Crypto investment products log net inflows, despite sell-offs after hawkish Fed comments: CoinShares

Quick Take Global digital asset ETPs saw $308 million in net inflows last week, overcoming intra-week outflows and volatility after the Fed’s Dec. 18 rate cut. Bitcoin led with $375 million in inflows, while Ethereum added $51 million and Solana faced $8.7 million in outflows, according to a CoinShares report.

Global digital asset exchange-traded products (ETPs) recorded net inflows of $308 million last week, despite intra-week outflows and heightened market volatility following the Federal Reserve’s Dec. 18 rate cut.

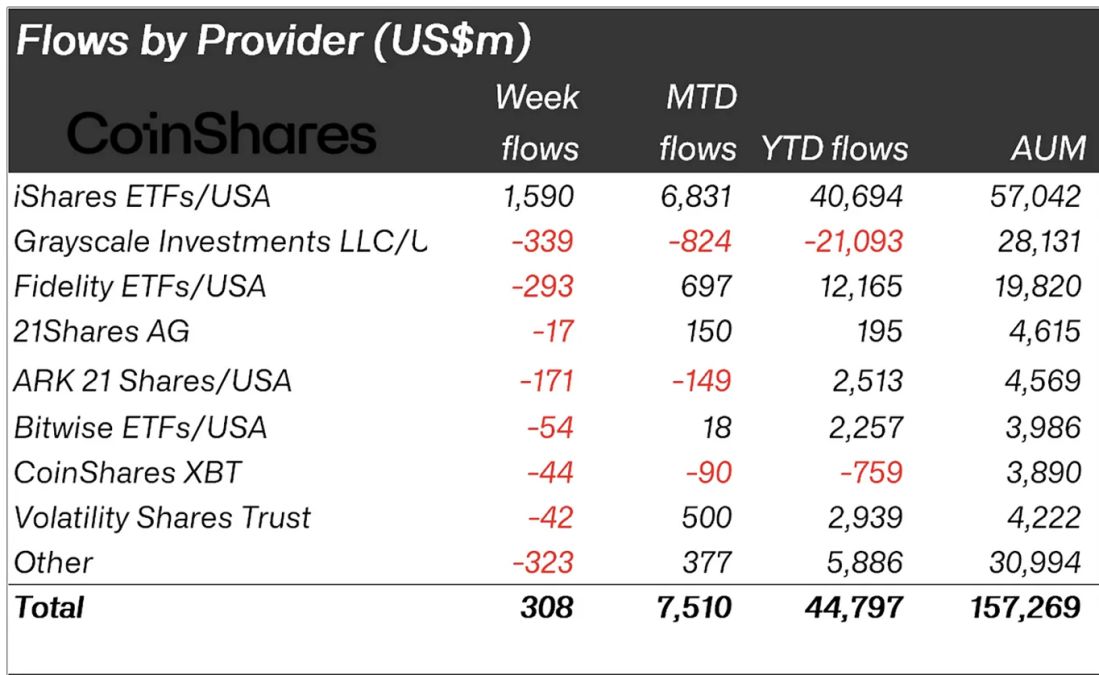

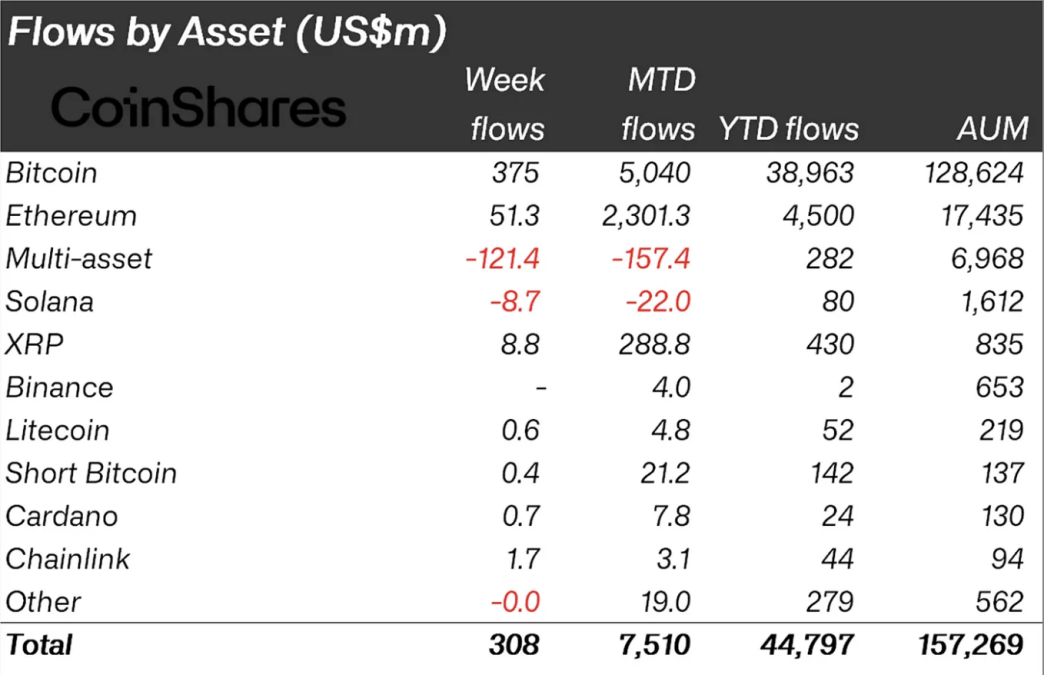

Bitcoin recorded $375 million in net inflows for the week, while Ethereum added $51 million. In contrast, Solana experienced $8.7 million in outflows, according to CoinShares data. The net inflows highlight continued institutional interest in digital assets despite shifting macroeconomic conditions, according to CoinShares Head of Research James Butterfill.

However, Butterfill said multi-asset investment products saw more pronounced outflows, totaling $121 million. “Although many altcoins continued to see inflows — such as XRP, $8.8 million, Horizen, $4.8 million, and Polkadot, $1.9 million — these trends suggest investors are adopting a more selective approach within the digital asset market," Butterfill said.

Digital asset fund flows by provider show significant inflows into iShares ETFs. Image: CoinShares.

Despite overall net inflows for digital asset ETPs last week, Butterfill said the significant market volatility towards the end of last week should not go unnoticed. "The net inflows mask the largest single day of outflows on the Dec. 19 totaling $576 million, with total outflows in the final two days of last week at $1 billion," he said.

