Week 51 On-chain Data: In-chain Sentiment Still Needs Adjustment, Short-term Bottom at $85,000

We anticipate that the next year will continue to be relatively loose in monetary policy, with ample liquidity. The likelihood of entering a bear market is low.

Original Article by: "Failed $110K Impact, Is This a Digestive Pullback or an Initial Glimpse of the Top? | WTR 12.23"

Original Source: WTR Research Institute

Weekly Review

This week, from December 16th to December 23rd, Bitcoin reached a peak near $108,353 and a low near $92,232, with a fluctuation range of about 15%. Observing the distribution of chips, a large number of chips were traded around 95,000, providing some support or resistance.

• Analysis:

1. 60000-68000 approximately 1.8 million coins;

2. 90000-100000 approximately 1.85 million coins;

• The probability of not breaking below 87,000 to 91,000 in the short term is 80%;

• The probability of not breaking above 100,000 to 105,000 in the short term is 70%.

Important News

Economic News

1. November PCE Price Index YoY 2.4%, lower than the expected value of 2.50%, higher than the previous value of 2.30%;

2. November Core PCE Price Index YoY 2.8%, lower than the expected 2.90%, unchanged from the previous value of 2.80%.

3. November PCE Price Index MoM 0.1%, November Core PCE Price Index MoM 0.1%, both lower than the previous and expected values.

4. December 1-year Inflation Rate Expectations Preliminary Value 2.8%, lower than the previous value of 2.90%.

5. Early Thursday, the Fed cut interest rates by 25 basis points, but reduced the expected rate cuts for 2025 from 4 to 2, leading to a general decline in stock indices, gold, and the cryptocurrency market.

6. Fed Chairman Powell said: Unfortunately, progress in reducing inflation has been slower than expected. When considering rate cuts, we focus on the progress of inflation;

7. The PCE inflation favored by the Fed has unexpectedly cooled across the board. These data are expected to help alleviate Fed members' concerns about the inflation outlook, with the market continuing to bet that the Fed will pause rate cuts in January and increase bets on rate cuts in March.

8. Citigroup stated: Since the November Core PCE inflation rose by 0.1% month-on-month, the price increase is slowing down, and the Fed's final rate cut may exceed current expectations. Flat employment and slowing inflation could be sufficient reasons to cut rates at every meeting at least until January.

Crypto Ecosystem News

1. International Monetary Fund (IMF) official Cozak, when asked about BTC's legal tender status in El Salvador, stated: The use of BTC in El Salvador will be voluntary, and the agreement between the IMF and El Salvador aims to mitigate potential BTC risks according to the IMF policy framework.

2. The Ethereum Foundation has sold 4466 ETH (approximately $12.6 million) in 32 transactions over the past year.

3. On December 20th, El Salvador increased its holdings by $1.07 million with the acquisition of 11 BTC for its BTC reserves.

4. Greekslive analyst Adam stated that following the failure to break $110,000, a retracement occurred, triggering a liquidation of aggressive leveraged long positions that occurred after stabilizing above $100,000. The altcoin adjustment has been ongoing for nearly a month. Based on past bull market experiences, a significant BTC retracement often ushers in an altcoin season, but the intensity of BTC retracement is currently uncertain.

5. On December 20th, CZ posted: "Waiting for new headlines, BTC hits a new high again." Previously, CZ posted on December 17th, 2020: "Waiting for new headlines: BTC from $10.1k to $8.5k, save this post."

6. K33 Research Report: Institutional investors accumulated a total of 859,454 BTC by 2024, accounting for approximately 4.3% of the total circulating supply, equivalent to 8 years of BTC issuance.

Long-term Insights: Used to observe our long-term situation; Bull Market / Bear Market / Structural Changes / Neutral State

Medium-term Exploration: Used to analyze the current stage we are in, how long this stage will last, and what situations we will face

Short-term Observations: Used to analyze short-term market conditions; as well as the direction and the likelihood of certain events occurring under certain conditions

Long-term Insights

• Large Exchange Net Inflows

• US ETF Reserves Net Inflows

• Aversion Sentiment

(Below: Large Exchange Net Inflows Chart)

From the exchange perspective, the outflow of large net transfers on-chain has started to decrease and inflows have begun, providing some initial pressure on the market, but the pressure is not significant.

(See Chart: US ETF Reserve Net Flow)

The willingness to purchase US crypto ETFs has also started to decline, and external funding has begun to weaken. The market currently seems somewhat lackluster.

