Bitvavo is once again the largest EUR-spot exchange worldwide

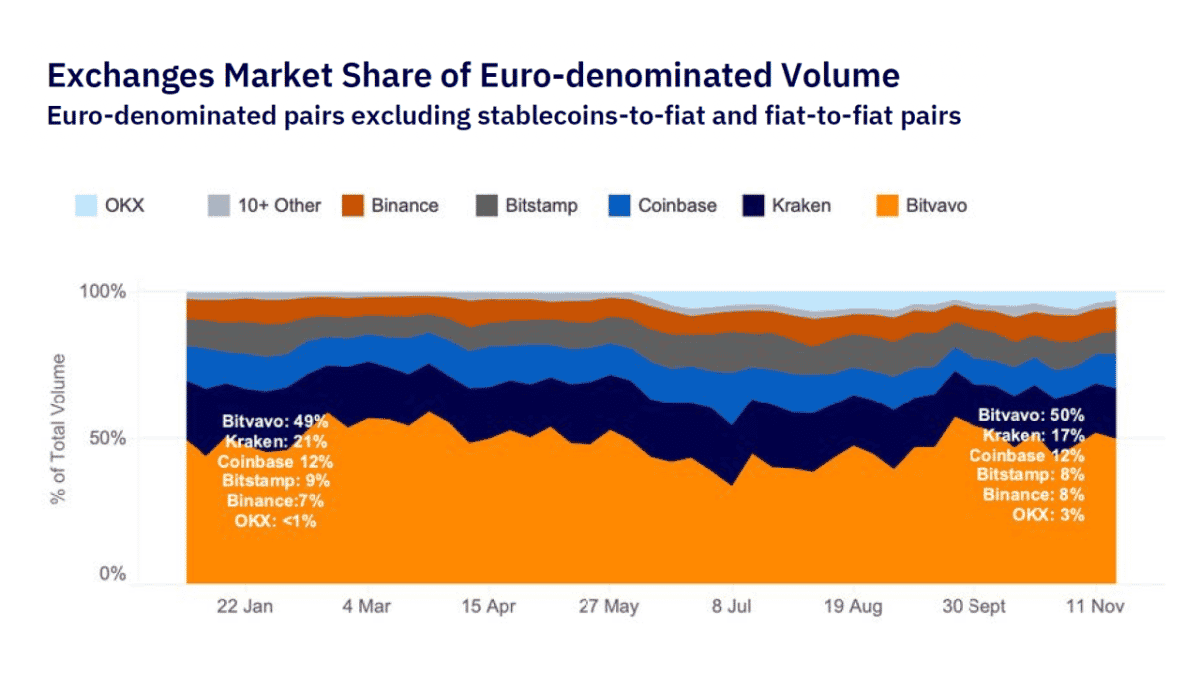

Amsterdam, December 11, 2024 – Bitvavo has once again solidified its position as the largest EUR spot exchange globally, according to the newly published 2024 report by Kaiko, the renowned provider of market data and analytics in the crypto sector. The report, which covers the first 11 months of this year, shows that the Amsterdam based Crypto exchange accounts for half of the trading volume in euros worldwide.

Bitvavo accounts for half the market volume

Bitvavo achieved a market share of nearly 50% in EUR-denominated trading volumes, confirming its role as the leading player in the European crypto market. Bitvavo outpaced global exchanges such as Kraken, Coinbase, and Binance, cementing its dominance in a market that saw significant growth in demand for euro-crypto trading in 2024.

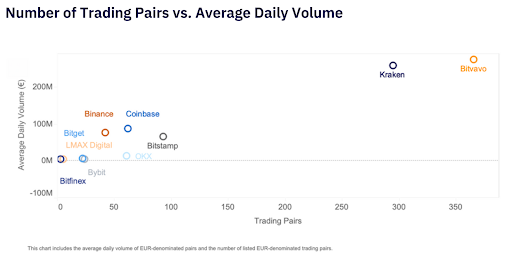

Most Euro pairs and deepest liquid EUR spot markets.

Bitvavo has - as the report shows - the largest range of digital assets (350+) in EUR-Spot, with the deepest liquid markets of all exchanges. In addition, Bitvavo listed more than 100 new digital assets, more than any other exchange.

Mark Nuvelstijn CEO of Bitvavo is proud of the leading position the platform has in the European crypto market: “We see this performance as a validation of our strategy. Our commitment to a powerful platform, a broad selection of digital assets, and competitive trading fees has helped us remain the preferred choice for both retail and institutional users in Euro-crypto markets worldwide.”

MiCA improves market opportunities

According to Nuvelstijn, the new European regulations provide an extra tailwind. “We will receive our MiCA license in 2025 (expected), this enables us to roll out our strong product-market fit throughout Europe. The arrival of MiCA will further strengthen consumer confidence in Europe, so that the market will continue to grow. As market leader, we will reap the benefits of this.”

Growth in Euro crypto trading

According to Kaiko, euro trading volumes surged to an impressive €50 billion in November, more than doubling compared to October. BTC-EUR, the top trading pair, saw its share of global BTC-fiat volume climb from 3.6% to nearly 10%. This trend reflects improved regulatory clarity in the EU and Bitcoin’s growing institutional adoption worldwide, which continues to attract retail- and institutional investors to Europe.

Leaving competition behind

In addition to the robust market growth, the report also underscores Bitvavo’s position compared to other major players like Kraken and Binance. Bitvavo continued to grow steadily and maintained its position as market leader with a market share of almost 50%.

About Bitvavo

Founded in 2018 in Amsterdam, Bitvavo is Europe’s leading cryptocurrency trading platform and the largest EUR spot exchange globally. Over 1.5 million European retail users value Bitvavo for its comprehensive and user-friendly platform, where they can buy, sell, and store more than 350 digital assets at competitive fees. Institutional traders appreciate Bitvavo’s fast and reliable platform for the deep liquidity in more than 350 digital assets. Bitvavo is registered with the Dutch Central Bank (DNB). For more information, visit www.bitvavo.com.

About Kaiko

Since 2014, Kaiko has been a leading provider of market data and analytics in the crypto industry. Their insights support the development of innovative indices and benchmarks, and their reports are recognized as essential resources for market participants worldwide.

For more information:

Karel Zwaan

+31 6 22 39 45 00

[email protected]

This post is commissioned by Blockman and does not serve as a testimonial or endorsement by The Block. This post is for informational purposes only and should not be relied upon as a basis for investment, tax, legal or other advice. You should conduct your own research and consult independent counsel and advisors on the matters discussed within this post. Past performance of any asset is not indicative of future results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — SAHARA/USDT!

SAHARAUSDT now launched for futures trading and trading bots

New spot margin trading pair — H/USDT!

Bitget x BLUM Carnival: Grab a share of 2,635,000 BLUM