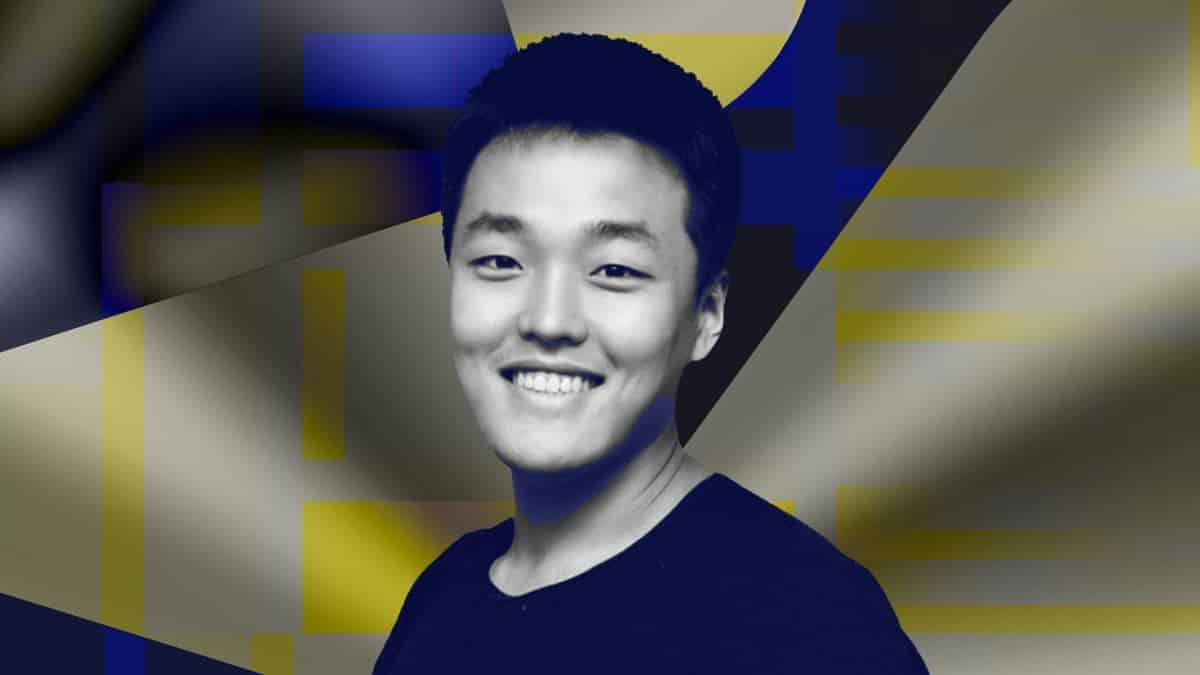

Judge sets Terraform founder Do Kwon’s trial for January 2026 in ‘unprecedented’ move, urges plea negotiations

Quick Take The criminal trial of Terraform Labs founder Do Kwon has been tentatively scheduled for late January of next year. Kwon, who pleaded not guilty, could face up to 130 years in prison if convicted of the nine charges related to the collapse of his failed TerraUST stablecoin.

Terraform Labs founder Do Kwon — who faces up to 130 years in prison if found guilty of crimes related to the collapse of his failed TerraUST stablecoin — appeared for his second court appearance at the United States District Court for the Southern District of New York on Wednesday, kicking off the discovery phase of the much anticipated and much delayed federal case.

Kwon, who has pleaded not guilty to nine felony charges related to fraud at Terraform, was recently extradited to the U.S. after prolonged legal proceedings in Montenegro, where courts considered whether to send the crypto founder to his native South Korea, where he also faces charges.

Kwon is standing trial in the same district court as other alleged high-profile crypto-related hearings, including FTX's Sam Bankman-Fried and Celsius' Alex Mashinsky.

Wednesday’s “initial conference” was held to determine whether the U.S. case could be settled without a trial and determine other pre-trial minutiae. U.S. District Judge Paul Engelmayer, who has overseen a number of crypto-related cases and previously threw out a class action lawsuit against Coinbase, set the trial start date for Jan. 26, 2026, and encouraged plea negotiations.

While the collapse of Kwon's failed algorithmic stablecoin wiped out about $40 billion in value and fomented a contagion event that brought down a multitude of crypto entities in 2022, the criminal case against him largely revolves around allegedly material misstatements Kwon made about the system, which prosecutors called "a Potemkin village."

For instance, in a previous case brought against Kwon and his company by the U.S. Securities and Exchange Commission, the agency argued Kwon colluded with an outside firm ( allegedly Jump Crypto ) to salvage UST's peg well before its ultimate downfall. Despite knowing the system was vulnerable, Kwon continued to "advertise" its stability, lead prosecutor Jared Lenow said on Wednesday.

'Unprecedented'

Kwon’s defense attorneys asked for a least a year to prepare for the case, given Kwon’s additional legal issues outside the U.S. Engelmayer noted setting a trial start date so far after the initial conference was "unprecedented” during his tenure but granted the motion. The prosecutors also did not find it “unreasonable.”

The U.S. government noted there is a six-terabyte mountain of proposed evidence submitted by both the litigators and litigants for discovery, including four phones Kwon had with him in the Montenegro prison, social media accounts and other nonpublic information, much of which has to be translated and unencrypted. The prosecution said that some of this data may have been gathered without a warrant and that crypto keys appear to have gone "missing."

Lenow noted the trial could take up to six weeks, including four weeks alone for the prosecution, similar to the trial of FTX founder Sam Bankman-Fried. (SBF’s trial began nearly 10 months after his initial conference.)

Engelmayer also questioned whether securities law will play a substantial role in Kwon’s case, saying that "there will be a need for extreme clarity for a jury.” Prosecutors said whether bitcoin or tether are commodities is immaterial to their case and noted District Judge Jed Rakoff ruled that “Terraform's crypto assets were investment contracts” in a previous case.

In 2023, Rakoff moved for summary judgment in the U.S. Securities and Exchange Commission’s enforcement action against Kwon and his company, which were ordered to pay $4.5 billion in penalties and disgorgement in April. Engelmayer encouraged both sides to consider plea discussions , considering the outcome of that civil case.

On Monday, acting U.S. Attorney Daniel Gitner said in a court filing that Kwon’s alleged victims could “exceed hundreds of thousands of individuals and entities and potentially total more than one million .” Kwon is charged with securities fraud, wire fraud, commodities fraud and money laundering conspiracy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DOGE & PEPE Can Lead This Year’s Meme Surge — Nexchain Surges in Presale As a Top AI-Utility Coin

DOGE and PEPE surge, but Nexchain leads 2025’s crypto presale list with AI-powered tech, low fees, and real-world utility. Discover the top presale pick now.DOGE: Dogecoin Sees Fresh Momentum and Institutional InterestPEPE: Technical Patterns Signal Potential BreakoutNexchain: Leading AI Utility in the Crypto Presale MarketFinal Words: Nexchain Dominates the Crypto Presale List

30 Bitcoin price top indicators hint at $230K bull market peak

Expert predicts Pi Network won't see mass adoption until 2030

Shiba Inu (SHIB): Broke Now, Massive Bitcoin (BTC) Jump, XRP: Recipe for $3 Bounce