Why is Enso Essential Infrastructure in the DeFI Wave?

Who wouldn't want to do development that is both efficient and cost-effective?

In the field of Internet travel, the key to Uber's ability to quickly change people's way of getting around lies in its clever integration of basic functions such as maps, payments, and messaging, rather than developing everything from scratch. Google Maps provides its location, Stripe handles payment processing, Twilio is responsible for message notifications, and Uber focuses on creating a top-notch ride-hailing experience.

Likewise, for DeFi developers, the key to determining innovation efficiency is whether they can efficiently "call" rather than "build from scratch" infrastructure. However, in the crypto field, there is currently not a mature and general-purpose infrastructure comparable to Stripe or Twilio. Developers are often forced to deeply research the underlying logic of each public chain or protocol, write and maintain a large number of smart contracts, and additionally pay high audit fees. Just like any project involved in DeFi social trading, lending, automation, etc., the first step is to dig through protocol documentation, write integration code, and developers should focus on creating differentiated features, but they end up consuming a significant amount of time and resources in the endless cycle of "reinventing the wheel."

In the process of exploring the DeFAI narrative, the author found that the "DeFi+AI" narrative also faces the same problem. Although AI Agents can discover arbitrage opportunities, design yield strategies, there is a huge gap between AI being able to conceive these strategies and actually execute them on-chain. Enso's existence makes the DeFAI narrative more implementable.

Empowering Developers to Stop "Reinventing the Wheel"

Enso has now become a dark horse in the DeFi infrastructure field, integrating 180 DeFi protocols across multiple ecosystems such as Ethereum, Binance Smart Chain, and more. Enso has also launched in the form of APIs, and these features will play a bigger role once the network is officially launched.

As the flagship target of the narrative, CowSwap, once openly supported by dignitaries such as Vitalik and Trump, is able to complete complex DeFi execution paths and fulfill user requests at the lowest gas cost thanks to the integration of Enso's DeFi-intent-based API. This allows CowSwap to focus on the DeFi trading experience just like Uber focuses solely on ride-hailing.

Enso, as a DeFi middleware, did not start with such a product implementation. Initially, Enso was merely a social trading platform derived from its founder Connor's "copy-trading" demand, disrupting the market through "vampire attacks." Later, Enso integrated with over 50 DeFi projects, launched social trading features, allowing anyone to create investment strategies and invite others to follow. During this time, Enso's TVL once reached $8-9 million.

However, as user demand grew, the team needed to continually integrate more DeFi protocols and conduct frequent code audits. Auditing just 12 protocols alone cost over $500,000. "The DeFi market updates too quickly, and the maintenance costs make it hard for us to keep up," this was the team's most direct feeling. To break through the bottleneck, they decided to completely rebuild the underlying infrastructure, achieve a unified abstraction of various protocols, and launch an externally facing API based on this.

