Modular Yield Tokenization: Napier Finance Returns Ahead of Its Launch

Today marks the initial release of Napier v2, the first step toward realizing a modular yield tokenization protocol that enables exponential scaling and universal alignment for anybody.

What is Napier v2?

Napier v2 introduces modular yield tokenization primitives, enabling users to fix yields, trade them, and build without limitations on EVM-compatible chains. The platform ensures full ownership and allows curators to offer profitable yield products while maintaining scalability and user demand.

Background

Modularity has become central to non-custodial finance, with examples like Morpho, Euler v2, Uniswap v4, and Mellow. While permissionless infrastructure fosters growth, users also seek efficient, feature-rich platforms. Modularity meets these demands while enabling scalability for expanding markets and user bases.

Yield tokenization, despite its growth, faces scalability challenges such as rising management costs and reliance on excessive incentives. Napier v2 addresses these by serving as a neutral framework, efficiently connecting curators designing yield strategies with users seeking them.

Why Napier v2?

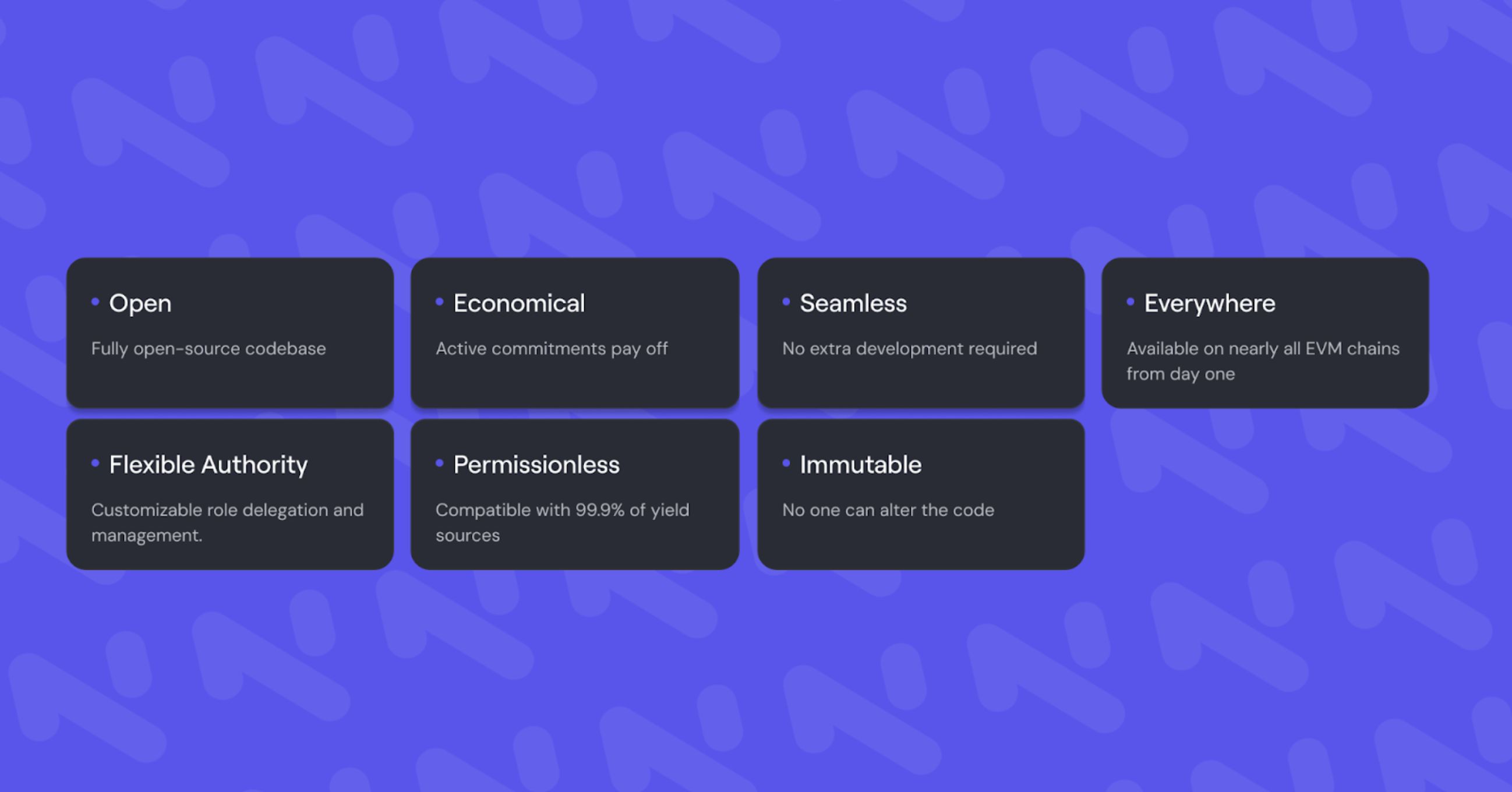

Napier v2, also known as "PT and YT as a Service," eliminates the need for curators to fork unfamiliar codebases, allowing them to retain full ownership and offer yield products seamlessly. The protocol is:

- Open-source: Transparent and accessible

- Economically rewarding: Efforts directly pay off

- Flexible: Supports customizable governance

- Permissionless: Compatible with most yield sources

- Immutable: Code cannot be altered

- Seamless: Requires no additional development

- Widely available: Across all EVM chains

These features make Napier v2 a scalable solution to existing sector limitations.

Backed by the Best

Napier v2 is supported by one of the best backers in the industry who share our vision of modular software. Their contributions have been instrumental in achieving this milestone.

Securing Napier

Napier v2 prioritizes security, working with top auditors and experts like Cmichel (Spearbit), Cantina, Winney, vectorized.eth, Euler Labs and Michael Egorov. Comprehensive audits, code reviews, gas optimization, and formal verifications ensure the protocol’s reliability. Our commitment to security remains steadfast, with more measures to be revealed as the launch progresses.

Announcing PT and YT Alliance

We are proud to announce the PT and YT Alliance ( @ptytalliance ), a hub for curators to foster collaboration, advance PT and YT standards, and empower users. Napier v2 provides a neutral financial framework akin to ERC4626, enabling entities—from companies to DAOs—to launch trust-minimized yield tokenization modules or extend existing protocols. If you align with our mission, join us as launch partners: forms.gle/i2XiWtzwC4PDQvV78 .

Building Napier Together

Napier v2 overcomes the limitations of traditional yield tokenization, establishing itself as the leading yield derivatives layer in on-chain finance. Its modular architecture enables scalable growth, offering a permissionless design space for PT and YT with economic and governance flexibility. Seamlessly integrating across the DeFi ecosystem, Napier v2 paves the way for the next era of yield tokenization.

This post is commissioned by Napier Finance and does not serve as a testimonial or endorsement by The Block. This post is for informational purposes only and should not be relied upon as a basis for investment, tax, legal or other advice. You should conduct your own research and consult independent counsel and advisors on the matters discussed within this post. Past performance of any asset is not indicative of future results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Obol Collective may launch OBOL token on May 15

Price analysis 4/14: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, ADA, LEO

Spot Solana ETFs to launch in Canada this week

Trade wars could spur governments to embrace Web3 — Truebit