How Polygon is Leading the Way in Layer-2 Blockchain Solutions

- Polygon growth in transactions continues to outpace competitors, with significant contributions from gaming, infrastructure, and prediction markets.

- Partnerships like Jio and successful platforms like Polymarket boost Polygon’s market position and Web3 adoption.

According to Blockworks Research , the Polygon blockchain now has over 24 million weekly transactions and 97 million monthly transactions, beating numerous other layer-1 (L1) blockchains, including Aptos and Avalanche C-Chain. Over the past few weeks, the Polygon PoS ( Proof-of- Stake) chain has likewise shown ongoing increases in transactions—even exceeding 20 million weekly counts.

The Expansion of Polygon Keeps Going Since January 2024

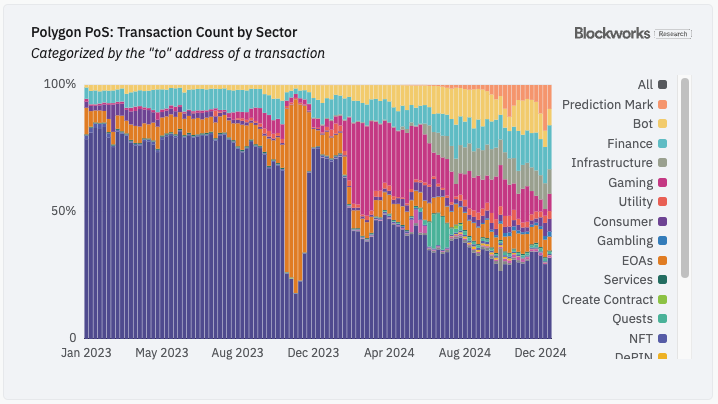

Polygon has experienced a boom in transactions in many important sectors, including the gaming sector, which contributed 6.6%, followed by infrastructure at 8.4% and prediction markets at 5.7%, indicating consistent expansion since January 2024.

These industries still draw user attention, which helps to explain daily and monthly transaction volumes rising. Polygon recorded 97 million monthly transactions in December 2024, significantly more than certain other layer-1 blockchains, such as Avalanche C-Chain with 8.9 million transactions and TON with 30.3 million transactions. Polygon’s transaction volume is still behind those of the larger Sui, Near, and Solana, though.

Rising Transaction Fees and Fee Distribution

Transaction costs have also exhibited a rise along with the increased activity on the Polygon network. Following a protracted period of declining rates, Polygon noted transaction fees of $1.4 million in December 2024. Prediction markets lead with a 22.5% contribution, followed by bots at 16.6% and the infrastructure and finance industries each making roughly 8%.

Notable Platforms Showing Excellent Performance

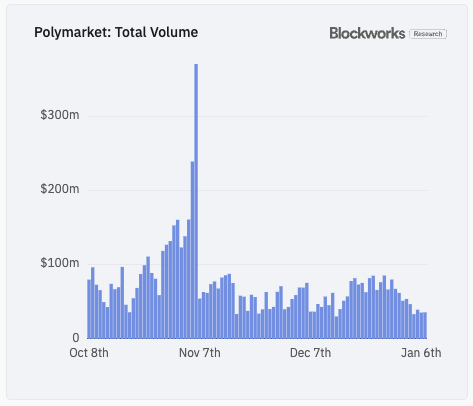

Particularly during the 2024 election season, Polymarket , a prediction market platform among the most used ones on Polygon, has seen an increase in users. At its height, Polymarket even managed to surpass traditional prediction platforms and a daily volume of $371.19 million is noteworthy.

Comprising 60,000 daily unique wallets and a daily volume of $100 million, the platform reflects 70% of the overall wealth locked in prediction markets.

Besides that, also showing notable expansion is Courtyard.io, a collectible card market based on Polygon. With physical asset storage combined with digital commerce, the technology allows effective worldwide trading of confirmed collectibles utilizing NFT representation. Courtyard.io has about 580,000 NFTs minted right now.

Polygon Improves Its Place in the Real-World Asset Ecosystem

By occupying the third place in total real-world asset value (RWA) among blockchain networks, Polygon PoS also exhibits strength in the practical domain. Polygon oversees a sizable portfolio encompassing EU Treasury bonds and institutional money with a market share of 4.1% and 19 separate RWAs.

On the other hand, Polygon is also under increasing attraction for big corporations, like Jio. Jio has teamed with Polygon to improve its digital offerings for almost 450 million Indian users. By means of this alliance, as noted by CNF , Polygon will offer Web3 capabilities in Jio Platform applications and services, so creating new blockchain use possibilities in the digital sector.

Meanwhile, as of writing, POL , Polygon’s native token, is swapped hands at about $0.4405 and has been moving sideways during the last 24 hours.

Recommended for you:

- Polygon (MATIC) Wallet Tutorial

- Check 24-hour Polygon (MATIC) Price

- More Polygon News

- What is Polygon?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Gains Edge in ETF Race Over SOL and DOGE, Says Kaiko

Strive Pushes Intuit to Add Bitcoin to Treasury

Strive urges Intuit to hold Bitcoin in its treasury to hedge against AI-driven disruption risks.Bitcoin as a Hedge Against AI Disruption?Why Bitcoin, and Why Now?BTC in the Boardroom

JP Morgan Predicts Imminent Interest Rate Cuts

JP Morgan forecasts upcoming rate cuts, signaling a major shift in U.S. economic policy that could impact markets and crypto alike.JP Morgan Signals Upcoming Interest Rate CutsWhy Rate Cuts Matter for MarketsCrypto Could See Renewed Interest

Raydium launches Launch Lab, a token issuance platform