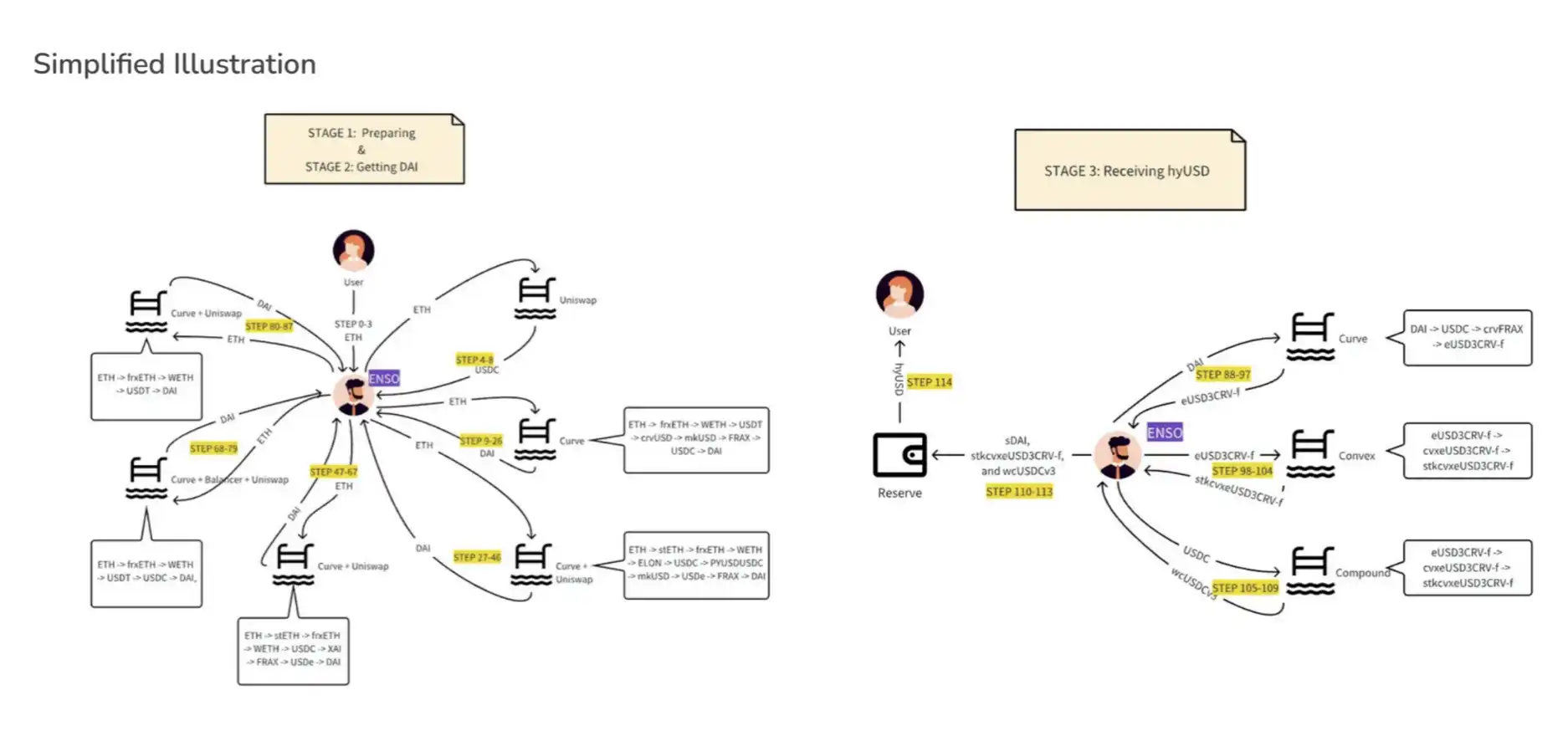

Enso's official team once showcased a typical case, vividly illustrating the core value of its product: simplifying complex processes into user-friendly interfaces. Developers only need to call Enso to easily integrate with over 40 DeFi protocols, using 25 different assets to complete a series of complex on-chain operations. The entire process appears simple, but in reality, it covers over 100 steps of on-chain interaction.

Using the example of a user swapping ETH for hyUSD, wcUSDCv3, and sDAI, the funds need to flow successively through multiple protocols such as Curve.fi, Compound, Balancer, and Uniswap. Without Enso, the team would need to independently integrate and audit these protocols, resulting in extremely high time and cost.

The value of Enso lies in encapsulating complex on-chain operation processes into a unified development interface. In the background, Enso precisely designs the optimal path for exchange rates and Gas costs and efficiently integrates multiple protocols. For developers, "swap ETH for a basket of assets" is just a simple operation call to the interface, while all the complex calculations and integrations are handled by Enso. This simplification not only reduces developers' maintenance and audit costs but also highlights the core role of middleware APIs in accelerating the development of the DeFi ecosystem. Through Enso, developers can focus on product innovation while leaving the underlying technical details to this powerful tool to solve.

