'I like profitability': Czech central bank chief proposes allocating up to 5% of reserves to bitcoin: FT

Quick Take Czech National Bank Governor Aleš Michl wants to add billions of dollars worth of the country’s reserves into bitcoin, the Financial Times reported. Michl told the FT he will present a bitcoin investment plan to the bank’s board on Thursday to diversify its reserves.

Czech National Bank Governor Aleš Michl is set to submit a plan to allocate as much as 5% of its €140 billion ($146 billion) of reserves to bitcoin, according to The Financial Times.

Michl told the FT he will present the bitcoin investment plan to the central bank’s board on Thursday to diversify its reserves. If approved, the CNB would become the first central bank known to hold the foremost cryptocurrency.

The governor acknowledged bitcoin’s volatility and limited record but highlighted increased investor interest since BlackRock and other asset managers launched U.S. spot Bitcoin exchange-traded funds and President Trump’s campaign pledges on crypto deregulation and the creation of a bitcoin strategic stockpile.

“For the diversification of our assets, bitcoin seems good,” Michl told the FT in an interview. “Those [Trump] guys can now kind of create some bubble for bitcoin, but I think the trend would be an increase without those guys as well, because it’s an alternative [investment] for more people.”

Michl noted he had a “totally different philosophy” on bitcoin compared to most of his counterparts. “Of course, if you compare my position with other bankers, then I’m the one entering the jungle, or the pioneer,” Michl told the outlet. “I used to run an investment fund, so I’m a typical investment banker I would say, I like profitability.”

More central banks could follow

The CNB chief added that more central banks could follow his lead over the next five years, but also warned that the investment could end up proving worthless.

“It’s possible to have a big range of outcomes, that bitcoin will have a value of zero or an absolutely fantastic value . . . but in our history we have also had some stocks like Enron or the payment company Wirecard, so we have some experience with bad investments, so, yes, I’m ready [for a possible bitcoin collapse],” he said.

The CNB estimated that holding 5% of its foreign reserves in bitcoin over the past decade would have boosted annual returns by 3.5% but also doubled their volatility.

Escalating plans

The news follows reports earlier this month that Michl was considering bitcoin for potential reserve asset allocation. However, speaking with local media company CNN Prime News on Jan. 6, the central bank chief said there were no concrete plans to acquire cryptocurrency.

"Sure, I consider bitcoin, but there are seven of us on the board," Michl said at the time, adding that discussions would continue. "Bitcoin is an interesting option for diversification against other assets."

"I was thinking of acquiring just a few bitcoin, but I never intended to make a significant investment," Michl added.

However, if his plan is approved, the potential 5% allocation could see as much as $7.3 billion worth of the digital asset acquired. The bank also plans to increase its gold reserves to approximately 5% of total assets by 2028.

The CNB’s potential bitcoin allocation marks the latest step in the country’s increasingly crypto-friendly stance, following the passage of a law on Dec. 6 exempting bitcoin holdings of over three years from capital gains tax. This legislation, which was unanimously approved by the Czech parliament, took effect on Jan. 1.

In 2021, El Salvador became the first country to roll out an official bitcoin treasury program , though the funds are held by the government, managed by a state development bank rather than its central bank. President Trump also recently issued an executive order establishing a task force to explore a strategic digital asset reserve in the U.S.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano Surges 17%, Eyes Potential $5 Target

Cardano’s Price Recovery Suggests Potential Bullish Trend But Risks Remain Below $0.70

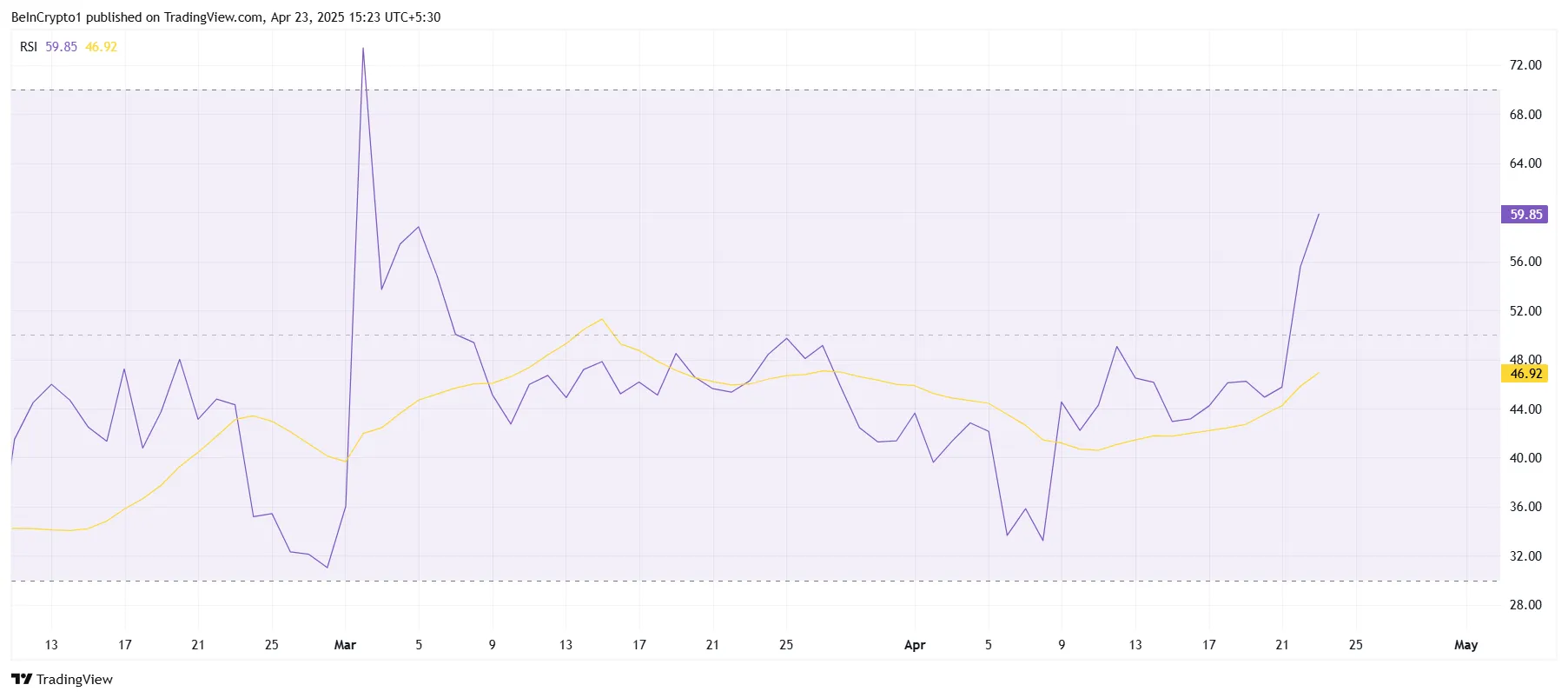

Bitcoin: Crucial Metric Signals Bullish Momentum

Bitcoin Price Faces Crucial $97K Resistance, Glassnode On-Chain Data Reveals