From Skeptic to Advocate: How BlackRock and Larry Fink Are Leading the Crypto Revolution

BlackRock, the world’s largest asset manager, continues to dominate crypto headlines with its Bitcoin ETF developments , advocacy for tokenized assets, and CEO Larry Fink’s remarkable evolution from Bitcoin skeptic to advocate. From acquiring Bitcoin to calling for SEC approval of tokenized stocks and bonds, BlackRock is redefining the financial landscape which might end with a crypto revolution. Here are the BlackRock news and Larry Fink's latest announcements.

Larry Fink’s Journey: From Bitcoin Skeptic to Advocate

Larry Fink’s stance on Bitcoin has transformed dramatically over the years. In 2017, he referred to Bitcoin as an “index of money laundering,” expressing deep skepticism about the cryptocurrency’s legitimacy. However, by 2024, Fink publicly acknowledged that he had been “wrong” about Bitcoin. He now describes it as “digital gold” and a “legitimate financial instrument” that offers long-term value and stability.

BlackRock Bitcoin ETF: A Milestone in Institutional Adoption

BlackRock’s recent acquisition of 11,000 Bitcoin for its iShares Bitcoin ETF signifies a pivotal moment for institutional cryptocurrency adoption. This move aligns with Fink’s newfound confidence in Bitcoin as a transformative asset class. The ETF’s success, with over $1 billion in trading volume, highlights growing investor interest in regulated crypto investment options.

Nasdaq’s In-Kind Redemption Proposal: Enhancing Efficiency

A recent Nasdaq proposal to the SEC aims to implement an “in-kind” creation and redemption process for BlackRock’s iShares Bitcoin ETF (IBIT) . This mechanism would allow authorized participants to transact directly in Bitcoin rather than converting holdings to cash, reducing intermediaries and increasing operational efficiency.

Notably, this process is exclusive to institutional participants, which further enhances the ETF’s appeal to large-scale investors. With BlackRock’s IBIT seeing inflows of $2 billion over six consecutive days, this upgrade is set to boost its operational and financial efficiency, making it an even more attractive option for institutional adoption.

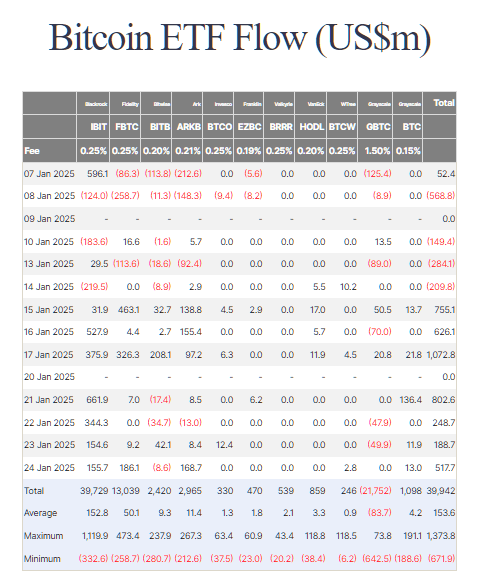

By FarSide - BTC ETF Flow 2025-01-25

By FarSide - BTC ETF Flow 2025-01-25

Bitcoin All-Time High and Future Potential

Following the buzz around BlackRock Bitcoin ETF and Fink’s endorsement of Bitcoin as “digital gold” was what fueled optimism about Bitcoin reaching new all-time highs (ATH). Analysts point to increasing institutional adoption and rising trading volumes as key drivers for Bitcoin’s future growth.

Recently, Fink suggested that Bitcoin’s price could soar to “$700,000” if institutional investors allocate even 2% to 5% of their portfolios to the cryptocurrency. This bold Bitcoin price prediction further underscores his shift from critic to one of Bitcoin’s most influential advocates, reflecting a broader trend among financial leaders becoming more receptive to digital assets.

Advocacy for Tokenized Bonds and Stocks

Fink’s push for the SEC to approve tokenized financial instruments like bonds and stocks showcases his belief in blockchain technology’s potential to modernize traditional finance. Tokenization involves representing these assets as digital tokens on a blockchain, which can improve transparency, reduce costs, and streamline settlement processes.

BlackRock Pioneers the Crypto Revolution

BlackRock’s transformative initiatives, from its Bitcoin ETF to Larry Fink’s advocacy for tokenized assets, are reshaping both crypto and traditional financial markets. Fink’s journey from skepticism to confidence in Bitcoin reflects a broader shift among financial leaders toward embracing digital assets. With record-breaking trading volumes, bold price predictions, and a push for blockchain-based tokenization, BlackRock is leading a crypto revolution that could redefine the future of finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TON Core Reveals 2025 Roadmap with Mainnet Upgrade

MicroStrategy to raise funds for Bitcoin with new perpetual preferred STRK stock offering

Michael Saylor's firm unveiled a strategic financial tool to convert preferred stock into actionable Bitcoin investments.

Why the TRUMP launch wasn’t a ‘mass onboarding event’

Trump’s coin may have led to new wallets, but it hasn’t yet brought onchain adoption

Is Ethereum’s (ETH) Triangle Formation Pointing to a Major Breakout Similar to XRP’s Recent Surge?