Enso's Technical Implementation and Network Role Division

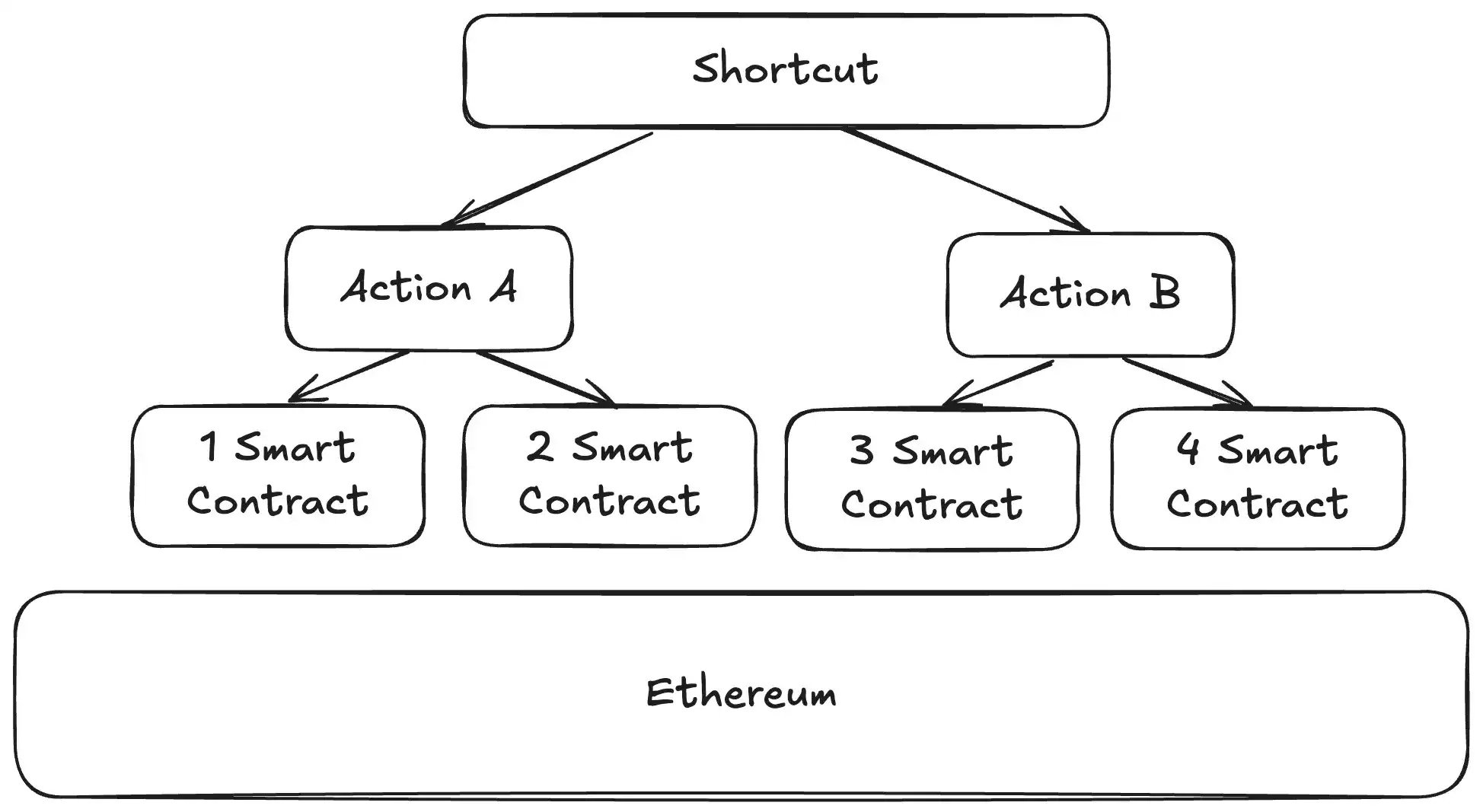

To understand the above product application scenario, we need to understand the concept proposed by Enso called shortcuts.

The so-called shortcuts are essentially pre-combinations of a series of on-chain actions. A single action may only contain one transaction or it may cover multiple steps that need to be completed consecutively. For example, merging approval and enter vault into a single deposit action, and further stacking leverage on this can be combined into a more complex functional module. Through this modular design, developers can greatly improve the efficiency of building on-chain applications.

Currently, Enso's existing shortcuts include token exchange and DeFi routing, asset management, fund management tools and automation, DeFi protocol integration, smart contract interaction, complex trade bundling, and more.

Furthermore, Enso is gradually evolving into a more open decentralized network, where all contributors are network participants, rather than just a team behind a product. In the future, anyone can contribute their skills or resources around Enso's underlying architecture, avoiding bottlenecks caused by insufficient resources of a single team and allowing the network to iterate quickly through multi-party collaboration.

Enso also provides three pathways for operators to participate, catering to developers with different expertise and resource conditions.

1. Action Providers

For developers with programming abilities, they can contribute smart contract abstractions on the network, providing specific behavioral operation logic, such as defining how to lend on Aave. These action providers become core contributors of behaviors in the network by proposing methods to address user needs. Additionally, they can earn revenue through fee sharing, incentivizing more high-quality behavioral logic contributions.

