Why These Altcoins Are Trending Today — January 2

As 2025 begins, altcoins like VIRTUAL and KEKIUS are making waves. Read about their recent price jumps and what could be next for these trending altcoins.

As 2025 kicks off, investors are optimistic for a year of stronger gains. Interestingly, bar a few, most of the altcoins trending today have seen their prices increase in the last 24 hours.

According to CoinGecko, two of the top three altcoins — Virtuals Protocol (VIRTUAL) and Kekius Maximus (KEKIUS) — have recorded impressive double-digit growth, while ai16z (AI16Z) has bucked the trend with a decline. Here are the details.

Virtuals Protocol (VIRTUAL)

Throughout Q4 of last year, VIRTUAL was a regular on the trending list as one of the top-performing altcoins. Today, January 2, it continues to capture attention, surging by 23.60% in the last 24 hours.

VIRTUAL’s sustained rise could be attributed to the growing buzz around AI and gaming, which has propelled the altcoin to new heights. Following the price increase, VIRTUAL now trades at $4.89.

On the daily chart, VIRTUAL continues to hit a higher high, indicaitng notable demand for the altcoin. The Relative Strength Index (RSI) reading has also increased, indicating notable bullish momentum around the token.

Virtuals Protocol Daily Analysis. Source:

TradingView

Virtuals Protocol Daily Analysis. Source:

TradingView

Should this trend continue, the altcoin’s value could climb to $6. However, if demand for the Virtuals Protocol token drops, it might face correction. In that case, the value could decline to $2.90.

Kekius Maximus (KEKIUS)

Unlike VIRTUAL, Kekius Maximus price has decreased by 50% in the last 24 hours. However, that is not the major reason it is part of the altcoins trending today.

Earlier on, the meme coin built on Ethereum recorded a mind-blogging increase after Elon Musk changed his X handle to Kekius Maximus. However, yesterday, the Tesla CEO switched back to his original name, causing the meme coin’s market cap to fall by $300 million within an hour.

