Global crypto investment products hit record $44 billion net inflows in 2024: CoinShares

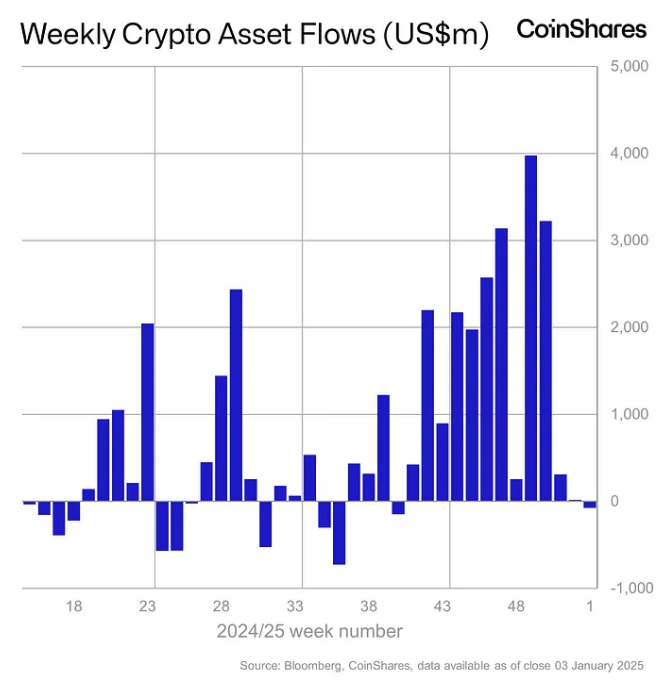

Quick Take Global crypto funds generated a record $44.2 billion in net inflows during 2024, according to data from asset manager CoinShares. 2025 is also off to a good start, attracting $585 million worth of net inflows so far, Head of Research James Butterfill said.

Global crypto funds run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares registered a record $44.2 billion in net inflows last year — nearly four times the prior $10.5 billion annual peak in 2021 — according to CoinShares.

Digital asset investment products are also off to a good start in 2025, generating $585 million in net inflows, CoinShares Head of Research James Butterfill noted in a Monday report. However, including the final two days of 2024, last week saw net outflows of $75 million overall, Butterfill said.

Weekly crypto asset flows. Images: CoinShares .

2024 was marked by the approval and launch of U.S. spot Bitcoin and Ethereum exchange-traded funds for the first time, attracting $44.4 million in combination. Crypto investment products in Switzerland also registered $630 million worth of net inflows for the year. However, net annual outflows of $707 million and $682 million from Canada and Sweden-based funds offset the overall figure as investors switched to U.S.-based products and, in some cases, took profits, Butterfill said.

Bitcoin funds dominate while Ethereum investment products see late-2024 resurgence

Bitcoin-based products dominated globally, generating $38 billion of the net inflows and accounting for 29% of all-time bitcoin assets under management at the funds. Short-bitcoin products also attracted $108 million worth of investments amid the 2024 price rise, though this was down slightly from $116 million the year before.

Despite long periods of underperformance, Ethereum-based products saw a resurgence in late 2024, Butterfill noted, bringing annual net inflows to $4.8 billion — 2.4 times 2021’s total and 60 times 2023’s figure.

XRP-based funds generated the third-largest single asset net inflows of 2024 with $438 million, while Solana investment products attracted $69 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICNTUSDT now launched for futures trading and trading bots

CBKUSDT now launched for futures trading and trading bots

Notice: Suspension for VND deposit and withdrawal services

New spot margin trading pair — HFT/USDT!