2. Graphers

Some participants focus on algorithms and data processing, similar to solving the "shortest path on a map" problem. They listen to intent requests in the network, traverse all contributed behavioral operations, and find the optimal path. For example, converting from USDC to aDAI on Aave can have various methods, including multi-step paths or direct conversion paths.

Graphers are responsible for finding a route that balances Gas costs and final rewards through computation and providing the final solution to the network. In this process, as they optimize for different objectives (such as Gas savings or higher returns), there may be competition among graphers. These participants are usually experts in mathematics and algorithms, unconcerned with the source of data, focusing only on how to efficiently utilize data to complete computational tasks.

3. Validators

Any contribution submitted by action providers or paths proposed by graphers need validators to simulate and validate to ensure the security and validity of underlying logic and execution results. Validators are responsible for checking if operations include authorized behaviors, involve delegate calls, conduct transfer operations, and identify potential malicious behaviors.

In addition, validators will also run the resolver-proposed path call data, validate its output, Gas consumption, and other key parameters. For users with node operation experience, this is a relatively low-threshold role, but crucial for ensuring network security and execution accuracy.

It is important to emphasize that as Enso gradually evolves into a network, these three roles will collectively participate in the maintenance and operation of the network. Any developer, algorithm expert, or node operator can join seamlessly to contribute to the entire ecosystem and receive incentives.

Aside from developer-oriented contribution roles, Enso offers different types of usage scenarios for users as well. Enso's product provides three types of intent abstractions to meet users' varying needs and preferences.

1. Explicit Intent: Users explicitly specify the operation protocol, such as carrying out leverage in a specific protocol, for example, "I want to leverage on Aave."

2. Semi-Explicit Intent: Users only define the target leverage multiple or yield rate, allowing the system to automatically select the optimal path among protocols like Aave, Maker, or GMX.

3. Fully Abstract Intent: AI chooses the best solution based on user history and market conditions, requiring minimal explicit instructions from the user. This model significantly simplifies user involvement complexity.

Enso Adoption and Future Outlook

Currently, Enso has raised a total of $9.2 million, with over 60 angel investors participating. From DeFi Summer to the present, Enso's product iterations and protocol integration capabilities across cycles are widely acknowledged in the market.

For example, as mentioned earlier, projects like CowSwap, Berachain's Boyco, and the recently popular DeFAI are all integrating and connecting at the core level with Enso. Currently, Enso has integrated with over 180 protocols, with more than 60 applications adopting the Enso API.

We can explore several specific cases to understand how Enso collaborates with other DeFi projects or protocols in the current market to provide a more convenient development environment for developers.

