Bitcoin’s Future Uncertain as Mt. Gox Redistribution Sparks Sell-Off Fears and Recovery Hopes

-

Mt. Gox’s recent Bitcoin redistribution has introduced a wave of uncertainty in the cryptocurrency market, with traders grappling between sell-off fears and recovery hopes.

-

As Bitcoin faces critical technical levels, market reactions remain mixed, reflecting cautious investor sentiment amidst ongoing volatility.

-

The Mt. Gox movement has triggered a notable shift in sentiment, with analysts emphasizing the need for close monitoring as $49.3 million in Bitcoin is redistributed.

Bitcoin’s market faces uncertainty post-Mt. Gox redistribution, with critical support levels tested as traders weigh sell-off fears against potential recovery.

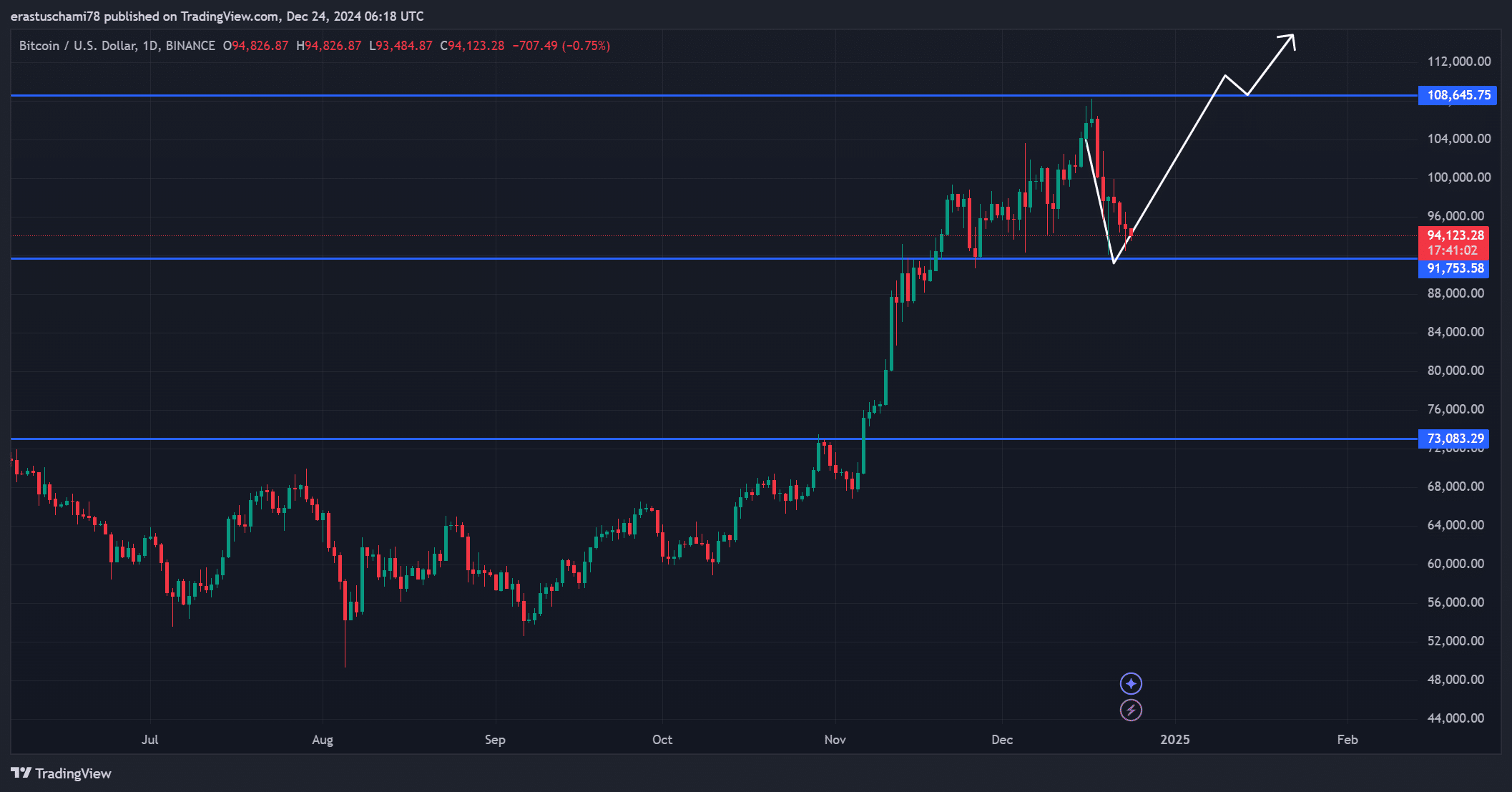

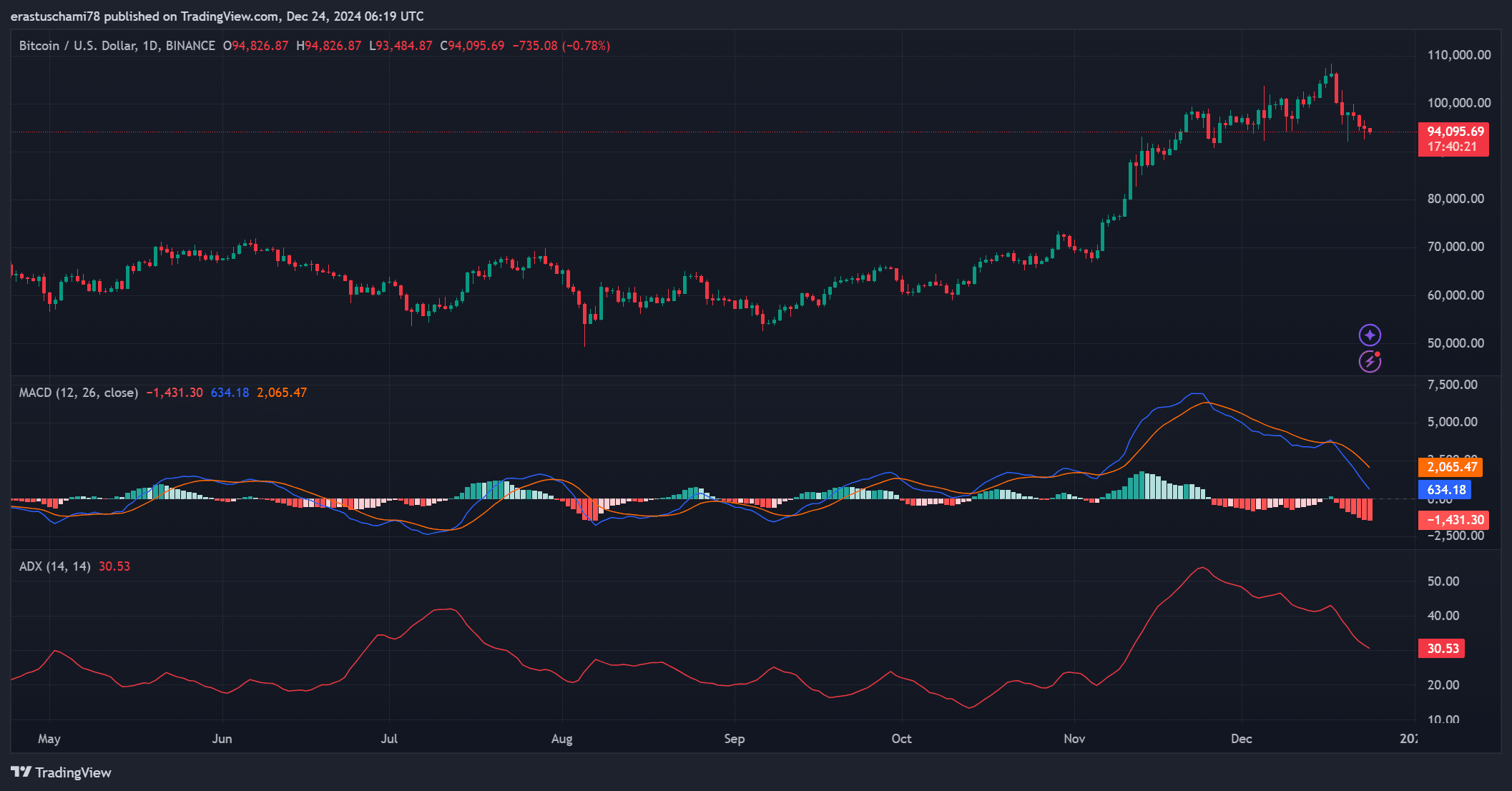

Can BTC Break Resistance or Risk Losing Support?

