XRP Investors Profit Taking Hits $1.6 Billion as Consolidation Continues

XRP remains stuck in a consolidation range as profit-taking rises to $1.6 billion. Will support at $2.00 hold, or is a drop to $1.50 ahead?

XRP’s price action remains stagnant, with the crypto consolidating for six weeks and failing to reach its all-time high (ATH) of $3.31.

Investors, frustrated by the lack of momentum, are opting to cash out, signaling increased profit-taking activity. This trend may impact the altcoin’s price trajectory in the coming weeks.

XRP Investors Are Bowing Out

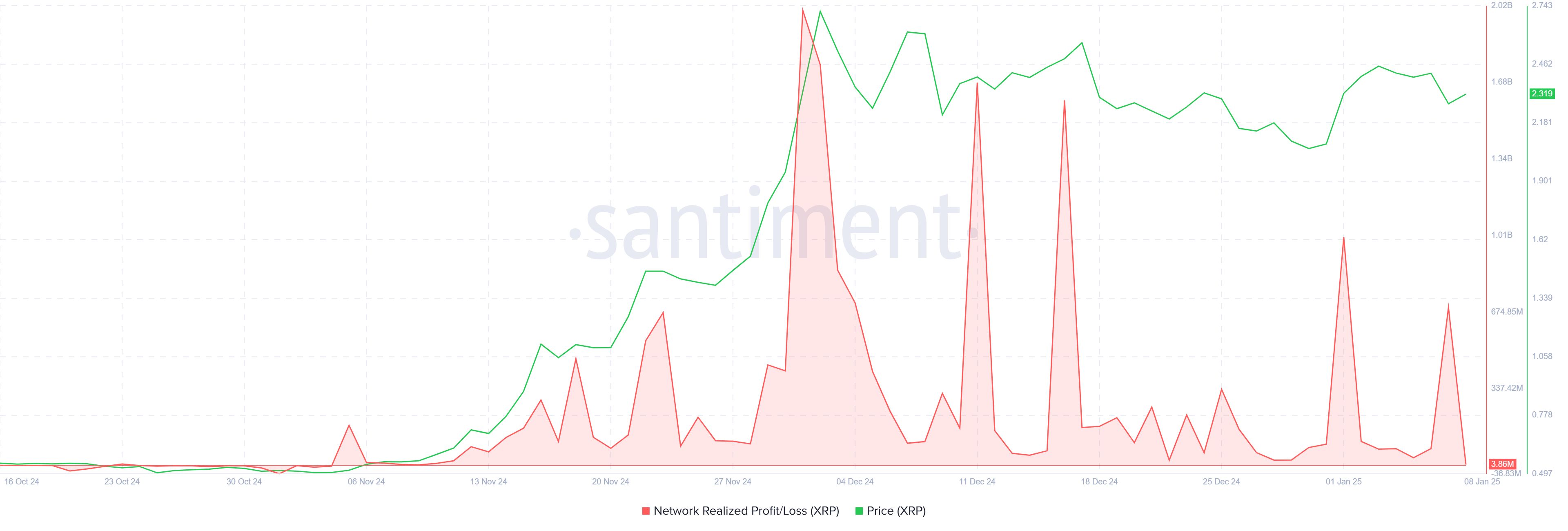

Realized profits spiked significantly in the last 24 hours, with nearly 695 million XRP, valued at over $1.6 billion, sold. This increase in profit-taking highlights growing investor dissatisfaction with XRP’s stagnant price movement. Such behavior has been observed before during prolonged consolidations and could exacerbate selling pressure.

The ongoing consolidation has previously triggered minor sell-offs, which have kept XRP from gaining upward momentum. As selling frequency increases, the token’s price may face further challenges, though the resilience of key support levels offers hope for stability.

