Bitcoin derivatives market signals increased volatility ahead of Trump inauguration

Quick Take The bitcoin derivatives market shows increased volatility ahead of President-elect Donald Trump’s second inauguration, with a notable rise in put options. Ethereum traders anticipate even higher volatility than bitcoin traders, as both markets reflect cautious sentiment in response to the upcoming political transition.

The bitcoin derivatives market is signaling increased expectations for volatility as President-elect Donald Trump is preparing for his second inauguration on Jan. 20.

Trump is set to return to the White House, becoming only the second president in U.S. history to serve non-consecutive terms, following Grover Cleveland who embarked on a second term in 1893. However, unlike Trump, Cleveland was notably opposed to implementing high tariffs.

Sentiment among traders appears cautious ahead of the upcoming event. Data from the Derive.xyz derivatives exchange shows signs of bearish anticipation in the medium-term outlook. Bitcoin put options have increased to comprise 40% of all open interest on Derive.xyz, up significantly in the past week. "This is a sharp increase from 20% just last week and suggests traders are hedging against potential downside risks as we approach the Trump inauguration," Derive.xyz Head of Research Sean Dawson told The Block.

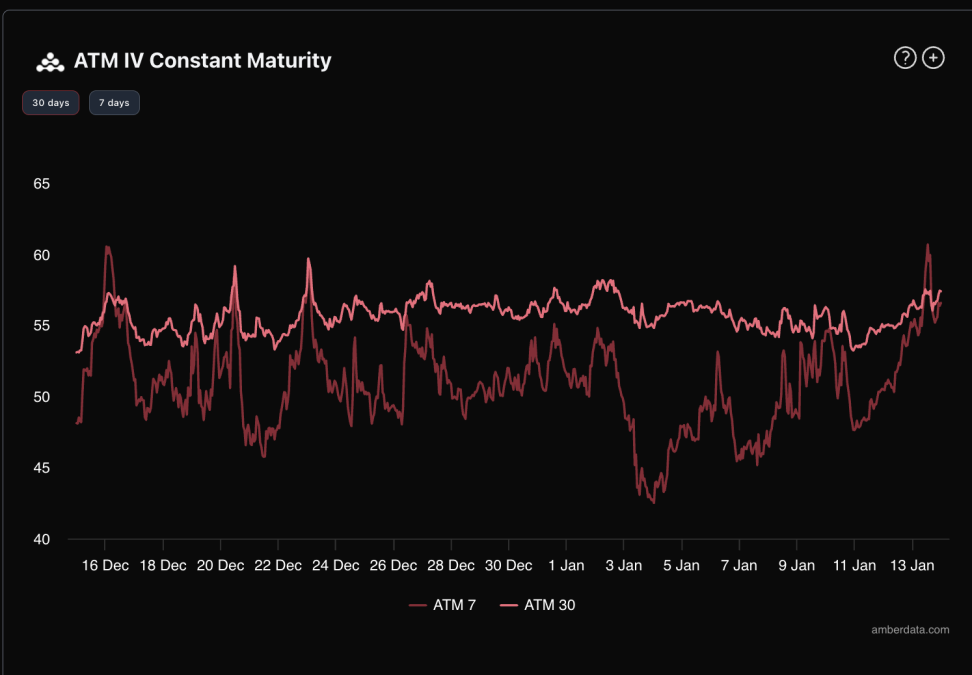

Bitcoin options implied volatility has increased in the past week. Image: Derive.xyz

Rising bitcoin options implied volatility

Bitcoin's implied volatility has also been climbing — underscoring market uncertainty. Over the past week, bitcoin’s seven-day at-the-money IV rose by 3% to 56.5%, while its 30-day IV increased by 1.5%, now at 57.5%. According to Dawson, these trends point to heightened anticipation of sharp price swings in the days leading up to the inauguration. "This steady climb points to a more volatile market sentiment leading up to the event," Dawson said.

Ethereum traders are exhibiting even stronger expectations for volatility. Over the past 24 hours, Ethereum’s seven-day IV surged by 6% to 74%, while its 30-day IV climbed 2.5% to 69.5%. "This disparity suggests Ethereum traders are anticipating greater immediate volatility, possibly due to its higher sensitivity to macroeconomic shifts and speculation surrounding post-inauguration policies," Dawson explained. "This disparity suggests that Ethereum markets are bracing for sharper immediate swings compared to BTC."

Increased derivatives trading volumes over the past 24 hours

The derivatives market has also seen a notable uptick in activity. Bitcoin’s options open interest surged to $237 million in the last 24 hours, reflecting increased trader engagement.

"With 38% of bitcoin contracts being calls bought and 37.3% puts bought, it’s clear that traders are positioning for increased volatility, particularly with the inauguration just days away," Dawson added. "This appetite for market swings likely reflects growing uncertainty in U.S. markets as expectations for a near-term rate cut diminish."

Bitcoin's price is now hovering above the $96,714 mark, posting a slight increase of around 0.5% over the past 24 hours, according to The Block's Price Page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Elon Musk Targeted By An Explosive Investigation In France Regarding The Excesses Of X

35% Tariff: Why Is Trump Reigniting The Trade War With Canada?

XRP Takes the Fight to Bitcoin: A New Crypto Rivalry Ignites

XLM Is Pumping Hard: Here’s Why