Frax Finance Proposes $5M Investment in Trump’s WLFI Project

Frax Finance plan to integrate frxUSD into WLFI, leveraging its governance distribution, and partnership network for growth.

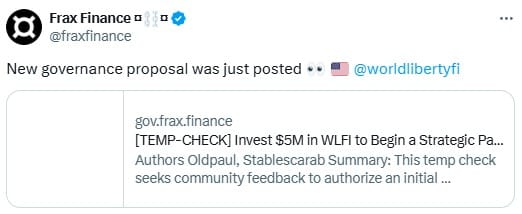

Frax Finance has proposed a $5 million investment in World Liberty Financial (WLFI), a DeFi platform tied to Donald Trump’s administration. This move aims to solidify FRAX’s leadership in the expanding U.S.-based DeFi sector.

A second investment of $10 million is also on the table, depending on the success of the partnership. The election of Donald Trump as the 47th president has spurred interest in U.S.-origin crypto initiatives.

Source: X

Source: X

While Trump hasn’t officially mentioned Bitcoin or cryptocurrencies since taking office, his administration has backed U.S.-focused blockchain projects. WLFI, aligned with Trump’s pro-crypto agenda, has emerged as a key player, aiming to onboard millions of Americans into DeFi.

Frax Finance plans to integrate its algorithmic stablecoin, frxUSD, into WLFI’s ecosystem. The initial $5 million will secure WLFI tokens, granting FRAX governance influence. If the partnership succeeds, FRAX could invest another $10 million to expand its role in WLFI’s network.

WLFI’s portfolio includes top DeFi tokens like Ethereum, Chainlink, AAVE, and Wrapped Bitcoin, with ETH assets surpassing $184 million. Its governance model allows users to shape the ecosystem, enhancing the adoption of projects like FRAX.

Frax Finance’s U.S. roots and co-founder Stephen Moore’s ties to the Trump administration strengthen its alignment with WLFI’s vision. By integrating frxUSD, FRAX could boost its influence in the DeFi sector while driving U.S.-based crypto adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Eric Trump Denies Role in $210 Million Tron Merger

Cardano Faces Challenges Amid Treasury Liquidity Debate

Kaito AI Updates Mindshare Algorithm to Address Quality Concerns Around Loud Token Engagement

U.S. Spot Ethereum ETFs Reach Record Holdings Led by BlackRock Amid Recent ETH Price Decline