Ethereum Enters ‘Belief Phase’ as Historical Metrics Signal Early Bull Market

- Ethereum reclaims $4,000 amid improving market sentiment

- Long-term holder metrics indicate early bull market phase

- MVRV ratio suggests room for continued appreciation

As Ethereum reclaims the $4,000 threshold, historical data patterns reveal fascinating insights into the current market cycle. To understand where we are in this cycle, we need to examine how long-term holder behavior typically evolves through different market phases and what that means for price action.

The Psychology of Long-Term Ethereum Holders

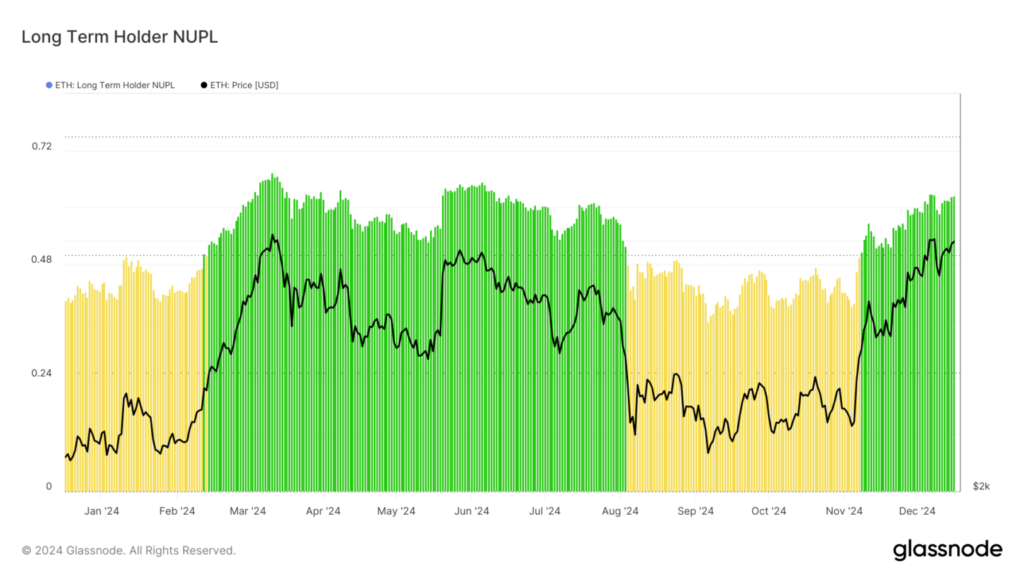

The Long-Term Holder-Net Unrealized Profit/Loss (LTH-NUPL) metric provides a window into the market psychology of experienced investors who have held ETH for more than 155 days.

This indicator divides market sentiment into distinct phases: capitulation (extreme fear), hope (early recovery), optimism (growing confidence), belief (sustained momentum), and euphoria (market peak).

Ethereum Long Tern Holder NUPL. Source: Glassnode

Ethereum Long Tern Holder NUPL. Source: Glassnode

Currently, Ethereum sits firmly in the ‘belief’ phase, a position that historically precedes significant price appreciation. This placement is particularly significant because it suggests we haven’t yet reached the euphoric phase typically associated with cycle peaks. In previous market cycles, the transition from belief to euphoria has coincided with substantial price increases.

The Market Value to Realized Value (MVRV) ratio adds another layer of validation to the bullish thesis. With a current 30-day reading of 8.73%, significantly below March’s 22.61% peak, the metric suggests Ethereum remains relatively undervalued. This lower MVRV ratio indicates reduced profit-taking pressure and increased potential for sustained price appreciation.

From a technical perspective, Ethereum maintains strong support at $3,075, a level that has proven crucial in supporting the recent rally. The successful breach of the $4,003 resistance, combined with a positive Bull Bear Power reading, suggests momentum remains firmly in the bulls’ favor.

The convergence of positive long-term holder sentiment, favorable valuation metrics, and strong technical structure suggests potential for continued appreciation toward $4,400.

However, traders should remain mindful of the $3,578 support level, as any significant deterioration in market conditions could trigger a test of this zone. The current position in the market cycle suggests we’re in the early stages of a broader bull market, though careful risk management remains crucial.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mobee Partners with ATT Global to Launch Exclusive IEO Platform

ORDI falls below $6

DWF Labs spends $25 million to buy WLFI tokens

Bitwise Lists Four Crypto ETPs on London Stock Exchange