The Daily: 24-hour crypto liquidations surpass $500 million, Thai police seize 1,000 Bitcoin miners and more

Quick Take Over $500 million in cryptocurrency liquidations occurred in the past 24 hours as the prices of bitcoin and ether faced increased volatility. Thai police seized 996 Bitcoin mining machines from a raid on JIT Co.’s premises in the country’s eastern Chon Buri province amid accusations of electricity theft, according to local media reports. U.S. entities now hold 65% more bitcoin reserves than their offshore counterparts, with the ratio soaring from 1.24 in September to 1.65 as of Jan. 6, according

Happy Thursday, folks! Prices might be falling, but the latest news is still worth its weight in crypto. Grab a coffee, get comfortable and dive into your daily dose.

In today's newsletter, 24-hour crypto liquidations surpass half a billion dollars, Thai police seize almost 1,000 Bitcoin miners, U.S. entities now hold bitcoin reserves 65% greater than their offshore counterparts, plus more.

Let's get started.

Crypto liquidations surpass $500 million in 24 hours

Over $500 million in cryptocurrency liquidations occurred in the past 24 hours as the prices of bitcoin and ether faced increased volatility.

- Markets continue to digest Wednesday's release of the Federal Reserve's December meeting minutes, which signaled the potential for a slower pace of rate cuts in 2025.

- Over 188,000 traders were liquidated across centralized exchanges during the past day, according to data from CoinGlass.

Bitcoin led the liquidations, with $134 million worth of positions liquidated, $87 million on the long side. - Ether traders also experienced significant liquidations, with $94 million in positions liquidated, $50 million of which from longs.

- Liquidations happen when traders cannot meet margin requirements, forcing positions to close automatically.

Thai police seize 1,000 Bitcoin miners

Thai police seized 996 Bitcoin mining machines from a raid on JIT Co.'s premises in the country's eastern Chon Buri province amid accusations of electricity theft, according to local media reports.

- The firm, registered to conduct digital asset trading activities, allegedly tampered with power meters to mine bitcoin while avoiding paying for electricity, Thai police Crime Suppression Division commander Pol Maj Gen Montree Theskhan said.

- The raid was part of a joint operation by the CSD and Provincial Electricity Authority, with officials estimating that the operation had illegally consumed electricity worth millions of dollars.

- The CSD is continuing to investigate the individuals behind the operation, confirming it plans to seek court warrants for their arrest.

US entities dominate bitcoin holdings

U.S. entities now hold 65% more bitcoin reserves than their offshore counterparts, with the ratio soaring from 1.24 in September to 1.65 as of Jan. 6, according to CryptoQuant.

- The ratio measures bitcoin holdings of known U.S. entities — including MicroStrategy, ETFs, exchanges, miners and the government — against those of known offshore entities, CryptoQuant CEO Ki Young Ju explained.

- Pro-crypto sentiment surged during the period after Donald Trump's re-election and his pledge to establish a national bitcoin stockpile, driving BTC prices to all-time highs above $108,000.

- Spot Bitcoin ETFs attracted significant inflows, amassing over $108 billion in assets, while MicroStrategy has increased its bitcoin holdings to 447,470 BTC as part of its ongoing corporate treasury policy.

Fidelity's ETFs post largest daily outflows

Fidelity's spot Bitcoin and Ethereum ETFs posted their largest single-day net outflows on Wednesday, with $258.7 million and $147.7 million exiting the funds, respectively.

- U.S. spot Bitcoin ETFs registered total net outflows of $582.9 million, while Ethereum ETFs saw $159.3 million in outflows combined, according to SoSoValue data.

- The Bitcoin ETFs generated $3.4 billion in trade volume for the day, while the total trading volume of the Ethereum ETFs shrank to $459 million from $819 million on Tuesday.

- Despite the record outflows, Fidelity's ETFs still rank second in cumulative net inflows among both spot Bitcoin and Ethereum funds.

Judge throws out UK bitcoin landfill case

A UK High Court judge dismissed early Bitcoin adopter James Howells' attempt to sue his local council in South Wales to recover an accidentally discarded hard drive from a landfill, which he claims holds access to £600 million ($739 million) in BTC .

- Judge Andrew John Keyser KC ruled there were "no reasonable grounds" for Howells' case, as existing laws make the hard drive Newport City Council's property, and environmental permits block excavation.

- Despite organizing experts and narrowing the search from 1.4 million tonnes to 100,000 tonnes of waste, Howells' attempts to retrieve the device have been repeatedly denied, with the lost bitcoin in question effectively remaining a gift to all users of the network.

In the next 24 hours

- U.S. nonfarm payroll data are due at 8:30 a.m. ET on Friday.

- Optimism is set to unlock 4.47 million OP tokens, representing 0.33% of the circulating supply.

Never miss a beat with The Block's daily digest of the most influential events happening across the digital asset ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fartcoin Soars After Breakout: What Investors Need to Know

In Brief Fartcoin experiences a significant breakout with increased trading volume. A newly created wallet purchases over 1 million FARTCOIN, signaling bullish interest. Investors see price movements as opportunities for potential gains.

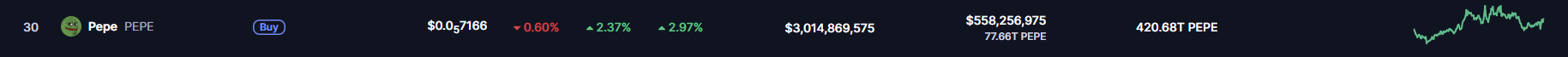

PEPE Price Prediction: Will the Memecoin Hit Its December High Again?

Mantle (MNT) Heading Toward Key Support – Double Bottom Setup Hints at a Possible Reversal