CyberKongz NFT Collection Hit with SEC Wells Notice

CyberKongz criticized the SEC's "perplexing" view of smart contracts, arguing it misinterpreted a contract migration as a sale.

NFT collection CyberKongz announced late Monday that the SEC issued a Wells notice , signaling its intent to charge the project. This notice means the regulator believes there might be securities law violations and is preparing to take enforcement action against CyberKongz.

“We are extremely disappointed at the approach the SEC has taken towards us, but we are going to stand up and fight for a brighter future that holds more clarity for NFT projects,” the project said in an X post.

“We have been suffering in silence for the last two years, ever since we first received contact from the SEC,” it added. “Throughout the entire process they have showcased a complete lack of understanding of blockchain technologies that has resulted in unjust accusations and information inaccuracies.”

CyberKongz Genesis Collection Sparked the PFP NFT Boom

In March 2021, artist Myoo launched the CyberKongz project with 1,000 unique, randomly generated NFTs known as the Genesis Collection. Myoo designed these 34×34 pixelated gorilla images specifically as profile pictures (PFPs).

At the time, using NFTs as PFPs was still a novel concept. However, CyberKongz quickly gained traction for its innovative approach. Setting the initial mint price at just 0.01 ETH also made the collection affordable, boosting its early success.

CyberKongz Slams SEC Over Misunderstanding of NFT Contract Migration

The project claimed the SEC has presented a “perplexing interpretation of smart contracts.” It pointed out that one of the SEC’s key concerns—the ‘sale’ of Genesis Kongz in April 2021—was actually a contract migration. The team questioned how a clear regulatory path can exist if the SEC cannot distinguish between a primary sale and a contract migration.

“It has become increasingly apparent that the current administration is trying to force their anti-crypto agenda at the last minute,” it said. “We hope that the new administration puts an end to this unjustness on our industry, but until then we will fight for NFT projects on all chains.”

The crypto industry has repeatedly criticized the SEC for relying on “regulation by enforcement” instead of providing clear rules. The SEC’s use of the Howey Test to classify NFTs as securities remains especially controversial. Many in the industry argue this approach is unclear and overly punitive.

Earlier this year, the SEC issued a Wells Notice to OpenSea , the largest NFT marketplace, claiming some NFTs on the platform might qualify as securities under US law. OpenSea’s leadership quickly pushed back, framing its resistance as a defense of creative freedom in digital art.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honda prepares to send its hydrogen tech to space

Share link:In this post: Honda is working with Sierra Space and Tec-Masters, two space technology companies, to try their high-differential pressure water electrolysis system. Honda aims for hydrogen to help it get all of its cars off carbon by 2040. Honda says it will work with NASA to get the equipment to the ISS on Sierra Space’s Dream Chaser space plane.

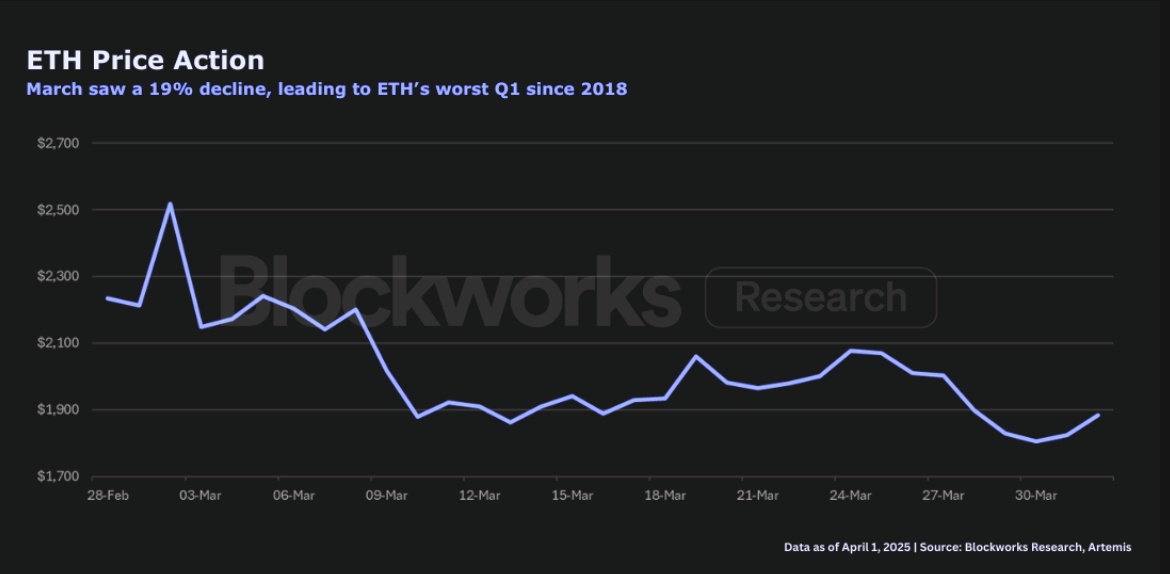

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far