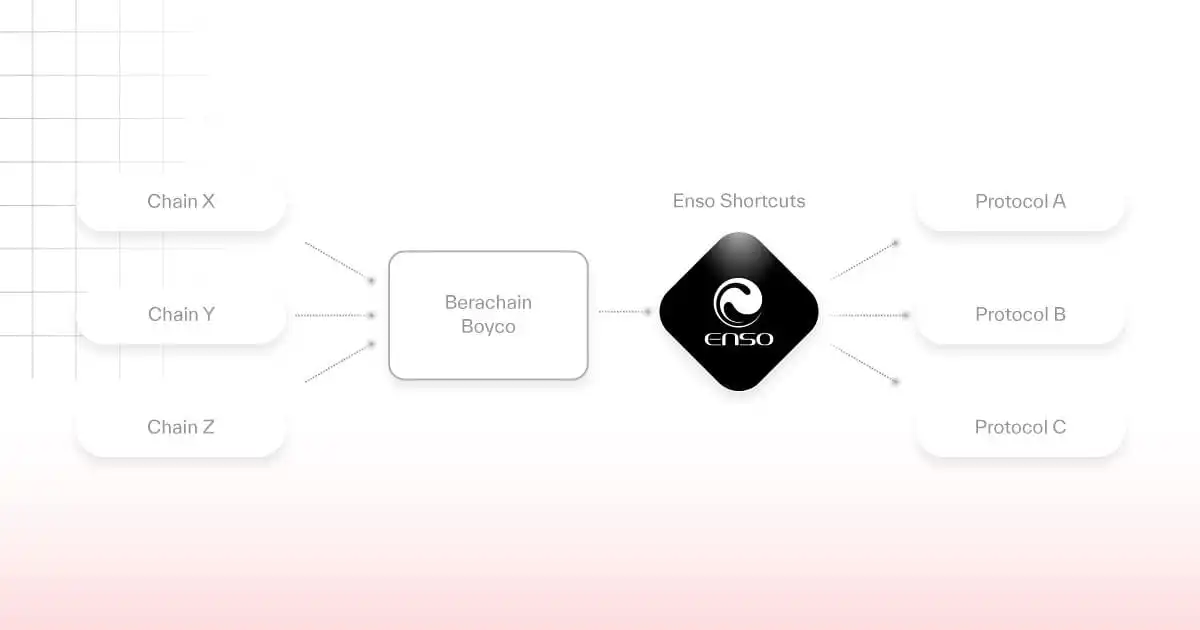

Royco Protocol is an Incentivized Action Market (IAM) protocol that allows anyone to create a transaction market or a series of transaction markets around any on-chain activity. Enso collaborates with Royco to jointly create an incentivized Boyco market treasury for Berachain. The Boyco project supports project owners in integrating with the Royco Protocol, enabling them to directly receive liquidity support from Berachain to focus on project development and community operations.

The complexity of the Boyco Market varies, encompassing both single-token deposits and multi-token strategies. Without Enso's support, the team would need to manually integrate multiple protocols, write custom code for each market's specific requirements, and invest a significant amount of engineering resources in testing and audits, making the process extremely cumbersome.

When users enter the Boyco Market and need to acquire specific deposit assets, the traditional approach would require users to leave the Boyco platform and complete multiple actions on other interfaces, including granting token permissions, submitting transactions, returning to Boyco, and so on, which can easily lead to user churn. With Enso integration, Boyco can keep users within its platform at all times and complete all operations in a single transaction: for example, using USDC, users only need to first approve the use of the required asset, and then exchange USDT for USDC in a single transaction and complete the deposit, all without the need to navigate between different application interfaces.

Enso also keeps up with the latest market trends and, leveraging the advantage of protocol integration, supports DeFAI projects. For example, BrianKnowsAI uses natural language prompts to execute transactions, search for resources, and retrieve on-chain data; SphereOne converts conversational commands such as 'send,' 'exchange,' or 'cross-chain' into executable transaction operations; and Velvet Unicorn provides AI-driven portfolio management tools.

Conclusion

"Enso" was originally a circular symbol in Japanese culture, symbolizing cyclical repetition, uniqueness, and the idea that the human mind can surpass boundaries and create infinitely. In the DeFi field, composability with each other is a core value. However, to truly support large-scale innovation, developers first need an efficient and unified infrastructure. Enso aims to be such a foundational pivot, providing developers with a 'road-building' abstraction in a fragmented multi-chain world.

If this step can be successfully taken, it is of significant importance to the industry and users. For DeFi protocol providers, they can quickly gain user traffic and funds. Developers can avoid repetitive code writing and high audit costs, focusing more on optimizing product functionality and user experience. Finally, end users can unknowingly enjoy the optimal returns and paths from multi-protocol combinations without having to understand the complex underlying logic.

In the blockchain field, behind every seemingly ordinary call may be a series of cumbersome cross-chain, cross-protocol operations. DeFi is hailed as a 'permissionless financial innovation paradise.' However, to enable true large-scale applications, developers and users must first feel the convenience of a 'flattened threshold.' When the cost of 'reinventing the wheel' greatly decreases, DeFi developers have the opportunity to unleash their creativity. With the increasing modularization and intelligence of Enso, the blockchain will also be one step closer to an 'Uber-like simple experience.'

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BRICS News: Russia Launches Gold Digital Asset Pilot—A Shift in Global Payments?

XRP News: XRPL Enhances Onchain Finance with Permissioned Domains

Ethereum Whales Face Bear Market Profit Levels

ETH whales see unrealized profits drop to bear market levels as ETH/BTC declines and sentiment weakens.ETH/BTC Ratio Continues to DeclineWeak Sentiment and Market Outlook

Floki Inu Made Millionaires Overnight—BTFD Coin’s 3650% ROI Potential Could Be Your Shot at the Next Big Win

Meme coins have been on a wild ride, turning small investments into life-changing profits for those who got in earlyBTFD Coin’s Play-to-Earn Game Is Fueling the Next Big Crypto SurgeFloki Inu Proved Meme Coins Can ExplodeThe Bottom Line