The Rise of DEX Futures Trading: A New Milestone in December

In December, decentralized exchanges (DEXs) achieved a significant milestone, with futures trade volume hitting 10.17% of centralized exchange (CEX) futures volume—an all-time high. This surge underscores the growing prominence of DEXs in the cryptocurrency market, driven by consistent improvements in user experience, infrastructure, and adoption.

Why Are DEX Futures Gaining Momentum?

DEX Futures Trading: Image Source: THE BLOCK

DEX Futures Trading: Image Source: THE BLOCK

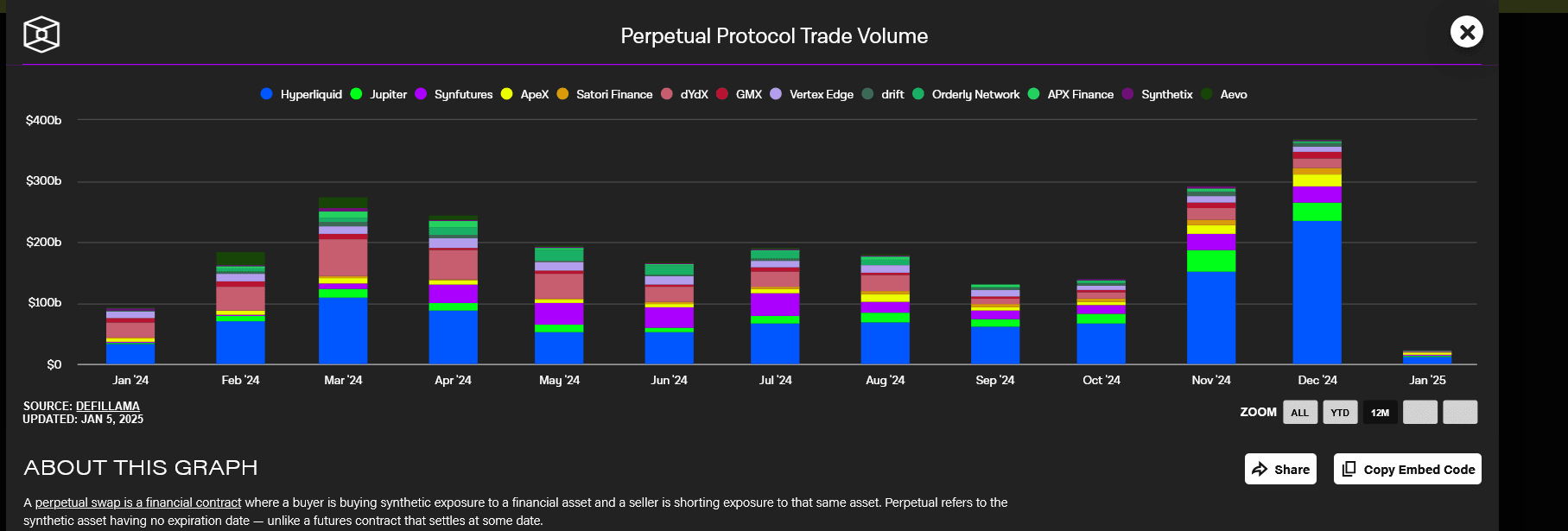

The increasing share of DEX futures trading is no accident. Over the past year, platforms like Hyperliquid , Jupiter, ApeX, Satori Finance, and Drift have steadily captured trader interest, offering compelling alternatives to traditional CEXs. Key factors driving this trend include:

- Improved On-Chain Experience: Enhanced scalability, lower transaction costs, and user-friendly interfaces make DEXs more accessible.

- Decentralization Appeal: Traders are drawn to the autonomy and transparency that DEXs offer, reducing reliance on intermediaries.

In 2024, DEX futures volumes grew at an impressive monthly average of 26.5%, culminating in a cumulative annual volume of $285 billion. This growth reflects the rising confidence in decentralized financial ecosystems.

Hyperliquid: Leading the Pack

Among DEX platforms, Hyperliquid emerged as the dominant player, contributing a staggering 78.8% of total DEX futures volume in December, with a monthly turnover exceeding $225 million. Its consistent growth and innovative features have positioned it as a leader in the decentralized trading landscape.

Following Hyperliquid were:

- Jupiter: 9.8% market share, with over $28 million in December volume.

- ApeX, Satori Finance, and Drift: Contributing 6.2%, 3.6%, and 1.6%, respectively.

These platforms highlight the diversity within the DEX ecosystem, as each caters to unique trader needs and preferences.

CEXs Struggle to Maintain Growth

In contrast, centralized exchanges faced a slowdown in December. Bitcoin futures volumes on CEXs were 17% lower than in November, while Ethereum futures volumes stagnated at previous levels. Despite the decline, absolute volumes on CEXs remain significantly higher than those on DEXs, showcasing the gap that still exists between the two markets.

What Does This Mean for the Future of Crypto Trading?

The rise in DEX futures trading marks a pivotal shift in the cryptocurrency market. While CEXs continue to dominate in absolute terms, the rapid growth of DEXs signals a redistribution of market share driven by:

- Technological Advancements: Further improvements in blockchain scalability and cross-chain compatibility could accelerate DEX adoption.

- Regulatory Trends: As governments impose stricter regulations on CEXs, traders may increasingly pivot to decentralized platforms for privacy and control.

- Market Maturity: Growing trust in DEXs and the increasing sophistication of their offerings are likely to attract institutional players.

Predictions for 2025

Looking ahead, we expect the DEX-CEX volume ratio to continue climbing, supported by:

- Innovative DEX Features: Platforms will introduce advanced tools, matching or exceeding CEX capabilities.

- Increased User Migration: As trust in DEXs solidifies, more traders will shift away from CEXs, particularly in regions with restrictive regulations.

- Institutional Interest: The maturing DEX ecosystem may see institutional adoption, boosting volumes further.

By the end of 2025, it wouldn’t be surprising if DEX futures volumes reach 20% of CEXs—a significant leap that could redefine crypto trading dynamics.

Conclusion: A Decentralized Future

The December milestone is a testament to the growing appeal of DEXs in the crypto ecosystem. While centralized exchanges remain dominant, the rapid rise of platforms like Hyperliquid and Jupiter highlights a shift toward decentralization. As infrastructure and adoption continue to improve, DEXs are poised to play an increasingly pivotal role in shaping the future of cryptocurrency trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether Enters Cybersecurity with Decentralized Password Manager

Tether CEO Paolo Ardoino has unveiled PearPass, an entirely local, open-source password manager built to function without cloud infrastructure.

Story Protocol’s IP Token Jumps 15% Amid Whale Accumulation and Volume Surge

After enduring a multi-day decline, Story Protocol’s IP token has bounced back with a sharp 15% gain, now hovering slightly above the $3 mark.

Auto-Compounding Comes to uniETH Restaking Rewards: What It Means for Your ETH Yield

Ripple and SEC Agree to Pause Appeals Process