Increased Bitcoin Liquidation by Miners Coincides with Market Highs Above $100K

- In December, Bitcoin miners accelerated their sell-offs, liquidating 140,000 BTC valued at $13.72 billion as prices soared.

- Despite massive sell-offs, Bitcoin’s market value remained resilient, consistently maintaining levels above the $100,000 mark.

- Institutional interest continues as ETFs recorded $4.9 billion in inflows, with MicroStrategy purchasing $3.6 billion in Bitcoin.

As Bitcoin’s market price exceeded $100,000, miners intensified their asset liquidations, selling approximately 140,000 BTC in December alone, equating to a market value of $13.72 billion.

This activity reduced their collective holdings from just over 2 million to 1.95 million bitcoins, according to data from the analytics platform Santiment.

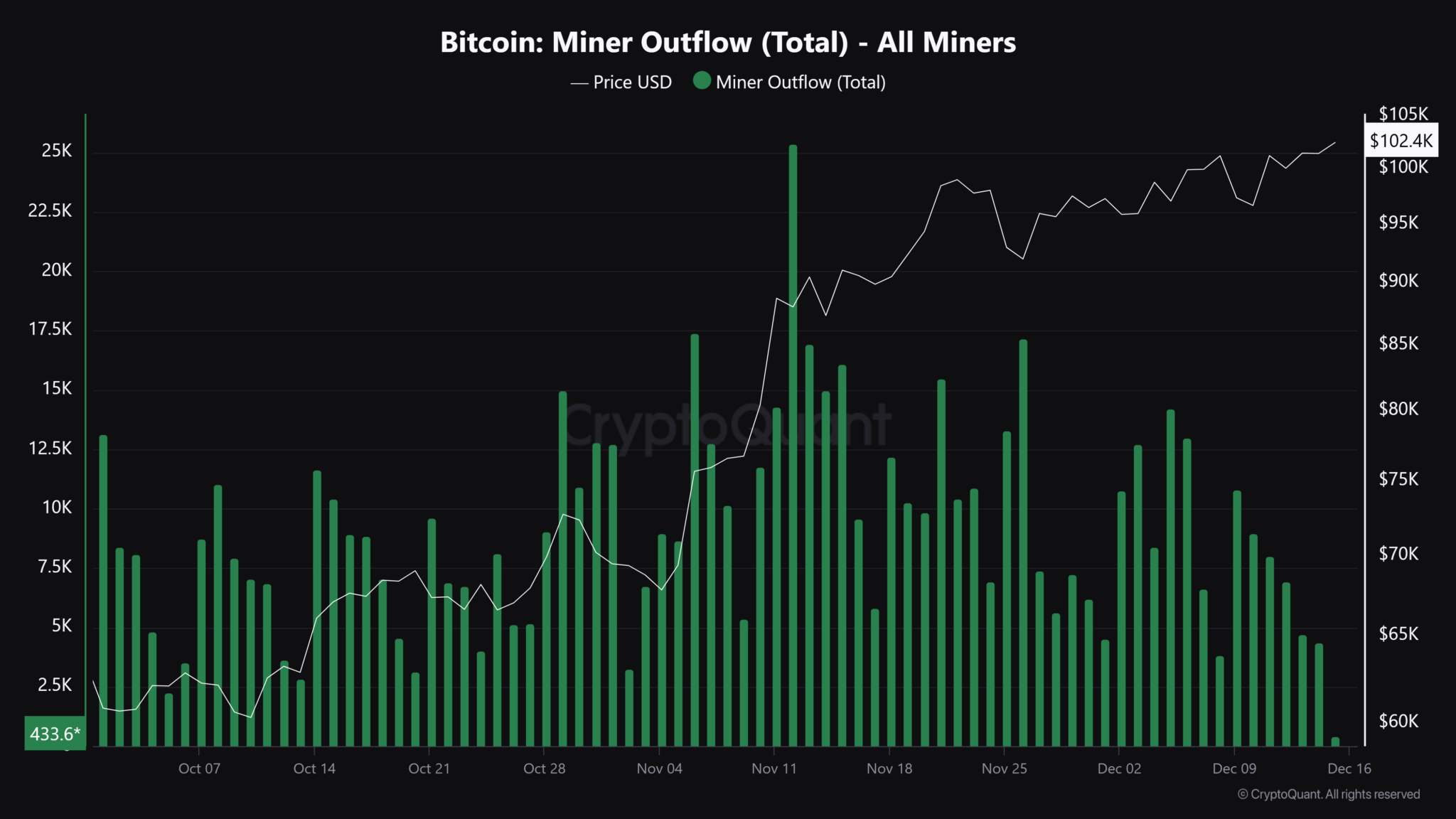

Despite the extensive asset sell-off by miners, Bitcoin’s market price has remained stable , consistently staying above the $100,000 threshold. Analysis of miner outflow, which tracks the transfer of bitcoins from mining wallets to trading platforms, recorded a single-day peak in November where 25,000 BTC were sold.