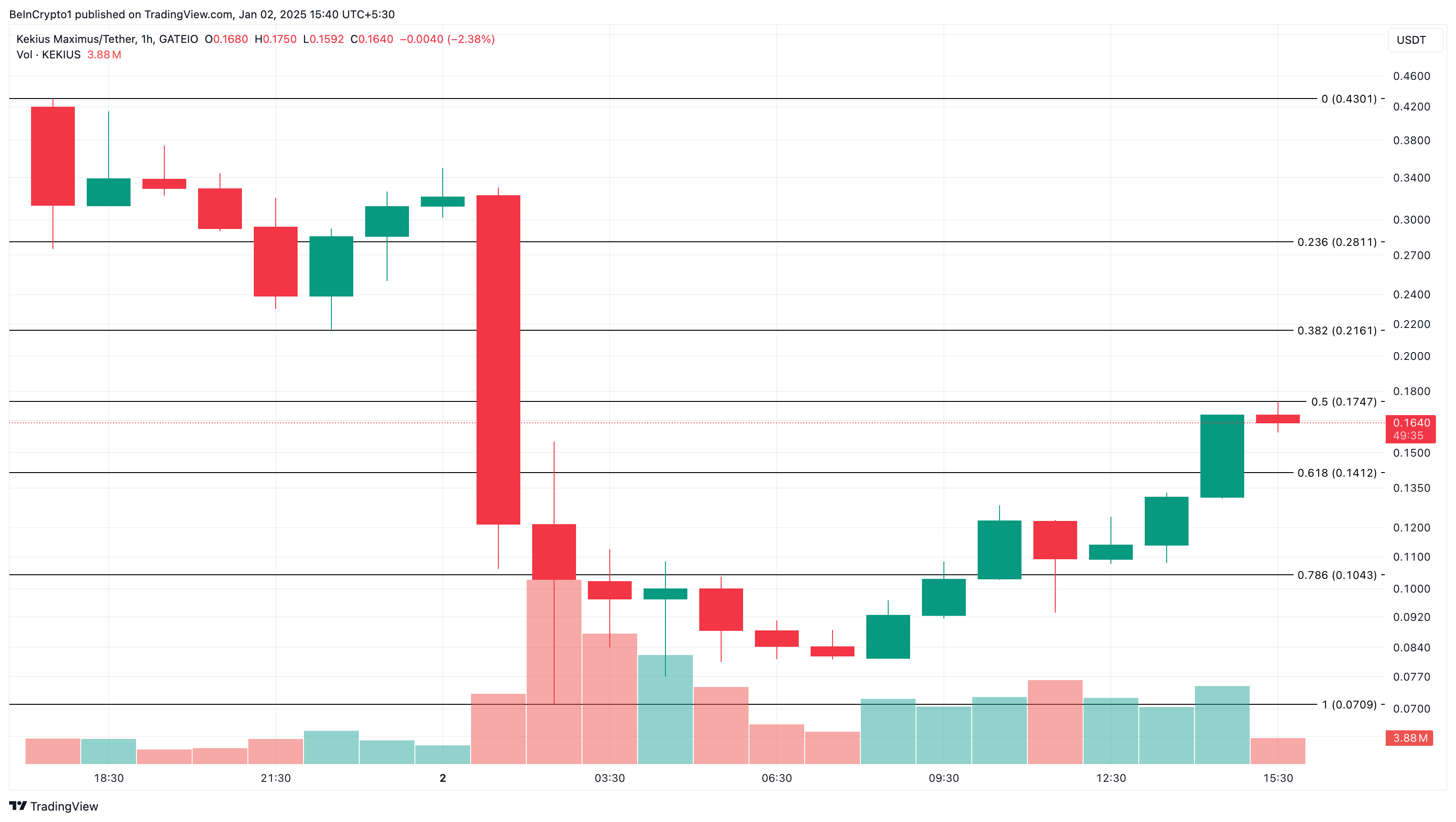

However, the 1-hour chart shows that the token has erased some of those losses. If sustained, KEKIUS value might rally toward $0.28 in the short term. On the flip side, if bears take over the price action, it could decline to $0.10.

Kekius Maximum 1-Hour Analysis. Source:

TradingView

Kekius Maximum 1-Hour Analysis. Source:

TradingView

ai16z (AI16Z)

Ai16z, a token deployed by venture capital led by AI agents, has increased by 20% in the last 24 hours, which is why it is trending. Beyond that, the bullish sentiment around AI agent cryptos is another reason it is on the list.

As of this writing, AI16Z trades at $2.27. On the 4-hour chart, the Bull Bear Power (BBP) has remained in the positive region. This indicates that bulls are in control of the altcoin’s direction.

ai16z 4-Hour Analysis. Source:

TradingView

ai16z 4-Hour Analysis. Source:

TradingView

Should this remain the same, then the token’s value might rally toward $3.50. However, if bears have the upper hand, the trend might change. If that is the case, AI16Z could decline to $1.73.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

Recent bullish news surrounding a potential Solana ETF has reignited market optimism. The SEC has asked issuers to update their S-1 filings, signaling that ETF approval could be near. This development has boosted confidence in the Solana ecosystem. As a high-performance Layer-1 blockchain, Solana (SOL) offers fast transactions and low fees, making it a hub for DeFi and NFT activity, while also drawing increasing institutional interest. Jito (JTO), the leading liquid staking protocol on Solana, saw its token surge 17% after JitoSOL was included in a Solana ETF prospectus. Its MEV optimization further enhances network value. Jupiter (JUP), Solana's top DEX aggregator with a 95% market share, recently launched a lending protocol, highlighting strong growth potential. These tokens offer investors early exposure ahead of a possible ETF approval and a chance to benefit from Solana's expanding ecosystem.

Can Solana Ride the Nasdaq Hype to Close Q2 Above $160?

Solana's price rise is fueled by renewed institutional interest and growing trader participation, positioning SOL for a potential breakout above $160.

Bitcoin: Scarcity Deepens With Every Block Mined

BlockDAG Drops A Full 6-Week Launch Plan as LTC Drops 10% & PEPE Holds $1.64B Volume Amid 12% Fall

Explore how BlockDAG’s six-week Go Live plan with active DeFi tools sets it apart as Litecoin drops 10% and PEPE holds $1.64B volume after a 12% fall.BlockDAG Prepares Full DeFi Launch With Six-Week Go Live PlanPEPE Slides 12% But Maintains $1.64B Volume Near Key SupportLitecoin Drops 10% in a Day While Holding Weekly Price RangeIn Summary