(See Chart: Aversion Sentiment)

In such a lackluster market environment, there have been two instances of true silver aversion sentiment, leading to two rounds of selling at a loss. If the market continues to trade sideways and remain lackluster, then the market will experience demoralization sentiment to digest any potential issues, possibly requiring several more triggers to reach a general market sentiment bottom. Short-term market dynamics are highly influenced by sentiment.

Mid-term Investigation

• New Address Growth Status

• Stablecoin Total Supply Net Flow

• Network Sentiment Positivity

• Liquidity Supply

• USDC Buying Power Composite Score

• Whale Composite Score

(See Chart: New Address Growth Status)

The growth status of new addresses has shown a relative stagnation trend over the past year. The increase in address users may represent the application and adoption of Blockchain technology. If the non-zero address increment of BTC is not high, the increment in the past year may come from on-chain investment fund increment, rather than user increment. The potential risk is that BTC may be more inclined to serve as a wealth validation tool in the financial sense, rather than for the widespread adoption and application of blockchain technology.

(See Chart: Stablecoin Total Supply Net Flow)

There has been a gradual decline in the stablecoin total supply net flow in the last 14 days, indicating a slight slowdown in on-chain fund increment. The on-chain fund increment may be facing a certain bottleneck, which may require some time to ease consensus.

(See Chart: Network Sentiment Positivity)

As network sentiment continues to decline, on-chain sentiment may be in a phase of repair and consolidation.

(See Chart: Liquidity Supply)

There has been a significant recent stagnation in liquidity supply growth, which may lead to reduced on-chain liquidity.

(See Chart: USDC Buying Power Composite Score)

The buying power score of USDC remains high, indicating that onshore US users may still have a high willingness to enter the market.

(Whale Integrated Score Model below)

The whale score has recently experienced some changes, with the rating hovering between "Very High" and "High." There may also be some divergence among whale users.

Short-Term Observations

• Derivative Risk Factor

• Options Intent Transaction Ratio

• Derivative Trading Volume

• Options Implied Volatility

• Profit and Loss Transfer Amount

• New and Active Addresses

• Honeycomb Exchange Net Position

• Whale Exchange Net Position

• High-Weighted Selling Pressure

• Global Buying Power Status

• Stablecoin Exchange Net Position

• Off-Chain Exchange Data

Derivative Rating: The risk factor is in a neutral area, indicating moderate derivative risk.

(Derivative Risk Factor graph below)

After more than a month, the risk factor has risen from the red zone to the neutral area, indicating the end of the market's euphoric uptrend.

(Options Intent Transaction Ratio graph below)

The put options ratio is at a moderately high level, with the trading volume at a median level.

(Derivative Trading Volume graph below)

The derivative trading volume has once again dropped to a low level. For the short term and a market in a bull run, each drop to a low level implies that the market is preparing for the next movement.

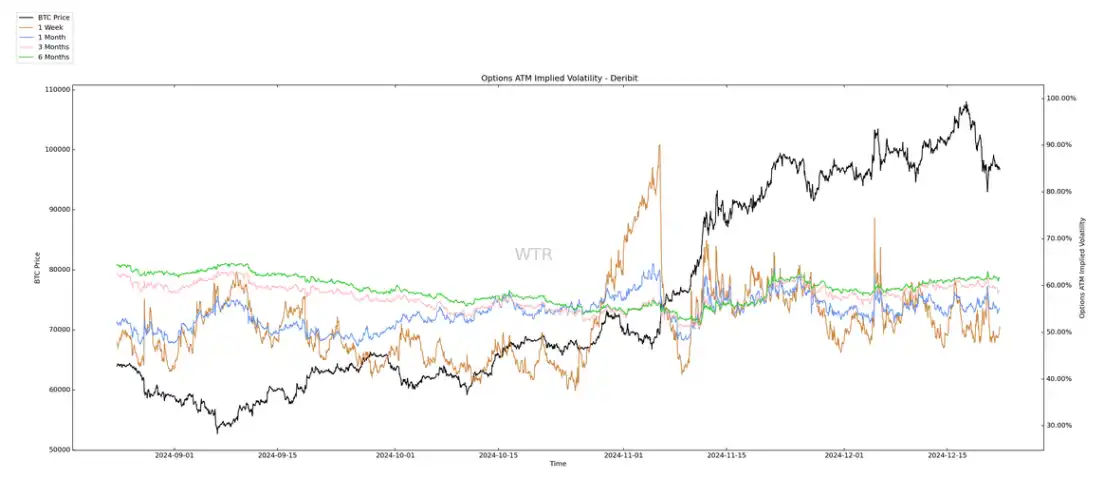

(Options Implied Volatility graph below)

The options implied volatility has not changed significantly.