Bitcoin’s current trading price is hovering near a significant threshold, with crucial support identified at $91,753 and resistance looming at $108,645. A drop below this support level could usher in a more pronounced bearish trend, potentially driving prices down to $73,083. Conversely, a successful movement above $96,000 could set the stage for advancing towards the psychologically important $100,000 mark, marking a period of consolidation critical for future direction.

Source: TradingView

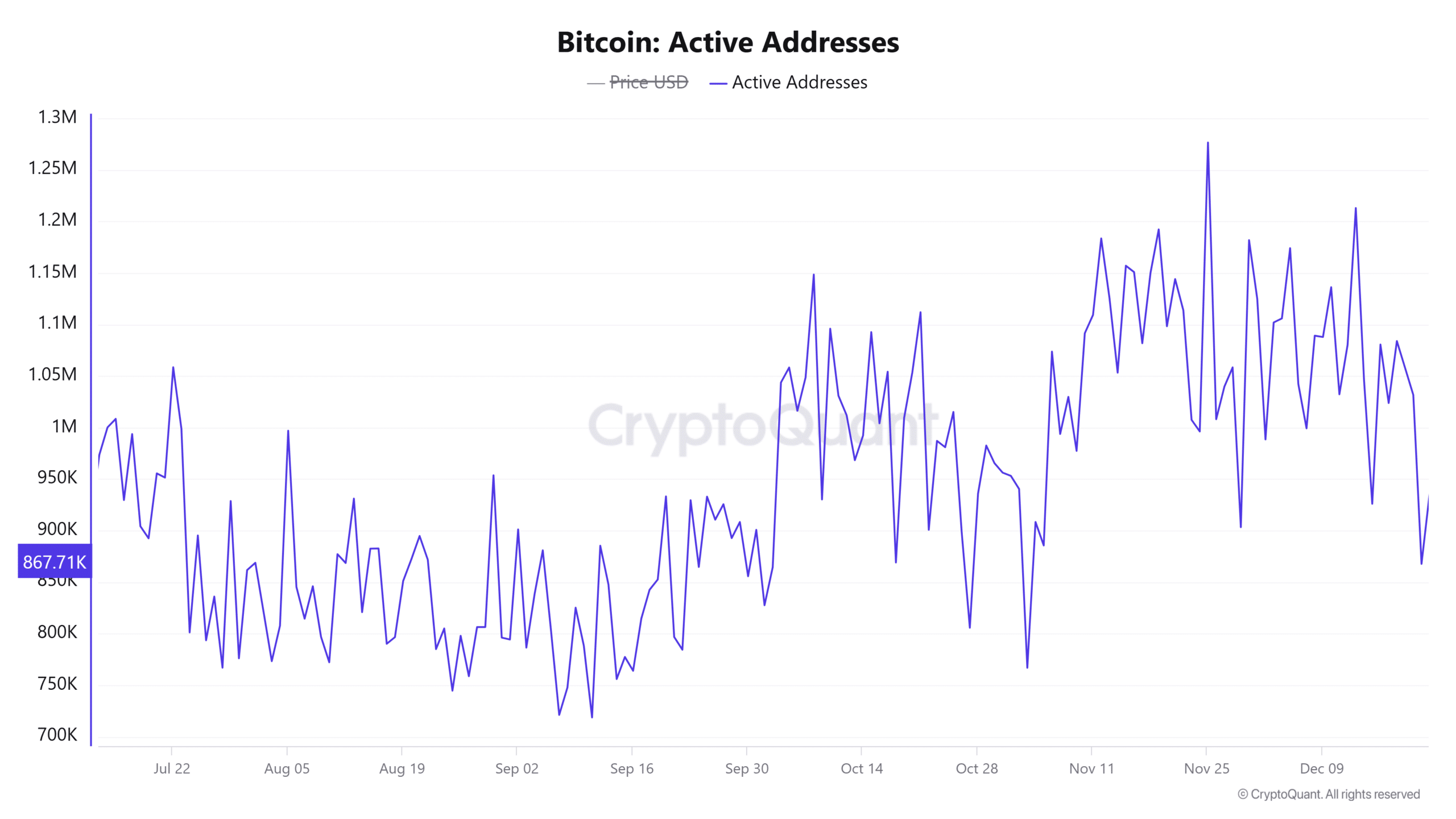

Active Addresses Show Rising Engagement

Recent data indicates that Bitcoin’s active addresses have surged by 1.21% in the past 24 hours, now reaching a total of 9,747K. This uptick is not only a positive signal for the network but also reflects heightened engagement as more participants enter the market, likely fueled by the speculation surrounding the Mt. Gox movements. Sustained growth in active addresses can be a strong indicator of market recovery.

