USDT Exits Europe: How Circle’s EURC is Dominating Under MiCA’s New Stablecoin Rules

- MiCA regulations reshape European stablecoin markets, removing USDT while Circle’s USDC and EURC capture growing transaction volumes.

- Strict reserve requirements and licensing force exchanges like Binance to delist USDT, prioritizing regulatory-compliant alternatives for users.

Starting December 30, the European Union will fully enforce the Markets in Crypto-Assets Regulation ( MiCA ), reshaping the stablecoin market within the region. This shift will exclude USDT, one of the most widely used stablecoins globally, from the European market due to its inability to meet MiCA’s stringent compliance requirements.

MiCA mandates that stablecoin issuers obtain electronic money licenses and ensure that at least two-thirds of their reserves are held by independent financial institutions. This regulatory framework has already led platforms like Binance and OKX to delist USDT , while other exchanges face a December deadline to comply.

Circle, the issuer of USDC and EURC , has emerged as a primary beneficiary of these regulatory changes. By securing its European license in July, Circle has solidified its position, allowing its stablecoins to remain active and capture significant transaction volumes. EURC, in particular, has strengthened its market dominance among euro-backed stablecoins, outperforming competitors like EURCV and EURI.

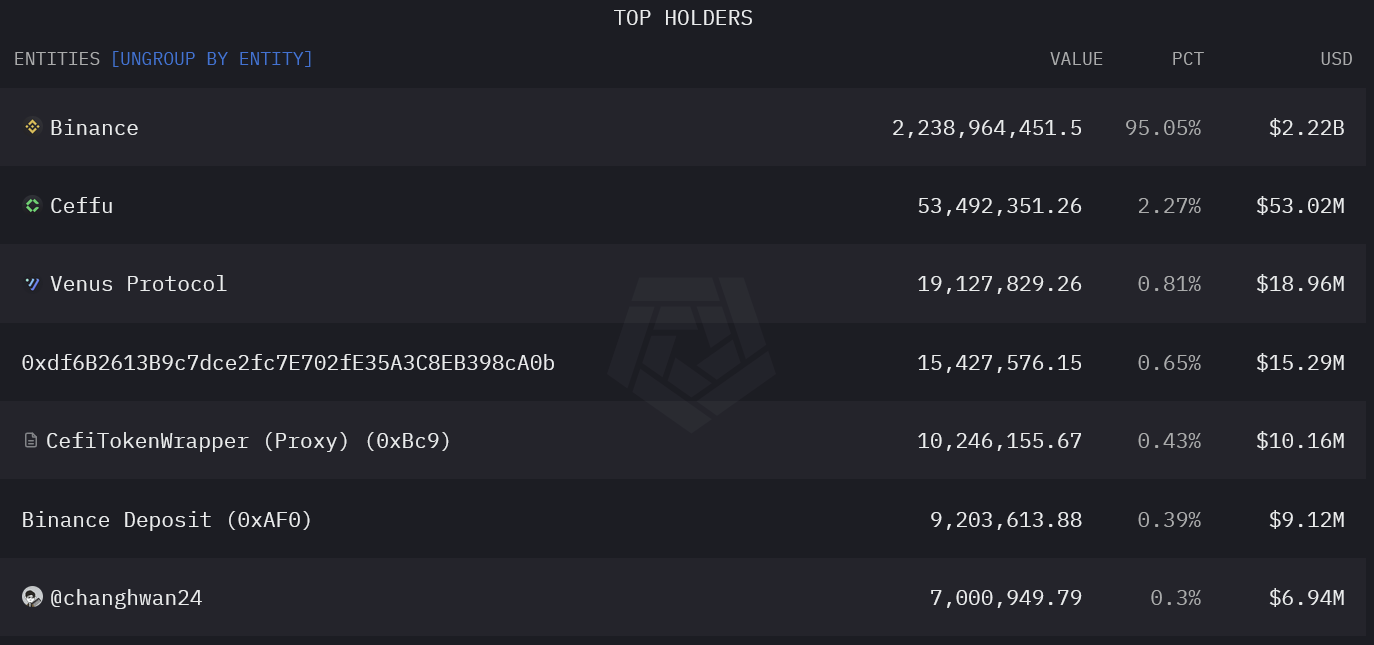

Binance’s collaboration with Circle has further facilitated the adoption of USDC and EURC as regulatory-compliant alternatives. This partnership aims to enhance investor confidence while aligning Binance with global regulatory standards in an increasingly scrutinized environment.

The MiCA regulation introduces measures to bolster transparency, stability, and security in the European crypto-financial market. By setting clear standards for reserves and compliance, MiCA fosters a safer ecosystem for users and industry participants alike.

The exclusion of USDT underscores the shift toward stricter oversight, benefiting regulated issuers like Circle while presenting substantial challenges for stablecoins unable to meet the new requirements.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Justin Sun’s allegations of FDUSD insolvency cause 9% depeg

The Binance-affiliated stablecoin lost about $200M of market capitalization

Trump's tariffs hit US stocks hard, Nasdaq plunged more than 1,000 points

Global stocks pay for Trump's tariff plan, with U.S. stocks performing worst since September 2022