Aave (AAVE) Surges 12% As Lending Protocol Proposes Chainlink Integration

AAVE surged 12% after Aave proposed adopting Chainlink’s SVR to redistribute MEV profits fairly. With strong market momentum, it eyes a $400 breakout.

AAVE, the native token that powers decentralized finance (DeFi) lending protocol Aave, has surged 12% in price over the past 24 hours. This rally follows a recent proposal to integrate a new Chainlink oracle.

As of this writing, AAVE trades at $369.10 and is poised to reclaim its three-year high of $399.85.

Aave Plans Chainlink’s Smart Value Recapture (SVR) Integration

On December 23, Chainlink introduced Smart Value Recapture (SVR). This is an oracle service designed to capture profits generated from Maximum Extractable Value (MEV) and distribute them back to DeFi protocols.

After this launch, a community member sent a temp check proposal to Aave’s governance forum to discuss integrating SVR into the lending protocol.

According to the proposal, liquidators and searchers often profit disproportionately during Aave’s liquidation process, leaving less value for protocol users. By integrating Chainlink’s SVR system, the MEV generated from Aave liquidations is recaptured and distributed fairly among all participants, including searchers, builders, and the protocol itself.

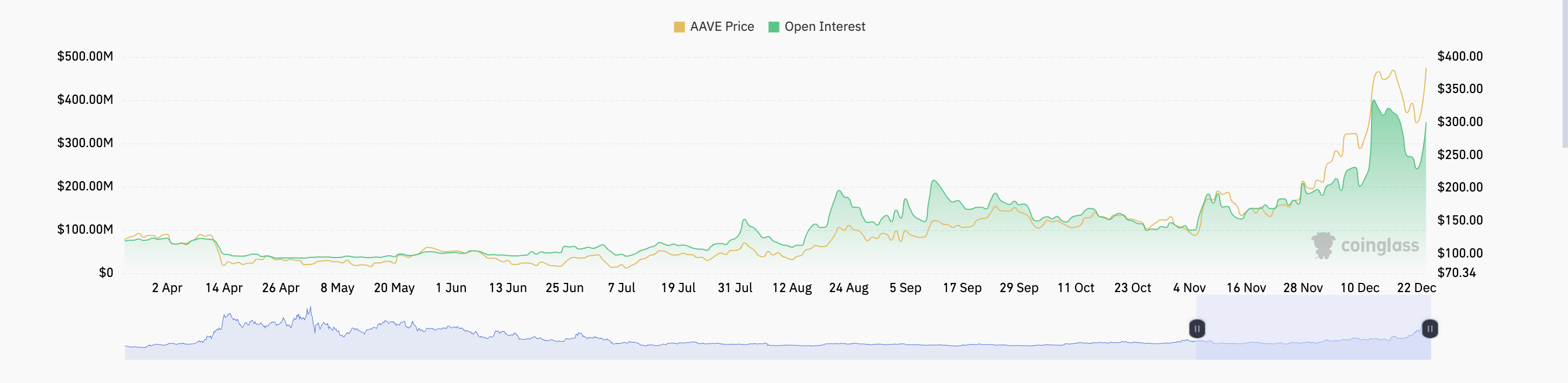

This proposal has ignited an uptick in AAVE’s trading activity. Over the past 24 hours, its value has climbed by double digits. Its rising open interest confirms the surge in the demand for the altcoin.

As of this writing, open interest stands at $376 million, climbing by 32%.

AAVE Open Interest. Source:

Coinglass

AAVE Open Interest. Source:

Coinglass

Open interest refers to the total number of outstanding contracts in a derivatives market, such as futures or options, that have not yet been settled. As with AAVE, when an asset’s open interest rises during a price rally, traders are opening new positions in the direction of the price move, indicating strong market confidence and potential for continued momentum.

Furthermore, on the daily chart, AAVE’s Relative Strength Index (RSI) is in an uptrend, reflecting the buying activity. As of this writing, it is at 62.88.

AAVE RSI. Source:

TradingView

AAVE RSI. Source:

TradingView

This indicator measures an asset’s oversold and overbought market conditions. At 62.88, and in an uptrend at press time, market participants are buying more AAVE than they are selling.

AAVE Price Prediction: A Rally Above $400 Is Possible

AAVE is currently trading below the resistance at its three-year high of $399.85. If buyers continue to accumulate, AAVE could break through this resistance and establish it as a support floor. This breakout could push its price above $400 for the first time since 2021.

AAVE Price Analysis. Source:

TradingView

AAVE Price Analysis. Source:

TradingView

However, if selloffs commence, they will invalidate this bullish outlook, and AAVE’s price could plummet to $323.46

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report