Source: CryptoQuant

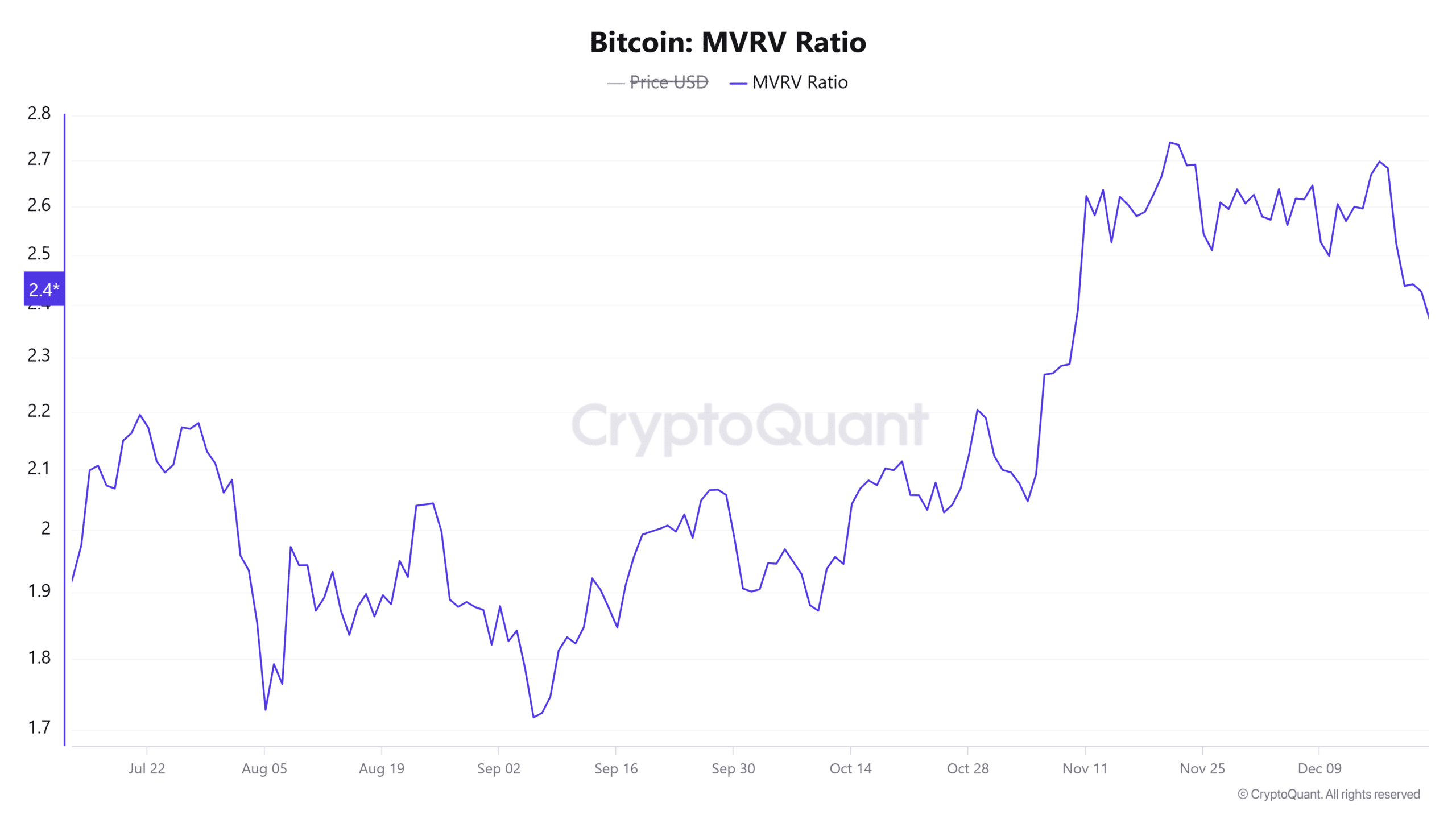

Is BTC Undervalued? MVRV Ratio Insights

The MVRV ratio currently sits at 2.4, following a 1.17% decline, suggesting that the market may be entering a cooling-off phase. Historically, lower MVRV ratios often indicate favorable entry points for long-term investors while attracting increased interest. Yet, continued declines in this ratio could reflect a decrease in market confidence, emphasizing the need for monitoring this crucial metric as a gauge for market positioning.

