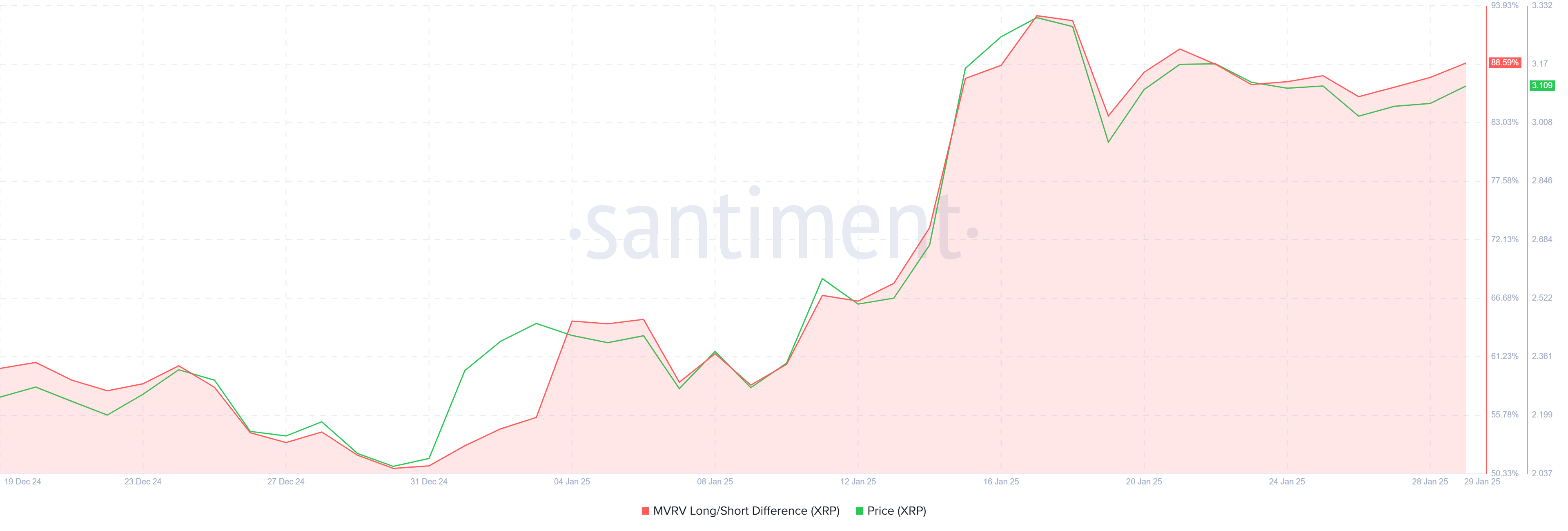

XRP’s broader macro momentum remains strong, as indicated by the MVRV Long/Short Difference, which is currently highly positive. This suggests that long-term holders remain in profit, reinforcing their commitment to the asset. Historically, LTHs play a crucial role in maintaining price stability, reducing the likelihood of sharp sell-offs.

With these investors refraining from selling, XRP is in a better position to sustain its current levels. The presence of strong hands in the market supports the argument that XRP could continue its upward trend, provided that broader market conditions remain favorable.

XRP MVRV Long/Short Difference. Source:

Santiment

XRP MVRV Long/Short Difference. Source:

Santiment

XRP Price Prediction: Aiming For The ATH

At the time of writing, XRP is trading at $3.10, holding above the $2.95 support level. This threshold has been tested twice in the past ten days, highlighting its importance in preventing further declines. A successful defense of this level could set the stage for a potential rally.

Despite bullish signals, reclaiming the ATH of $3.40 may prove challenging. However, if whales move to repurchase the XRP they previously sold, the asset has a stronger chance of rallying. Such accumulation could push XRP beyond $3.40, marking a new milestone for the altcoin.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

Conversely, if XRP loses the $2.95 support before initiating a rally, investor sentiment could shift bearish. This scenario may trigger increased selling pressure, sending XRP down to $2.73 or lower. Such a move would invalidate the current bullish-neutral outlook and expose XRP to further downside risk.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report