Sol Strategies is raising $20 million via debt financing from ParaFi Capital to expand Solana staking operations

Quick Take Sol Strategies (ticker HODL) is raising C$27.5 million by selling a convertible debt instrument to expand its footprint in the Solana ecosystem, according to an announcement on Thursday. The private placement from ParaFi Capital is expected to close by the end of next week.

Sol Strategies (tickers: CYFRF, HODL.CN) is raising C$27.5 million (about $19 million) via debt financing to buy more SOL tokens and invest further in Solana staking infrastructure, according to an announcement on Thursday. This is the second multi-million investment strategy the firm announced this week.

In particular, the Toronto-based firm formerly known as Cypherpunk Holdings is raising funds through a private sale of “unsecured convertible debenture units,” a type of long-term debt instrument that can be converted into company equity, to ParaFi Capital.

Sol Strategies’ CDs consist of one debenture with a principal amount of C$1,000 and 400 warrants. The latter can be converted into shares at a C$2.50 strike price at any point before the fifth anniversary of the closing of financing, which is expected to be Jan. 16.

Additionally, the CDs offer a yield of 2.5% per annum, which can be paid semi-annually in cash or common shares.

This is Sol Strategies' latest bid to raise capital to invest in the Solana ecosystem. Last year, when the firm hired CEO Leah Wald, the company decided to double down on Solana.

“ParaFi's investment will empower Sol Strategies to operate best-in-class validator services, implement a SOL treasury strategy, and support the Solana network,” Ryan Navi, managing director of the hedge fund ParaFi Capital, said in a statement.

Sol Strategies has grown to become one of the largest Solana stakers, having staked over 1.5 million SOL tokens (worth about C$450 million) as of mid-December. This includes over 140,000 SOL owned by the firm.

In a similar way that investing in bitcoin miners is a way to gain exposure without holding physical BTC, Sol Strategies says its focus on “leveraging investment opportunities in staking rewards and Solana-based projects” is a way for “shareholders to indirectly participate in the decentralized finance landscape.”

On Monday, the firm announced it had taken out a C$25 million credit line to help finance its staking expansion. In December, Wald told The Block the firm was looking to list on the Nasdaq.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Bottom Is Here, Says VanEck Citing Miner Capitulation

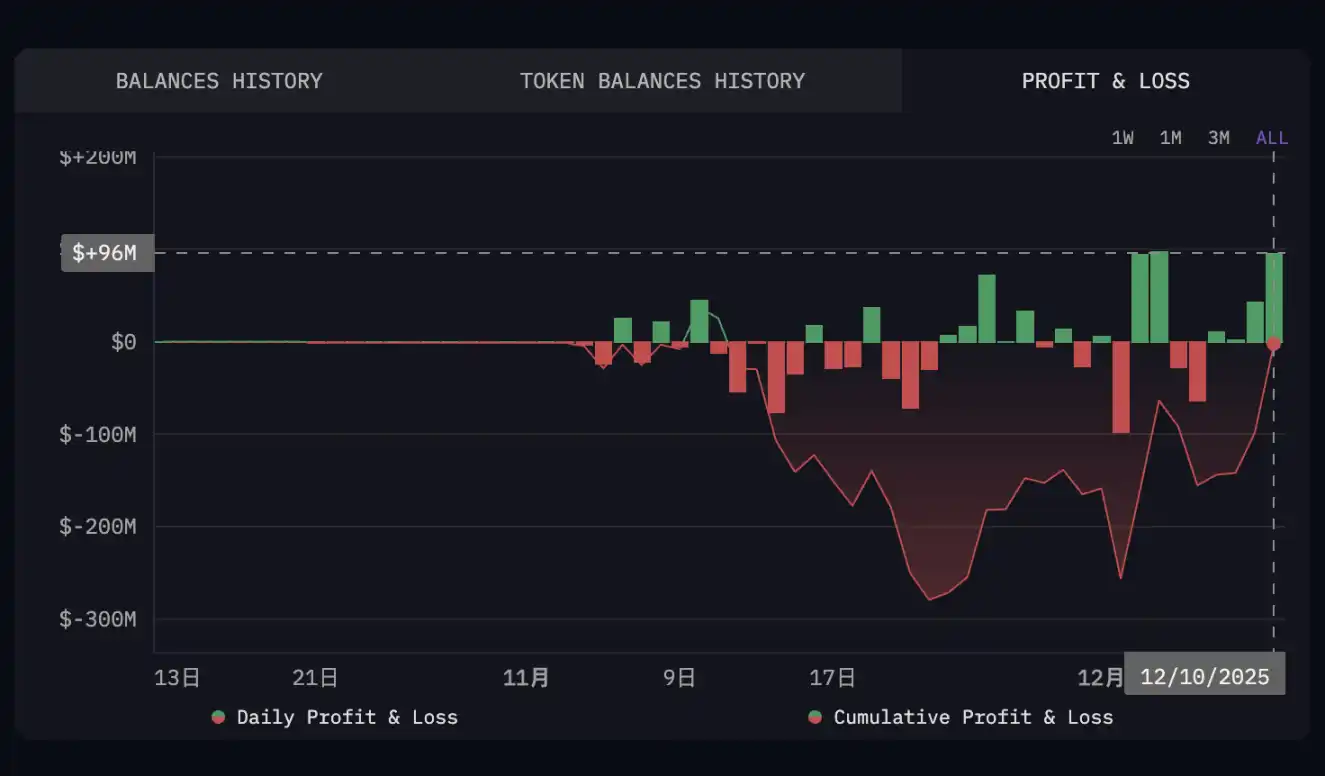

The 2025 Whale Tragedy: Mansion Kidnappings, Supply Chain Poisoning, and Hundreds of Millions Liquidated

Tether Data Expands QVAC Genesis II To 148 Billion AI Tokens

One year into the Trump administration: Transformations in the U.S. crypto industry