Metaplanet Secures $31.91M Bond Deal With EVO FUND to Buy More Bitcoin

- The company issued ¥5 billion in bonds via EVO FUND to expand its Bitcoin holdings.

- The bonds carry no interest and allow early redemption under specific financial conditions.

- Metaplanet invests in Bitcoin without depleting cash reserves, leveraging bonds for crypto asset acquisition.

Metaplanet Inc. has revealed the offer of its 5th Series of Ordinary Bonds as the 5th Tranche of the issuance through private placement to EVO FUND and secured ¥ 5 billion $ 31,910,000. The funds from this issuance will be invested in the purchase of Bitcoins, as the company indicates in previous announcements. However this comes after Metaplanet revealed on November 28, 2024, that it was venturing into the issue of bonds amounting to ¥5 billion.

The bonds sold at ¥250 million ($1.59 million) each and are due on Dec 20, 2024. The bonds attract no interest and redeemed at the face value of the bond issued with full coupon. The companies issued these bonds for a term that will mature on Jun. 16, 2025. However, the bonds can be redeemed by the request of EVO FUND.

Key Details of the 5th Series Bonds

The 5th Series Ordinary Bonds are exclusively available to EVO FUND and are not guaranteed . According to Article 702 of the Companies Act and Article 169 of the Regulations for Enforcement of the Companies Act, no bond trustee appointed. Metaplanet has clarified that principal and interest payments will be made from its Tokyo office in Roppongi, Minato-ku.

The company stated that the issuance would not affect its consolidated financial results for the fiscal year ending Dec. 31, 2024. However, Metaplanet has committed to providing timely updates should the transaction have any material impact on its financial outlook.

Borrowed Funds and Bitcoin Investment Strategy

This bond issuance is part of Metaplanet’s strategy to invest in Bitcoin using borrowed funds. Instead of utilizing its cash reserves, the company is raising funds through bond sales to investors like EVO FUND. While this approach enables Metaplanet to acquire Bitcoin without affecting its liquidity. It also introduces financial obligations, as the funds must be paid regardless of Bitcoin’s market performance.

The structure of the bonds allows for flexibility, including early redemption if the proceeds from the exercise of the 12th Series Stock Acquisition Rights surpass the bond’s principal value. This aligns with Metaplanet’s broader strategy to balance investment opportunities and financial obligations.

This is proven by Metaplanet which sought to issue bonds to purchase bitcoins to show its commitment to cryptocurrency investments . Thus the firm’s strategy is a deliberate attempt to use funds sourced from the external environment to fund the acquisition of fixed assets all the same keeping their cash. Such investors and stakeholders are keen to note how well this strategy is setting out concerning market standing.

disclaimer read moreCrypto News Land, also abbreviated as "CNL", is an independent media entity - we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

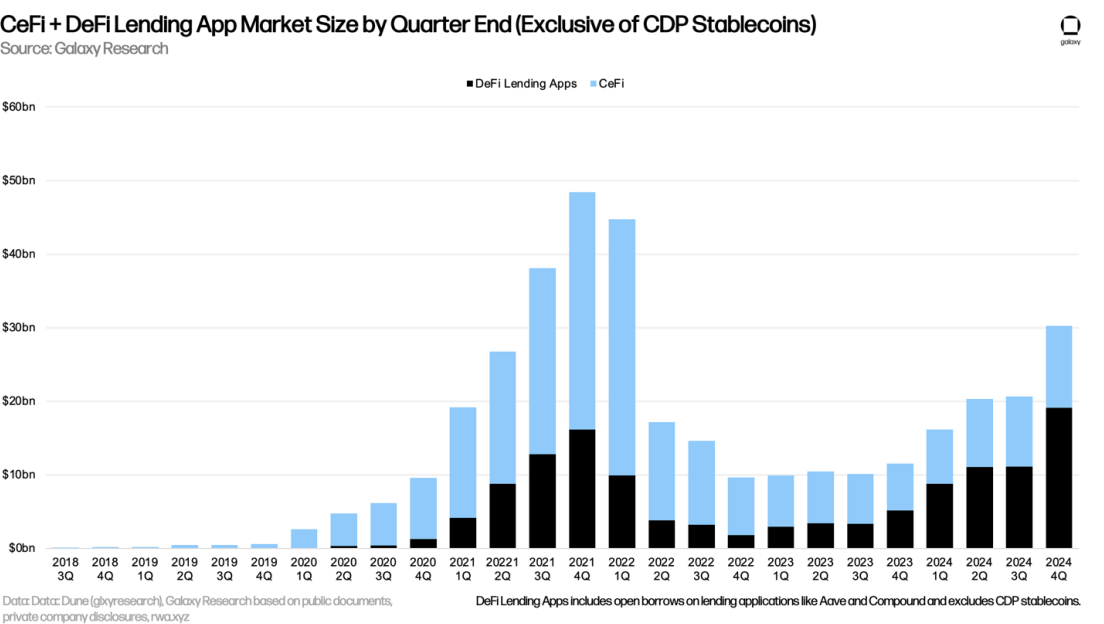

CeFi lending’s up 73% after the sector’s collapse: Galaxy

Both CeFi and DeFi lending have made a comeback, Galaxy noted

USDC’s ‘fueling’ stablecoin market cap rise: Wintermute

Taking a look at the biggest stablecoin players and where they stand

Could Stagnant Bitcoin Dominance Herald the Arrival of Altseason?

Signs of an Emerging Altcoin Season as Bitcoin's Market Dominance Dips to 63.3% Indicating Possible Capital Redirection