So far in December, #Bitcoin miners have sold over 140,000 $BTC , totaling $13.72 billion! pic.twitter.com/1g3sCo6uJM

— Ali (@ali_charts) December 14, 2024

This selling pressure has since diminished, indicating a slowdown in miner sales activity.

Further scrutiny suggests a significant portion of these transactions may have occurred off-exchange through Over The Counter (OTC) channels, possibly not captured fully by conventional exchange flow metrics.

Source: Santiment

Source: Santiment

Meanwhile, demand from institutional avenues such as Exchange-Traded Funds (ETFs) and substantial acquisitions by entities like MicroStrategy, which added $3.6 billion in Bitcoin to its holdings, injected notable liquidity into the market. Over a recent two-week period, inflows into Bitcoin ETFs totaled approximately $4.9 billion.

Source: CryptoQuant

Source: CryptoQuant

Nevertheless, the aggregate demand from ETFs and major corporate buyers like MicroStrategy, amounting to $8.3 billion, did not fully offset the $13.72 billion sold by miners, highlighting a potential imbalance in supply and demand dynamics.

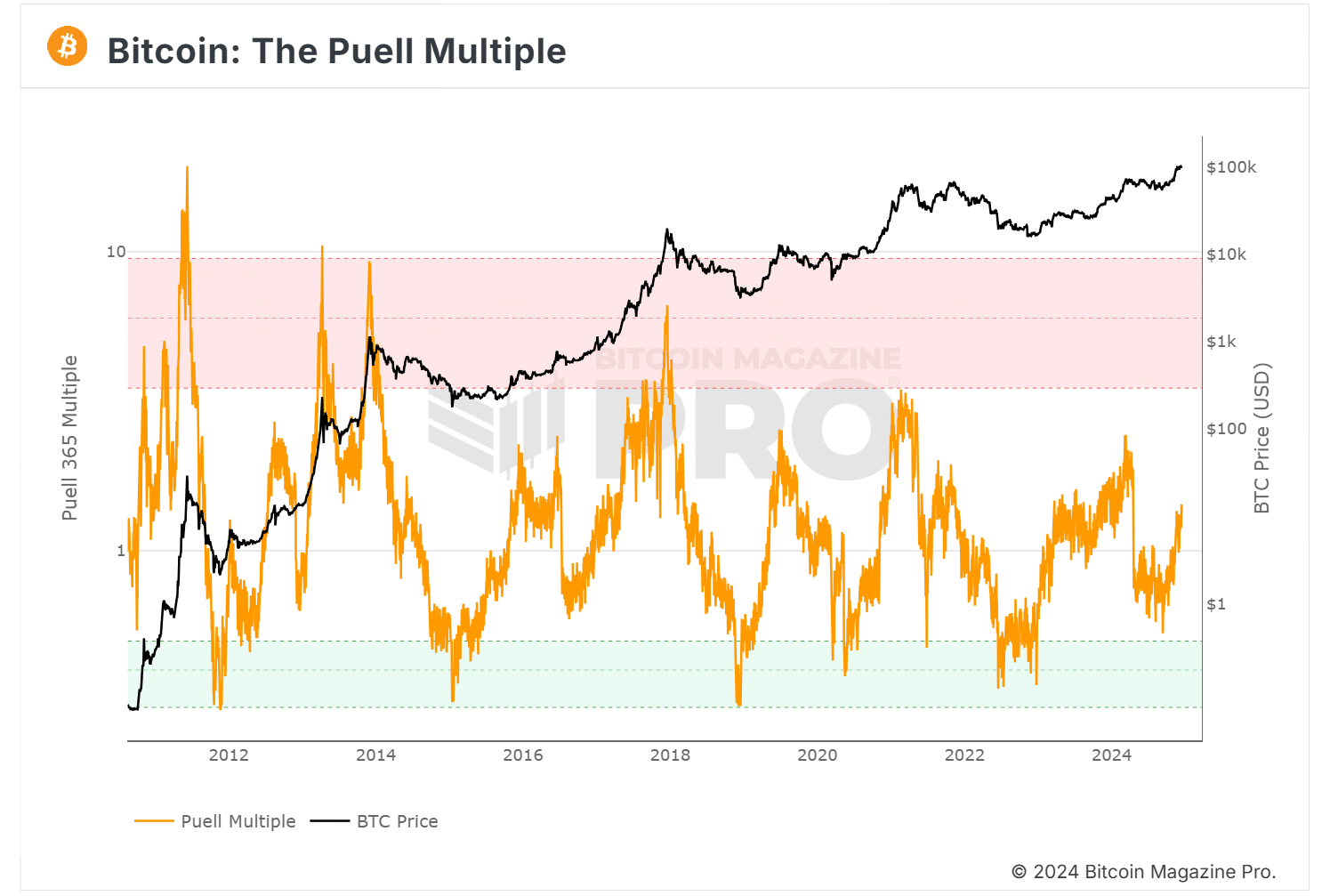

To gauge the economic impact of these sales, the Puell Multiple, a valuation metric that assesses the revenue streams of Bitcoin miners relative to the asset’s price, was consulted.

