‘Trump Inauguration Euphoria’ Triggers $2,200,000,000 in Institutional Flows to Crypto Products: CoinShares

Crypto asset manager CoinShares says institutional investors poured billions into digital asset investment vehicles last week alone in preparation for Donald Trump’s inauguration.

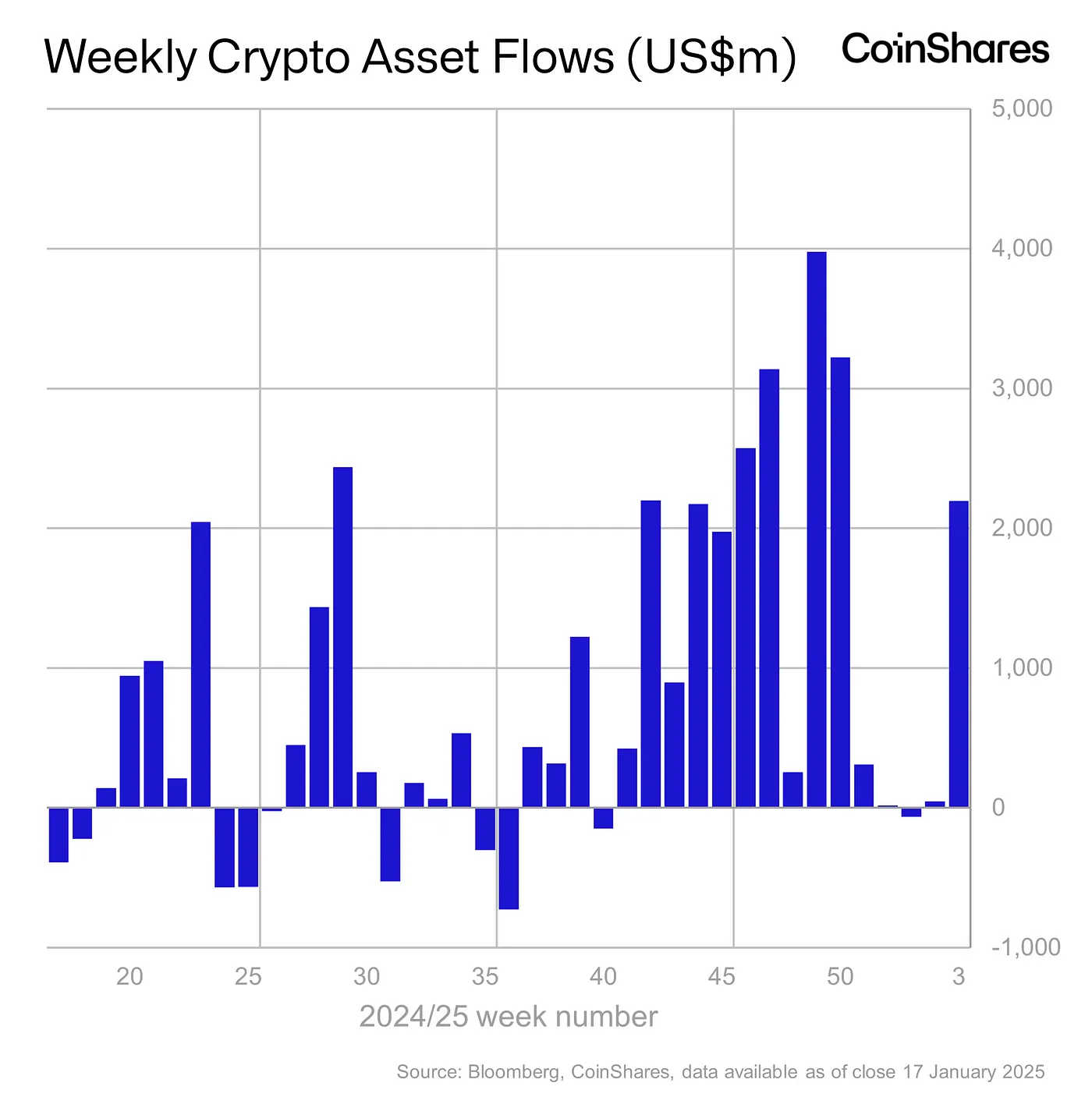

In its latest Digital Asset Fund Flows report , CoinShares says that institutional crypto investment vehicles raked in over $2 billion last week alone.

“Digital asset investment products recorded inflows of US$2.2bn last week amid the Trump inauguration euphoria, the largest week of inflows so far this year, bringing year-to-date (YTD) inflows to US$2.8bn.

Recent price rises have pushed total assets under management (AuM) to US$171bn, a new all-time high. Trading volumes on ETPs (exchange-traded products) globally remain high at US$21bn last week, representing 34% of total bitcoin trading volumes on trusted exchanges.”

Source: CoinShares/X

Source: CoinShares/X

The US regionally accounted for $2 billion of the inflows with Switzerland and Canada adding on $89 million and $13 million respectively.

Bitcoin ( BTC ) investment vehicles, per usual, raked in the lion’s share of inflows at $1.9 billion.

“Unusually, despite the recent price rises, we have seen minor outflows from short-positions of US$0.5m, while we typically see inflows after such positive price momentum.”

Ethereum ( ETH ) enjoyed inflows of $246 million over the same period, canceling out ETH’s poor outflows for most of the year.

“Regardless, it dwarfs Solana’s US$2.5m inflows last week.”

XRP products also saw inflows of $31 million.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report