Ethena launches new stablecoin product USDtb, reserve funds invested in BlackRock's BUIDL

According to the official blog, stablecoin issuer Ethena announced its collaboration with real-world asset tokenization company Securitize to publicly launch a new stablecoin product named USDtb. The reserve funds of USDtb are invested in BlackRock's US Dollar Institutional Digital Liquidity Fund (BUIDL).

USDtb shares similar characteristics with existing fiat stablecoins (such as USDC or USDT), that is, it uses cash or cash equivalents as reserves to support each token on a 1:1 ratio. Users can freely and unrestrictedly transfer USDtb. As BUIDL from BlackRock is used as the main reserve asset, USDtb can be expanded without any actual restrictions, accounting for the vast majority (90%) of total reserves - this is the highest BUIDL allocation among all stablecoins.

USDtb is an entirely independent product outside of USDe, providing users and exchange partners with a new choice of stablecoin which has completely different risk features compared to USDe. Additionally, USDtb can help USDe better cope with difficult market conditions. Last week, Ethena's Risk Committee approved a proposal to use USDtb as supporting assets for USDe. During periods when interest rates are negative, Ethena will be able to close out basic hedging positions for USDe and redistribute its supporting assets towards USDtb in order to further mitigate associated risks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump to Host “Trump Dinner” for TRUMP Token Holders

Zora: Airdrop Claiming is Now Open

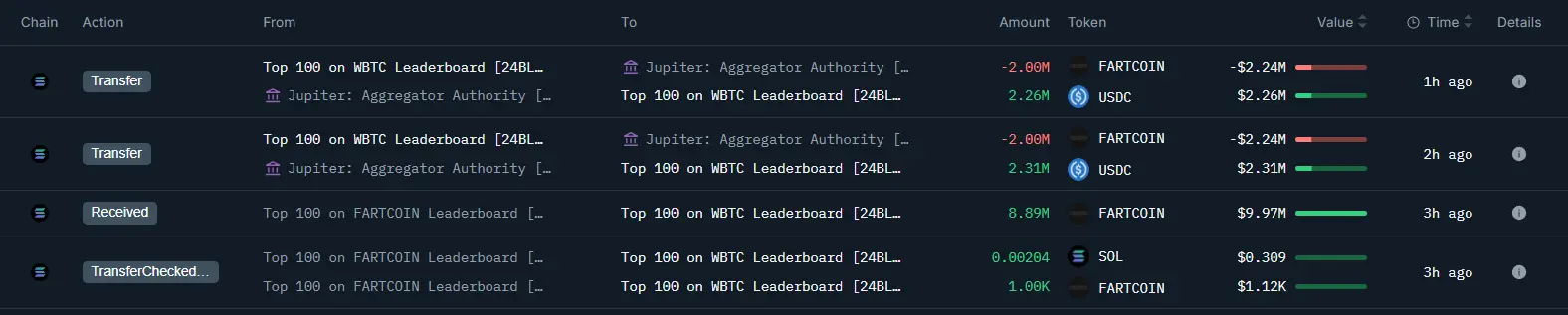

A whale sold 4 million FARTCOIN at an average price of $1.14, earning $7.66 million