Ultra’s Breakout Rally: Why $0.50 Could Be the Next Frontier

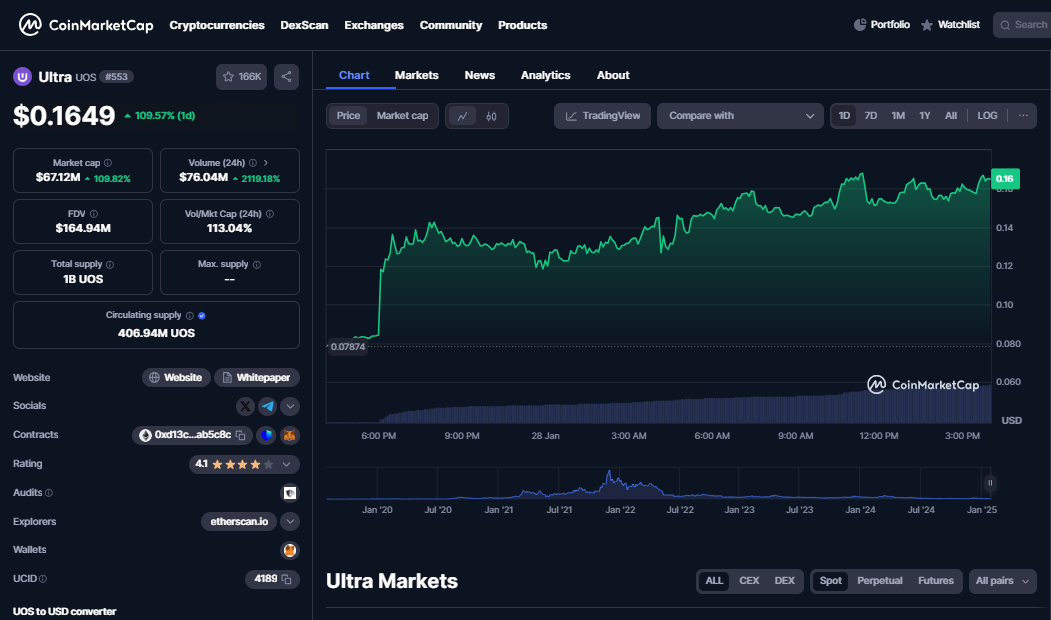

- Ultra (UOS) surged 109% in 24 hours, trading at $0.1649 after breaking key levels.

- The token targets $0.50 by 2025 due to its strong growth and ecosystem expansion.

- Ultra partnered with Thomson to deliver seamless gaming and blockchain integration.

Ultra (UOS) has surged 109.57% in the past 24 hours, climbing to $0.1649 from a low of $0.07874, according to CoinMarketCap. This rapid rise is supported by a 2119.18% addition in trading volume, reaching $76.04 million, and a 109.82% jump in market capitalization, now at $67.12 million. Strong Fibonacci breakouts and strategic partnerships that signal further growth in blockchain gaming can be attributed to these results.

Source:

CoinMarketCap

Source:

CoinMarketCap

Trading Momentum and Fibonacci Analysis

The price rally began with a strong wedge breakout near $0.073, showing consistent momentum throughout the day. Ultra has reclaimed key Fibonacci retracement levels: 38.2% ($0.142), 0% ($0.129), and 61.8% ($0.116). This highlights growing bullish control over the token’s market trend. The token currently hovers near the 23.6% retracement ($0.159), which serves as immediate resistance, while support has formed around $0.097.

Source:

TradingView

Source:

TradingView

Ultra’s fully diluted valuation is $164.94 million, supported by a high volume-to-market-cap ratio of 113.04%, signaling investor interest. If the current momentum is sustained, the token could aim for a short-term target of $0.20 while setting its sights on $0.50 by late 2025.

Strategic Moves and Unprecedented Extension

Ultra’s blockchain-based gaming platform continues to attract attention, boasting 166k CoinMarketCap watchlist entries. This surge aligns with its recent partnership with Thomson Computing, which integrates Web3-enabled laptops into Ultra’s ecosystem. This collaboration enables a wide range of blockchain games, offering a seamless gaming experience.

Thomson Computing’s cutting-edge technology, including its integrated cold storage wallet, ensures secure management of digital assets. This strategic partnership reflects Ultra’s vision to disrupt monopolies in game distribution, paralleling how Netflix transformed the film industry.

Related: Hoskinson Unveils Quantum HOSKY Game Launch in January

Breaking Barriers in Blockchain Gaming

The collaboration positions Ultra as a leader in European-led innovation, challenging tech dominance from Asia and the United States. With its circulating supply at 406.94 million UOS out of a total supply of 1 billion UOS, Ultra’s fundamentals align with its long-term growth potential.

As Ultra breaks resistance levels, analysts project further growth in market value. The chart suggests bullish momentum may propel the token toward $0.50–$0.60 by the end of 2025, driven by ecosystem expansion and technological advancements.

The post Ultra’s Breakout Rally: Why $0.50 Could Be the Next Frontier appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TradFi's deep liquidity issue is crypto's silent structural risk

Fidelity files for Solana ETF with staking option in US

Chamath projects $600 billion hit to US economy from tariffs, interest rate cuts

Ethereum Maintains Support, Attracts Institutions Despite ETF Outflows