Global crypto investment product YTD inflows quadruple any other year: CoinShares

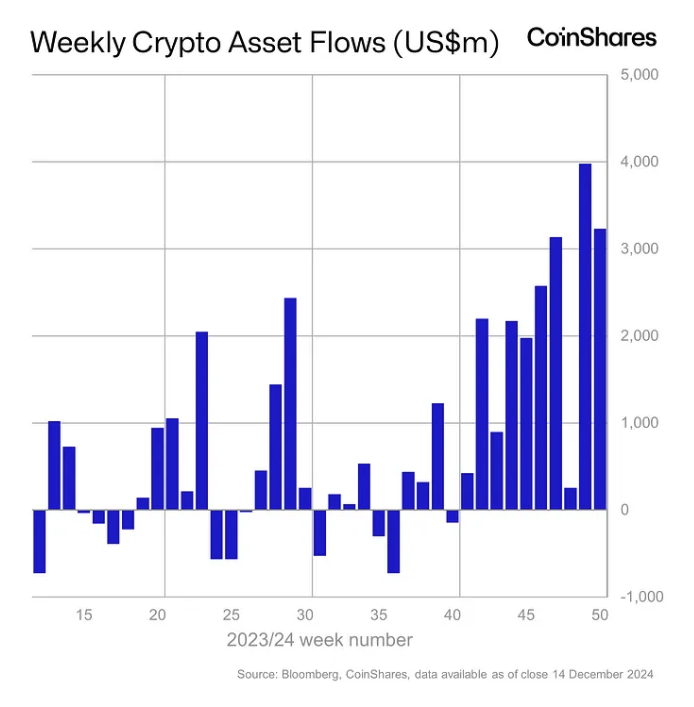

Crypto investment products registered $3.2 billion worth of net inflows globally last week, led by the U.S. spot Bitcoin ETFs, according to CoinShares.The funds’ year-to-date net inflows reached a fresh record of $44.5 billion — quadruple any other year, Head of Research James Butterfill said.

Global crypto funds run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares registered a 10th consecutive week of net inflows, adding $3.2 billion, according to CoinShares.

The positive flows also bring the year-to-date figure to a new record of $44.5 billion — more than quadruple that of any other year — CoinShares Head of Research James Butterfill noted in a Monday report.

“Trading volumes in ETPs have averaged $21 billion a week, comprising 30% of the bitcoin traded on trusted exchanges,” Butterfill added. “Bitcoin volumes on trusted exchanges (all investment types) are highly liquid, having averaged $8.3 billion a day this year, double that of the FTSE 100.”

Weekly crypto asset flows. Images: CoinShares .

US spot Bitcoin ETFs add $2.2 billion in weekly inflows

The 12 U.S. spot Bitcoin exchange-traded funds added $2.17 billion in net inflows alone last week, according to data compiled by The Block. The funds’ positive streak now extends to 12 trading days, totaling $5.3 billion — 15 % of the $35.8 billion worth of cumulative net inflows they have generated since their January launch.

“Bitcoin ETF demand has been relentless with over $2 billion of inflows clocked last week,” analysts at research and brokerage firm Bernstein wrote in a Monday note to clients. “Seven out of the last nine weeks, Bitcoin ETF inflows have exceeded $2 billion.”

U.S.-based funds also dominated overall, with $3.14 billion worth of net inflows offset slightly by net outflows of $19 million from crypto investment products in Sweden. Funds in Switzerland, Germany and Brazil also saw notable weekly net inflows of $35.6 million, $32.9 million and $24.7 million, respectively — highlighting broad positive sentiment, according to Butterfill.

Globally, bitcoin-based funds registered net inflows of $2 billion, bringing the total since pro-crypto Donald Trump’s election win to $11.5 billion, Butterfill noted. However, higher prices also prompted a further $14.6 million worth of inflows into short-bitcoin products.

Meanwhile, Ethereum-based funds witnessed their seventh consecutive week of net inflows, adding another $1 billion to a total of $3.7 billion for the period amid a “dramatic improvement in sentiment,” Butterfill said.

The U.S. spot Ethereum ETFs contributed $854.8 million to this amount last week, extending their own positive streak to 15 trading days totaling $2.25 billion, according to data compiled by The Block.

“Ethereum ETF inflows have exceeded $800 million/week since the last two weeks, reflecting an accelerating trend,” the Bernstein analysts led by Gautam Chhugani said.

XRP investment products also saw net inflows of $145 million last week as hopes rise for an ETF in the U.S. Polkadot and Litecoin-based funds generated inflows of $3.7 million and $2.2 million, respectively.

Bitcoin all-time highs

Bitcoin’s price registered a new all-time high above $106,600 late Sunday before correcting. The foremost cryptocurrency is currently trading for $104,514, according to The Block’s Bitcoin Price Page , having gained 54% in less than six weeks since the U.S. elections and around 150% year-to-date.

Bitcoin mining difficulty also reached a new all-time high of 109 trillion early Monday, jumping 4.4% amid record average hash rate levels for the network, according to blockchain explorer Mempool .

“With BTC consolidating above $100,000, ETHs growing momentum and huge ETF inflows could signal the onset of a broader altcoin Santa rally,” Coinstash co-founder Mena Theodorou said. “Combined with the pro-crypto Trump administration, easing inflation, and a likely Fed rate cut, the conditions to support potential crypto market growth couldn't be more favourable.”

Meanwhile, the GMCI 30 index, which represents a selection of the top 30 cryptocurrencies, is trading flat over the past week, having gained 113% in 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Over $50M in Dogecoin Moved Off Exchanges; Are Insiders Prepping for a Pump?

DOGE sees $54M outflows as whales accumulate. Meanwhile, traders eye Remittix for real-world payments as ETF hopes and Musk updates loom.Exchange Outflows and Whale MovesPrice Set-Up, Musk, and the ETF ClockWaiting for Pumps vs. Owning Payments

Bitcoin grabs $106K liquidity as whale longs BTC with $255M

Virtuals Protocol (VIRTUAL) To Bounce Back? Key Emerging Pattern Suggests Potential Upside Move

Analysts Believe These Altcoin ETFs Have a 90% Chance of Approval

Industry analysts predict a strong chance of SEC approval for altcoin ETFs like Solana and XRP, potentially shaping crypto investments by 2025. However, Bitcoin ETFs continue to dominate the market.