BoJ rate hike threatens yen carry trade unwind, shaking ‘Trump trade’ optimism and bitcoin markets, analysts say

Quick Take Analysts warn that a potential Bank of Japan rate hike next week could trigger an unwinding of the yen carry trade, potentially disrupting global liquidity and impacting risk assets like bitcoin. ‘Trump trade’ optimism ahead of Monday’s U.S. presidential inauguration and softer inflation data has bolstered risk-on sentiment, analysts added.

As the global market shifts its focus toward the upcoming U.S. presidential inauguration on January 20, 2025, analysts have flagged a potential risk that could disrupt market sentiment: the unwinding of the yen carry trade, a key driver of global liquidity.

“A BOJ rate hike would likely trigger a significant unwinding of yen carry trades, which could dampen ‘Trump Trade’ market enthusiasm,” RedStone Oracles COO Marcin Kazmierczak told The Block.

WeFi Head of Growth Agne Linge echoed this view, saying that a potential hike of the Bank of Japan’s interest rate at its policy meeting at the end of next week "could impact risk assets if they need to be sold off to cover the carry trade loans.”

The yen carry trade, a long-standing strategy where investors borrow yen at low interest rates to invest in higher-yielding assets worldwide, faces significant risk due to the Bank of Japan (BoJ) signaling potential interest rate hikes. Such a move could have wide-reaching consequences, affecting not only equities but also risk assets like bitcoin.

Impact of a BoJ rate hike

Market participants are closely watching the BoJ’s policy meeting next Thursday and Friday, in anticipation of an interest rate hike. Hawkish remarks from BoJ Governor Kazuo Ueda have fueled anticipation, driving Japanese Government Bond (JGB) yields to multi-year highs. The BoJ raised its short-term rate target to 0.25% in July, citing progress toward meeting its 2% inflation target. A further hike to 0.45% is now widely expected.

If rates rise, the yen could appreciate, further increasing the cost for global investors who borrowed yen at low rates to maintain their positions. This could prompt a large-scale unwinding of the carry trade, potentially forcing investors to liquidate assets to cover their positions. A similar situation occurred in August 2024, when market volatility triggered significant bitcoin liquidations.

"If the BoJ raises rates, this could strengthen the yen and force rapid unwinding of risk asset positions, potentially causing a ripple effect across global markets, as we saw in early August 2024 when bitcoin fell from $66,000 to $55,000 in a week," Kazmierczak said.

While a yen carry trade unwind could moderate “Trump Trade” optimism, Kazmierczak said the impact would likely be gradual rather than immediate. “The key will be watching how they balance domestic inflation targets against global market stability,” he noted.

The ‘Trump Trade’ and risk-on sentiment

Bitcoin may experience notable price volatility due to market uncertainty surrounding the U.S. presidential inauguration. However, risk-on sentiment has been bolstered by the latest U.S. Consumer Price Index (CPI) data . This raised investor expectations that the U.S. Federal Reserve could implement two rate cuts in 2025 rather than adopting a more hawkish stance. The positive reaction to the CPI report led to a rise in stocks and a decline in 10-year Treasury yields.

"The core CPI data showed that inflation rose less than expected,” Linge explained to The Block. "With the upcoming U.S. presidential inauguration, there is a high likelihood that the so-called ‘Trump trade’ effect could trigger a breakthrough in bitcoin's price, pushing it closer to its all-time high."

Despite the sharp fall in U.S. bond yields following Wednesday's inflation data, the U.S. dollar remained steady on Thursday. Market attention has now shifted to the inauguration, with speculation growing about the potential inflationary impact of Trump's policies and their effects on bitcoin and other assets.

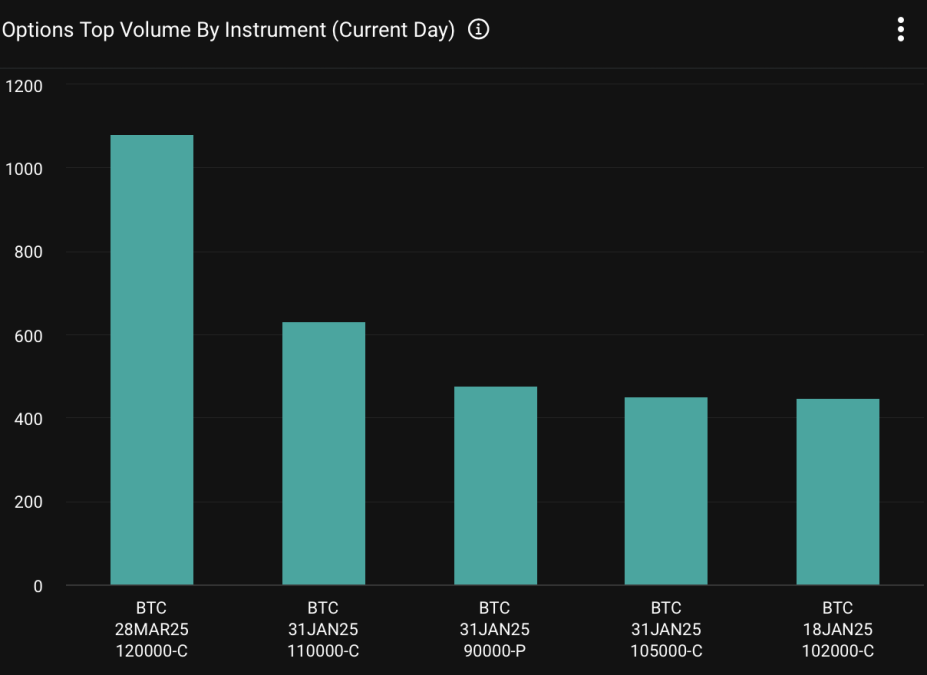

The derivatives market has also reflected this shift in sentiment. Bitcoin options saw a surge in end-of-January options trading volume, with traders increasingly purchasing calls with strike prices ranging from $100,000 to $110,000 and puts at $90,000, according to Deribit data .

Bitcoin options volume clusters at end-of-March strikes at $120,000 and end-of-January calls and puts. Image: Deribit.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — SAHARA/USDT!

SAHARAUSDT now launched for futures trading and trading bots

New spot margin trading pair — H/USDT!

Bitget x BLUM Carnival: Grab a share of 2,635,000 BLUM