Bitcoin rebounds above $96,000 amid global stock gains as investors focus on key US inflation data

Quick Take Bitcoin has rebounded above $96,000, gaining 6% in 24 hours, alongside gains in global equity markets. Investors are now focused on upcoming U.S. inflation data, which could shape investor expectations for the Federal Reserve’s next policy meeting.

Bitcoin has rebounded above the $96,000 mark after dipping to a multi-week low of just above $90,000 — rising alongside global equity indices and U.S. stock futures. The recovery comes amid a broader market rally, with investors cautiously anticipating key U.S. economic data releases this week, wary of any signs of increased inflationary pressures.

The cryptocurrency market capitalization has increased by around 3.4% over the past 24 hours, according to Coingecko data . Global equity indices also reflected improved market sentiment. France's CAC 40 gained nearly 1.0% in early trading to 7,478.96, while Germany's DAX rose 0.6% to 20,263.87. The UK's FTSE 100 gained 0.12%, now at 8,234.33. In the U.S., Dow Futures rose 0.31%, S&P 500 Futures increased 0.50%, and Nasdaq Futures climbed 0.70%.

The rebound in major cryptocurrencies coincides with modest gains in global markets, as traders position ahead of the first of two crucial inflation readings this week. On Tuesday, the U.S. producer price index (PPI), a key measure of wholesale inflation, will be released at 8:30 a.m. ET. Economists expect headline PPI to rise by 0.4%, with the core figure (excluding food and energy) up 0.3%.

On Wednesday, the consumer price index (CPI) report is set to provide further insight into inflation trends. Both reports will shape market expectations for the Federal Reserve’s next move on interest rates on Jan. 29. “Key PPI and CPI data are on the horizon, and potential surprises could tilt market sentiment as participants adjust to a prolonged higher-rate environment,” said analysts at QCP Capital.

Currently, the Fed’s target interest rate range remains at 4.25% to 4.5%. Fed funds futures suggest a high probability of 97.3% that rates will stay unchanged at the central bank’s upcoming meeting later this month. Markets also project a high chance of rates holding steady through March and May, only in July does the probability of a 25 basis-point cut begin to materialise, at just over 41%, according to the CME FedWatch tool .

The broader macroeconomic backdrop has fueled some volatility in bond markets. The U.S. 10-year Treasury yield recently surged to 4.8%, its highest level since late 2023, reflecting recalibrated expectations around potential rate cuts. QCP Capital analysts in a note on Tuesday suggested that the Fed’s commitment to keeping rates higher for longer is now more firmly priced into the market.

Trump inauguration and crypto market outlook

Bitcoin and other cryptocurrencies could face additional volatility in the run-up to the Jan. 20 presidential inauguration of Donald Trump. The inauguration marks Trump’s return to the presidency and has been speculated to carry significant policy implications for the crypto sector.

BRN analyst Valentin Fournier advised caution, as this week's inflation prints could reignite inflation fears, coupled with the potential for a "sell the news" event surrounding the upcoming presidential inauguration of Donald Trump on Jan. 20. "Given the volatility, we advise reducing exposure to digital assets, and waiting for a more favorable entry point may present better opportunities for maximizing returns," Fournier told The Block.

However, QCP Capital analysts expressed a more optimistic view, citing reports that Trump may prioritize crypto-friendly policies. “There is potential for positive catalysts,” they noted, “as Trump may sign executive orders on day one, addressing 'de-banking' and repealing a contentious crypto accounting policy, which could provide a boost to the market."

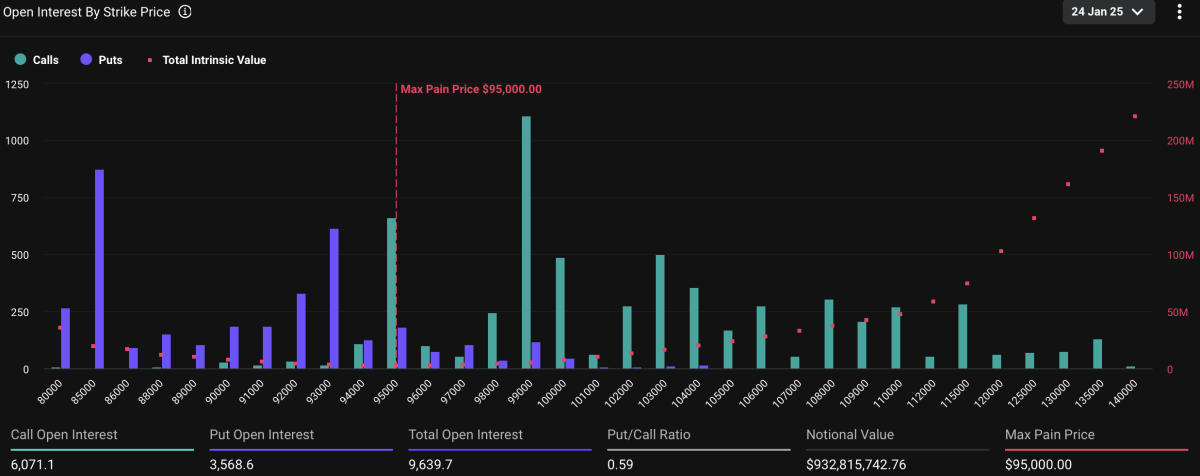

End of January bitcoin options expiry shows a cluster of calls at a strike price of $99,000. Image: Deribit.

Derivatives market indicators suggest market volatility

The derivatives market is already signaling elevated volatility for bitcoin and other cryptocurrencies. Front-end bitcoin options implied volatility remains high, with the CBOE Volatility Index (VIX) also elevated at 18.83 in equity markets.

According to data from Deribit, the first major bitcoin options expiry of the year, set for January 24, two days after the inauguration, shows a slightly bullish skew. The put-call ratio stands at 0.57, with the largest cluster of contracts centered on bitcoin calls at a strike price of $99,000. "Derivatives market indicators suggest volatility to persist through January," QCP Capital analysts said.

Bitcoin's price is now hovering above the $96,500 mark, posting an increase of around 6% over the past 24 hours, according to The Block's Price Page.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why Is TRUMP Coin Price Up by Over 60% Today?

Aptos Logs 133K Wallets, 558K Transactions in Osaka Expo Week One—Is Adoption

Aptos’ debut as the digital wallet provider at Expo 2025 Osaka showcases how seamless blockchain integration and soulbound NFTs can drive mainstream adoption, adding 133,000 new users in just one week.

$TRUMP Holders Dinner: Token Rockets 64% as Top Investors Chase Rare Trump Invite