Fidelity sees Solana as a 'notable contender' but backs Ethereum's stronger fundamentals

Fidelity Digital Assets says Ethereum’s strong fundamentals give it an edge over Solana from a long-term perspective.Solana’s speed and low costs stand out, but Fidelity highlights its reliance on short-term trends like memecoin trading.Fidelity also expects bitcoin and other areas of crypto to perform well this year, noting it is “not too late” for investors to dive in.

The Ethereum vs. Solana debate keeps going — focusing on scalability, speed and decentralization. Fidelity Digital Assets, the crypto arm of asset management giant Fidelity Investments, says Ethereum has the edge but acknowledges Solana's growth.

In its 2025 Look Ahead report , Fidelity highlighted Ethereum's strong fundamentals, including robust developer activity, total value locked and stablecoin supply. While Solana's revenue and TVL are growing faster, much of its revenue comes from memecoin trading , which Fidelity sees as a cyclical trend that thrives in bull markets but fades in bear markets.

Fidelity also noted similarities between Solana's reliance on memecoins and Ethereum's heavy use of Uniswap. However, it argued that Ethereum's fundamentals are less tied to speculation, making it more stable in the long run. These fundamentals, Fidelity said, guide long-term investors but may not predict short-term performance.

"Short-term price trends often revolve around narratives, and Solana may be the more notable contender in this regard throughout 2025 given the planned upgrades for both networks," Fidelity said.

Solana's Firedancer upgrade aims to significantly boost transaction speed, while Ethereum's Prague/Electra (Pectra) upgrade focuses on improving functionality, scalability and user safety. However, Fidelity noted that the Pectra upgrade is likely to generate less community excitement as it doesn't directly impact ether's value proposition from an investment standpoint.

Ether currently has a clear advantage over Solana due to its accessibility via exchange-traded products, though this could change depending on regulatory decisions, Fidelity said. Such decisions could either strengthen ether's position or level the playing field, making it a key factor to watch in 2025, it added.

While Solana has short-term momentum, its performance could benefit ether in the long run, much like Solana's earlier underperformance did before 2024, Fidelity said. As the bull market continues, investors are expected to focus more on fundamentals, which could shift attention back to ether, it added.

Fidelity on Bitcoin

In the 2025 Look Ahead report, Fidelity Digital Assets also shared its outlook on bitcoin, saying it could remain a valuable asset across various economic scenarios in 2025.

Fidelity also expects more governments, central banks and sovereign wealth funds to add bitcoin to their treasuries in 2025, following examples like Bhutan and El Salvador . "Facing challenges such as debilitating inflation, currency debasement, and increasingly crushing fiscal deficits, not making any bitcoin allocation could become more of a risk to nations than making one," it said.

On stablecoins, tokenization and DeFi

Fidelity acknowledged the massive growth of stablecoins but noted they are not yet a perfect product fit. It expects further measures to address compliance risks, improve cross-chain interoperability and integrate with traditional financial systems. Stablecoins could coexist with tokenized bank deposits and drive efficiencies in trading tokenized securities while maintaining the U.S. dollar as the global reserve currency, the report said.

Fidelity also called tokenization the "killer" app" of 2025. The nominal value of tokenized real-world assets on-chain has grown from $8 billion in 2023 to $14 billion and is expected to reach $30 billion by 2025, it said. "As institutions increasingly recognize the advantages of utilizing blockchains — including faster, cheaper, and relatively frictionless operability — we anticipate growth in tokenized asset classes could continue to expand," Fidelity added.

DeFi, too, is expected to see continued innovation in 2025, with growth in purpose-built blockchains, decentralized social media, decentralized physical infrastructure networks ( DePINs ) and crypto-AI areas, Fidelity said.

Still 'not too late' to enter crypto

Fidelity believes mainstream crypto adoption will grow this year and says it is still "not too late" for investors to enter the space, even as bitcoin recently crossed $100,000.

"In fact, we believe we may be entering the dawn of a new era for digital assets, one poised to span multiple years — if not decades," Fidelity said. "This era could see digital assets permeating various sectors — industries, technologies, fields, balance sheets, and even nation-states."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Price Today (March 21, 2025): Bitcoin & Altcoins Update; XRP, SOL Drops 4%

TON Bounces from Crucial Support Zone — Will SUI Follow the Same Path?

INJ and KAVA Eye Breakout from Falling Wedge – Reversal on the Horizon?