Total flows by asset show inflows into bitcoin and ether ETFs. Image: CoinShares.

Market reaction to December's FOMC meeting

The Federal Reserve’s press conference after its Dec. 18 meeting has influenced market dynamics, according to Butterfill. While the central bank announced a rate cut , Fed Chair Jerome Powell’s post-meeting comments — including a more hawkish economic outlook — sparked risk-off sentiment across markets. Key factors included the Fed’s revised 2025 core PCE inflation projections, up to 2.5% from 2.2%, and indications of only two rate cuts in 2025 instead of the previously anticipated four.

According to Wintermute’s OTC trading desk analysts, the market downturn that began in the middle of last week mirrored declines in equities and bonds as traders adjusted their risk exposure ahead of the low-liquidity holiday season.

Wintermute analysts noted derivatives traders protecting their positions, especially in the form of put options, which are bets that the price of an asset will drop. "General protection demand has pushed skew into put premium out until Jan. 10, and the market seems positioned for some downside volatility in the near-term in the face of shaky traditional risk assets," they said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CROSSUSDT now launched for futures trading and trading bots

BULLAUSDT now launched for futures trading and trading bots

BGB holders' summer celebration–a grand community giveaway! Trade 10 BGB to share 10,000 USDT!

New spot margin trading pair — ICNT/USDT!