XRP Realized Profits. Source:

Santiment

XRP Realized Profits. Source:

Santiment

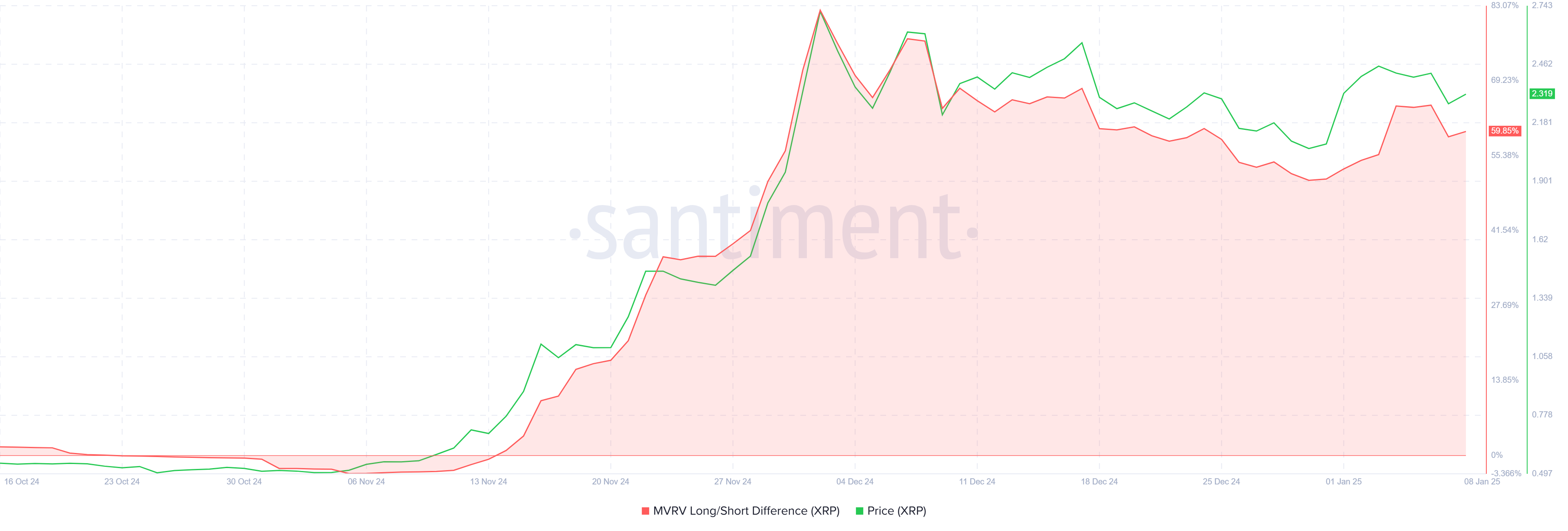

The MVRV Long/Short Ratio reveals that long-term holders are still sitting on profits, contributing to XRP’s stability. These investors, essential for the health of any cryptocurrency, are demonstrating resilience by holding their positions despite market stagnation.

This resilience has helped XRP maintain its support level at $2.00, even amid increased profit-taking. As long as these holders continue to back the asset, XRP is unlikely to experience a major decline in value, barring an unexpected spike in selling activity.

XRP MVRV Long/Short Ratio. Source:

Santiment

XRP MVRV Long/Short Ratio. Source:

Santiment

XRP Price Prediction: No Escape

XRP is currently trading at $2.31, confined to a consolidation range between $2.00 and $2.73. This sideways movement, persisting for six weeks, has stalled any significant price growth for the altcoin.

The consolidation has kept XRP from breaching the $2.73 resistance level and approaching its ATH of $3.31. Given the current market conditions and sentiment, this trend of price stagnation is likely to continue in the near term.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, a rise in selling pressure could threaten XRP’s support at $2.00. Losing this critical level could lead to a price drop, potentially reaching $1.50 or lower. Such a scenario would invalidate the current bullish-neutral outlook, resulting in significant losses for investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana’s midnight patch job isn’t the sign of decentralization

Bitcoin returns to $98K as Fed holds rates steady despite Trump’s demand

Polygon Targets $1 & Ethereum Eyes $3,600, Yet BlockDAG’s CertiK Audit and $0.0019 Coins Could Outperform All

Discover Polygon (POL) price movement and Ethereum (ETH) price analysis as both eye breakouts, and see why BlockDAG’s CertiK audit, growing presale, and attractive pricing position it among the best crypto for higher returns in 2025.Polygon (POL) Price Movement Signals Breakout Toward $1Ethereum (ETH) Price Analysis: Tight Range Could Spark $3,600 BreakoutBlockDAG’s CertiK Audit Strengthens Its Case as the Best Crypto for Higher ReturnsTo Sum It Up

$298M Crypto Liquidations Rock BTC and ETH Traders

Crypto liquidations hit $298M in 24 hours, with BTC and ETH leading losses. Here's what caused the wipeout.A Rough Day for Crypto TradersWhat Triggered the Liquidations?Caution Ahead for Leverage Users