Sentiment Rating: Neutral

(Profit and Loss Transfer Amount graph below)

In the past two weeks, the market sentiment assessment has remained neutral, and it is still neutral this week. As mentioned in the previous two weekly reports, the market's positive sentiment blue line is like waves, slightly lower each time, showing a deviation from the price.

The current market has completed an initial pullback. This week, the focus will be on whether panic selling of chips will occur again. The current panic sentiment orange line remains at a low level.

(See the chart below for New Addresses and Active Addresses)

New and active addresses are at a high level.

Cash and Selling Pressure Structure Rating: BTC is in a state of large outflow accumulation, ETH is experiencing overall minor outflow accumulation.

(See the chart below for BitCrunch Exchange Net Position)

The BTC exchange net position continues to experience significant outflow accumulation.

(See the chart below for E-Tide Exchange Net Position)

ETH is experiencing overall minor outflow.

(See the chart below for High Weighted Selling Pressure)

The current high weighted selling pressure has eased off.

Buying Power Rating: Global buying power is in a state of erosion, stablecoin buying power remains consistent with last week.

(See the chart below for Global Buying Power Status)

Global buying power is in a state of erosion.

(See the chart below for USDT Exchange Net Position)

Stablecoin buying power remains consistent with last week.

Off-chain Transaction Data Rating: Buying interest at 90,000; Selling interest at 100,000.

(See the chart below for Coinbase Off-chain Data)

Buying interest at the price range of 85,000 to 90,000;

(See the chart below for Binance Off-chain Data)

Buying interest at the price range of 85,000 to 95,000;

Selling interest at the price of 100,000.

(See the chart below for Bitfinex Off-chain Data)

Buying interest at the price range of 85,000 to 90,000

Weekly Summary

News Summary:

1. Currently, the probability of a rate cut this month is relatively low based on market news and the Federal Reserve's stance. However, the possibility of a rate cut in months other than this month is quite high because the Federal Reserve's favored PCE inflation has shown some improvement.

2. The Federal Reserve's rate cut pace is generally seen as decisive in the early stage, hesitant in the middle stage, and may accelerate in the later stage, ultimately likely to return to a long-term interest rate of around 3.25%.

3. The coming year is still expected to be a relatively accommodative year, with abundant fund inflows, posing low likelihood of a bear market.

On-chain Long-term Insight:

1. Net headwinds of large exchanges indicate a decrease in current buying interest and very subtle selling pressure;

2. Inflow into US ETFs has also started to decline, with US capital support synchronously decreasing;

3. Two extremely extreme aversion sentiments appeared during this pullback consolidation phase.

• Market Tone:

The market may still need some time to digest pressure and adjust, needing to trigger more aversion sentiment to reach an emotional bottom.

On-chain Mid-term Probe:

1. The growth of new addresses has been relatively stagnated in the past year;

2. The growth rate of new capital has slowed down;

3. Network sentiment is in a consolidation and repair stage;

4. Liquidity has somewhat weakened;

5. There is still some willingness among USDC users to participate in the market;

6. Whales have recently shown certain divergences.

• Market Tone:

Divergence, Adjustment

There is a certain divergence in the market recently, but there has been no worse scenario so far, and it is likely also in a correction phase.

On-chain Short-term Observation:

1. The risk factor is in the neutral zone, with moderate risk;

2. The number of new active addresses is at a high level, indicating high market activity;

3. Market sentiment state rating: Neutral;

4. Overall exchange net outflows are in a large amount for BTC, with ETH in a small outflow state;

5. Global buying power is in a declining state, stablecoin purchasing power is consistent with last week;

6. Off-chain transaction data shows buying interest at 90,000; selling interest at 100,000;

7. The probability of not breaking below 87,000-91,000 in the short term is 80%; with a 70% probability of not breaking above 100,000-105,000 in the short term.

• Market Recap:

After two weeks of declining market optimism, the market finally saw a rebound.

This week, market sentiment remains neutral, with the price action expected to depend on whether panic selling occurs. If not, we may see more consolidation around the current price; however, if panic selling ensues, the price could touch the short-term holder cost line near 85K.

Risk Disclaimer: The above is all market discussion and exploration and does not constitute investment advice; please handle with caution and be aware of and prevent market black swan risks.

This article is contributed content and does not represent the views of BlockBeats.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

EnclaveX launch brings fully encrypted, cross-chain futures trading to retail investors

Sui Integrates Babylon’s Bitcoin Staking Protocol and Becomes a BSN

Will Paul Atkins, the New SEC Chair, Change the Regulatory Stance?

Breaking: Court Pauses Appeal in Ripple Case