MicroStrategy buys 1,070 Bitcoin for $101M, yield reaches 74%

Key Takeaways

- MicroStrategy bought 1,070 Bitcoin for $101 million, raising its total holdings to 447,470 BTC.

- The company's Bitcoin yield reached 74% in 2024.

MicroStrategy said Monday it had acquired 1,070 Bitcoin for $101 million between Dec. 30 and 31, 2024, boosting its total holdings to 447,470 BTC, valued at around $44.3 billion at current market prices.

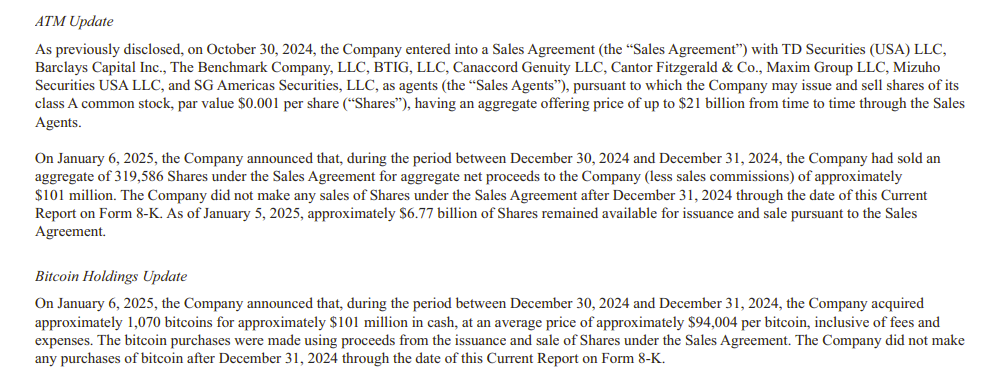

According to a recent SEC filing , the Tysons, Virginia-based company funded its latest purchase through the sale of f 319,586 shares during the same period. It acquired the digital asset at an average price of $94,004 per BTC. MicroStrategy also reported its Bitcoin yield reached 74.3% in 2024, with the metric standing at 48% for the period from Oct. 1 to Dec. 31.

The announcement came after Michael Saylor, MicroStrategy’s co-founder and executive chairman, teased the purchase on Jan. 5, referencing the lines on the Saylor Tracker, a monitoring tool for the company’s Bitcoin acquisitions.

Last Friday, MicroStrategy announced plans to raise up to $2 billion through public offerings of perpetual preferred stock to strengthen its balance sheet and fund additional Bitcoin purchases. This offering is aimed at its “21/21 Plan,” which targets raising $21 billion in equity and $21 billion through fixed income instruments over three years.

The company filed with the SEC on Dec. 23 to increase its authorized Class A common stock from 330 million to 10.33 billion shares, and its preferred stock from 5 million to more than 1 billion shares, seeking greater flexibility for future share issuance.

The latest purchase marks MicroStrategy’s ninth consecutive week of Bitcoin acquisitions since Oct. 31, when the company first announced its “21/21 Plan.” Saylor-led firm has acquired 195,250 BTC since initiating the plan, representing about 45% of its investment target. At current market prices, these holdings are valued at $19.3 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Could Stagnant Bitcoin Dominance Herald the Arrival of Altseason?

Signs of an Emerging Altcoin Season as Bitcoin's Market Dominance Dips to 63.3% Indicating Possible Capital Redirection

JPMorgan CEO Jamie Dimon offloads over 130,000 shares worth $31.5 million