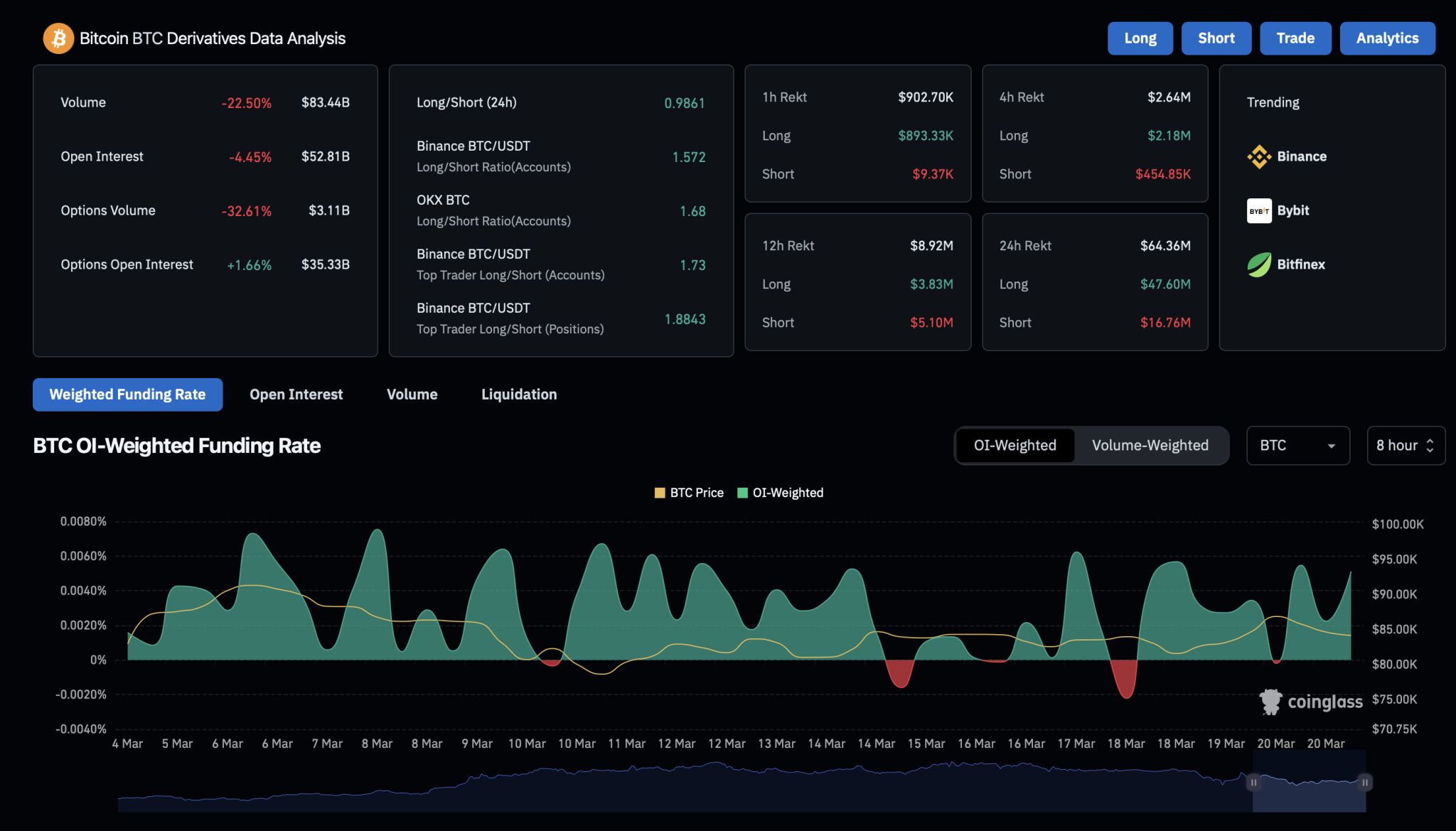

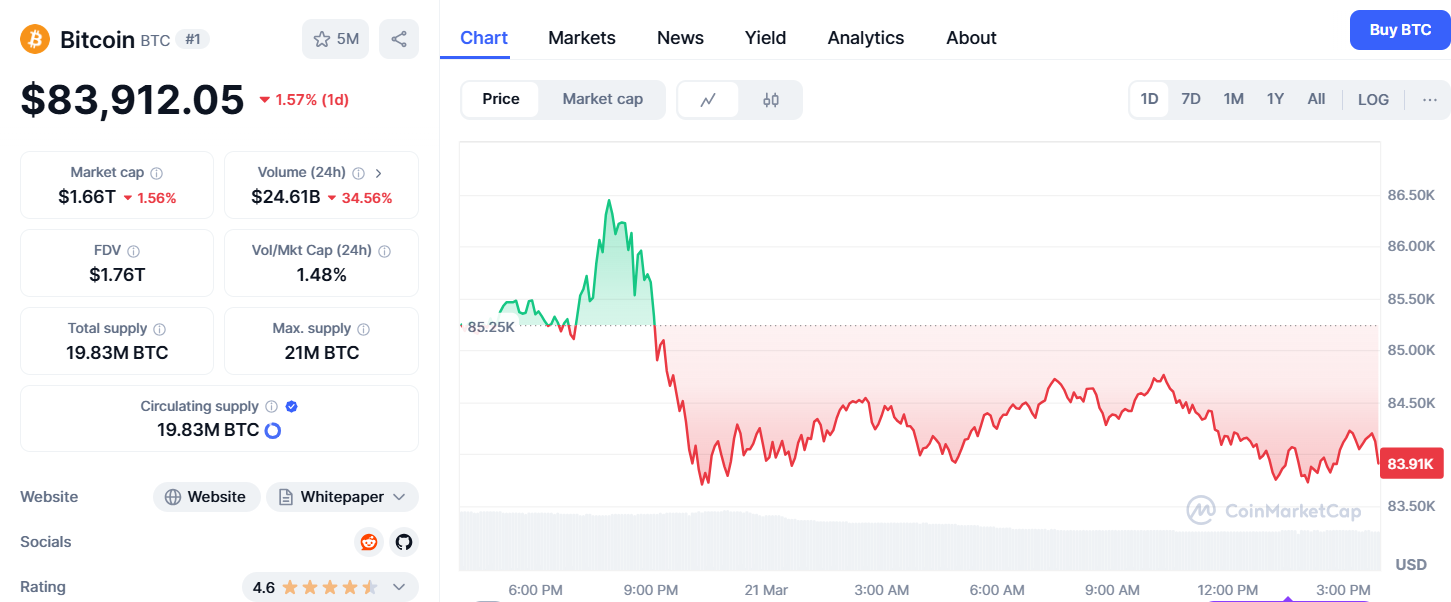

Bitcoin Breaks Below $85k as Leverage Spikes: Is $80k Next?