Solana Price Analysis Hints $300 Recovery Amid TVL Spike

This week, the cryptocurrency market recorded damped volatility as Bitcoin wavers between the $100k and $90k levels. This consolidation trend has stalled the prevailing correction sentiment in most major altcoins, including SOL. The Solana price holding above a confluence of major support signals a potential for a bullish recovery.

According to Coingecko, SOL price currently trades at $184.5, with an intraday loss of 2.5%. The asset market cap stands at $88.5 Billion, while 24-hour trading is at $3.6 Billion.

Key Highlights:

- A renewed uptrend in Solana’s TVL and open interest signals increased adoption and investor confidence if further rally.

- A downsloping trendline drives the current correction in Solana price.

- The $175 support is closely aligned with the 50% Fibonacci retracement level, and the 200-day Exponential moving average creates a high accumulation zone.

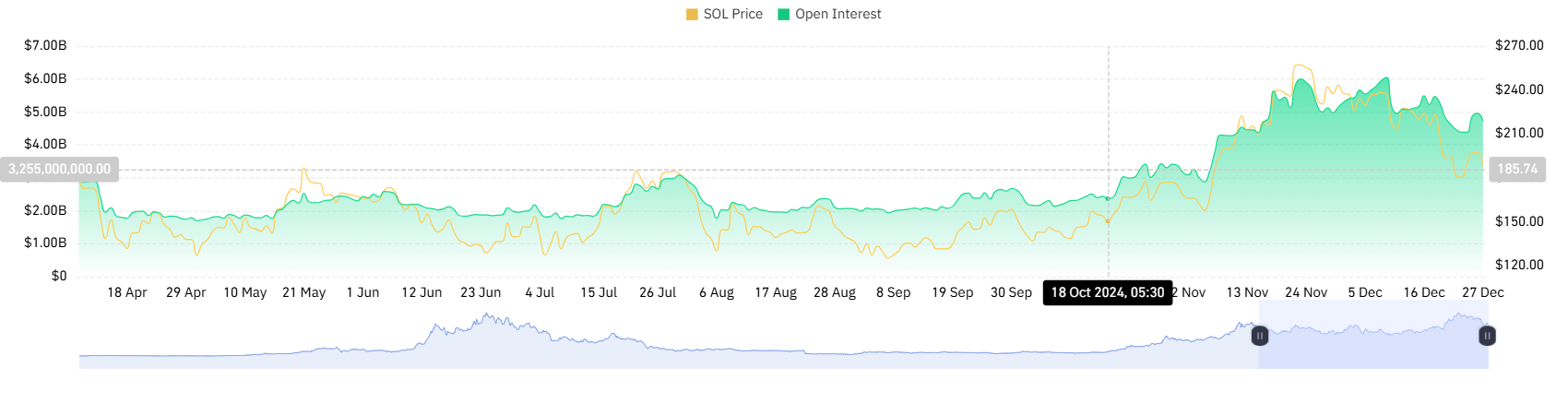

SOL Rebounds as Open Interest and TVL See Notable Increases

According to Coinglass data, the SOL futures open interest records a notable surge from $4.38 to $4.96— a 13% increase since last week. Open interest refers to the total number of outstanding derivative contracts that have not yet been settled.

A rise in open interest often suggests increased trader activity, signaling heightened interest and confidence in SOL’s price movements.

In the same period, Solana’s Total volume locked (TVL) records a jump from $8.06 to $8.67 Billion, registering a 7%. A growing TVL showcases increased trust in Solana’s DeFi platforms, suggesting that more users are staking, lending, or providing liquidity within its ecosystem.

Solana Price Correction Hits Key Support

For over a month, the Solana price has witnessed a major correction from $264 to $183, registering a 30% loss. The pullback is currently seeking support at $175, a horizontal coinciding with 50% FIB, 50-day EMA, and an emerging support trendline.

This creates a high area of interest for buyers to recuperate the bullish momentum and drive price reversal. An analysis of the daily chart shows the support trendline has acted as suitable pullback support for SOL since mid-September.

A potential reversal could drive the price 7.8% before a key breakout from the downsloping trendline. A successful breakout will further accelerate the bullying pressure to drive a rally past $300.

Also Read: Bitwise Files for Bitcoin Standard Corporations ETF with the SEC

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Under pressure, Trump’s crypto czar divests his $200M+ crypto holdings

David Sacks divested over $200 million in digital-asset holdings to avoid conflicts of interest. Senator Elizabeth Warren criticized Sacks, questioning his crypto holdings. Sacks’ divestment details were revealed shortly before Warren’s letter requesting crypto ownership clarification.

Smart Contract Risks Could Be Global Finance’s Ticking Time Bomb, Warns Movement Labs Co-Founder

Cooper Scanlon emphasizes the serious vulnerabilities in blockchain infrastructure, especially Ethereum, highlighting the growing threat to global finance and calling for secure innovations like Move programming.

VIPBitget VIP Weekly Research Insights

Over the past month, the cryptocurrency market has faced a downturn due to multiple factors. Global macroeconomic uncertainties, such as shifts in U.S. economic policies and the impact of tariffs, have heightened market anxiety. Meanwhile, the recent White House crypto summit failed to deliver any significant positive news for the crypto market, further dampening investor confidence. Additionally, fluctuations in market sentiment have led to capital outflows, exacerbating price declines. In this volatile environment, selecting stable and secure passive-income products is more crucial than ever. Bitget offers solutions that not only provide high-yield fixed-term products but also flexible options for users who need liquidity. Furthermore, with the added security of the Protection Fund, investors can earn steady returns even amidst market volatility.

SEI Price Surges Following World Liberty Financial Purchase