This metric suggested that at a value of 1.3, Bitcoin is currently not overvalued based on historical mining revenue data. The metric approached 2.4 earlier in the year, coinciding with a local price peak of $73.7K, indicating higher valuation thresholds.

Source: BM Pro

Source: BM Pro

As the cryptocurrency community anticipates the upcoming Federal Reserve rate decision on December 18th, Bitcoin’s price action remains closely watched, trading just below $102,000.

The current price of Bitcoin (BTC) is $101,434 USD, with no significant changes over the last 24 hours. Over the past week, BTC has gained 1.54%, showing an impressive 140.04% growth year-to-date. Its market capitalization stands at $2.01 trillion USD, reinforcing its dominance in the crypto market.

Analysts predict further potential growth, with some estimates suggesting Bitcoin could reach $180,000 by 2025, highlighting its long-term potential.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arweave (AR) Breaks $7.85, Eyes 100% Surge Toward $15 Target

BTC Market Share Rises 88% from 2022 Low, Eyes Critical Compression Level

XRP Breaks at $2.20: Here’s What Traders Must Watch for a Breakout

Long-term BTC holders are back in accumulation mode

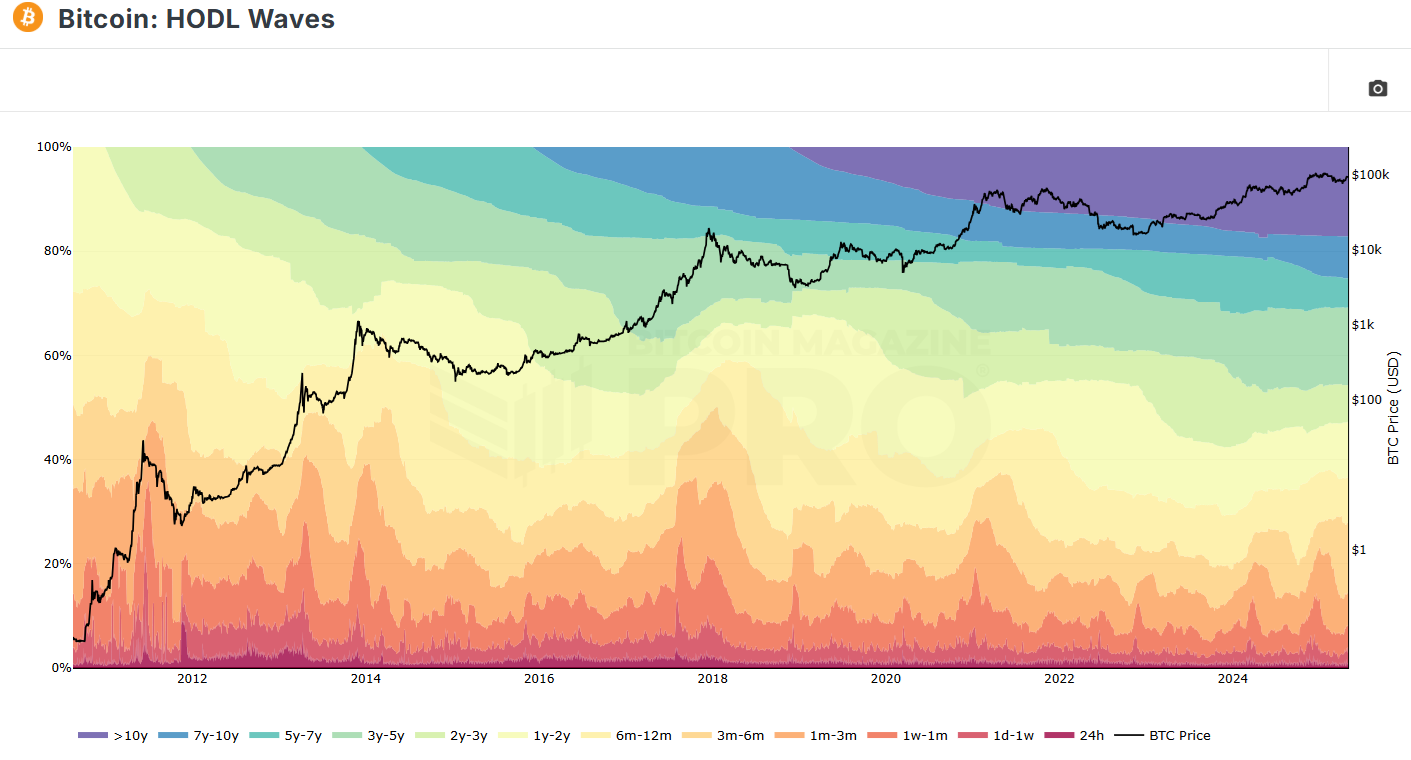

Share link:In this post: The period of capitulation and spot selling has ended, and almost all wallet cohorts either hold or accumulate. 87.6% of the BTC supply is in profit, as the coin consolidates around $97,000. Short term buyers are in the money, feeling less pressure for wallets aged less than one month.