Source: CryptoQuant

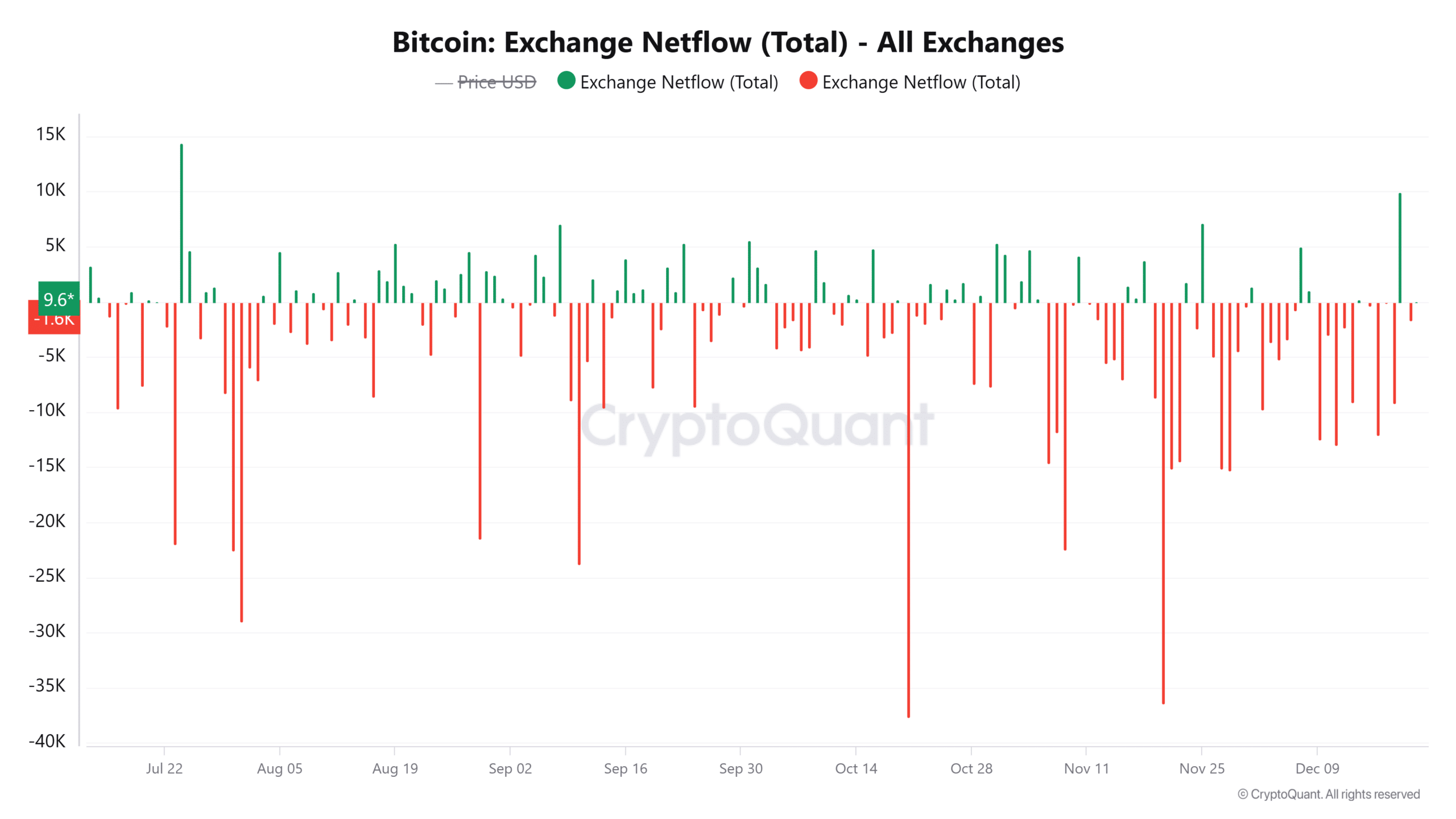

Exchange Inflows Suggest Caution

Amid ongoing volatility, Bitcoin has seen a significant uptick in exchange net inflows, which surged by 39.93%, now totaling 19.545K BTC. Such inflows often indicate that traders may be positioning to liquidate holdings, prompting scrutiny over whether these movements will trigger a market downturn. It is increasingly important to keep a close watch on exchange activities to discern the potential impact on market conditions.

Source: CryptoQuant

ADX and MACD Reveal Mixed Signals

The ADX indicator, currently reading 30.53, indicates a moderately strong trend existing within the market. In contrast, the MACD is showing bearish momentum following a recent crossover below the signal line. The MACD’s positioning near the zero line suggests that if buyers regain control, there is potential for an upward reversal. These mixed signals underline the market’s fragile balance between bullish energy and prevailing bearish pressures.

Source: TradingView

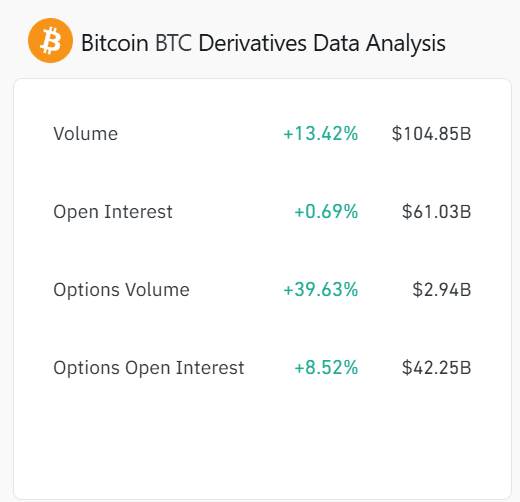

Derivatives Data Reflects Cautious Optimism

Noteworthy developments have emerged in the Bitcoin derivatives market, where options volume has increased by 39.63%, now reaching $2.94 billion. Additionally, the open interest has witnessed a slight increase of 0.69%, totalling $61.03 billion, while options open interest rose by 8.52% to $42.25 billion. These upward movements suggest a growing speculative interest in Bitcoin, yet the modest rise in open interest indicates a level of caution regarding directional trends.

Source: Coinglass

Read Bitcoin’s [BTC] Price Prediction 2024-25

In summary, the recent Bitcoin redistribution from Mt. Gox has cultivated a climate of uncertainty, positioning the market in a precarious state. BTC’s capability to maintain crucial support and navigate escalating exchange inflows could either provoke a wave of sell-offs or foster renewed confidence among investors. At present, Bitcoin finds itself at a critical juncture, oscillating between fear-induced caution and ripe opportunity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI16Z token launches Auto.fun this week

NVIDIA plans $500 billion AI factory buildout in US

Crypto funds lose $795 million amid tariff uncertainty

Tether invests $500 million in decentralised Bitcoin mining