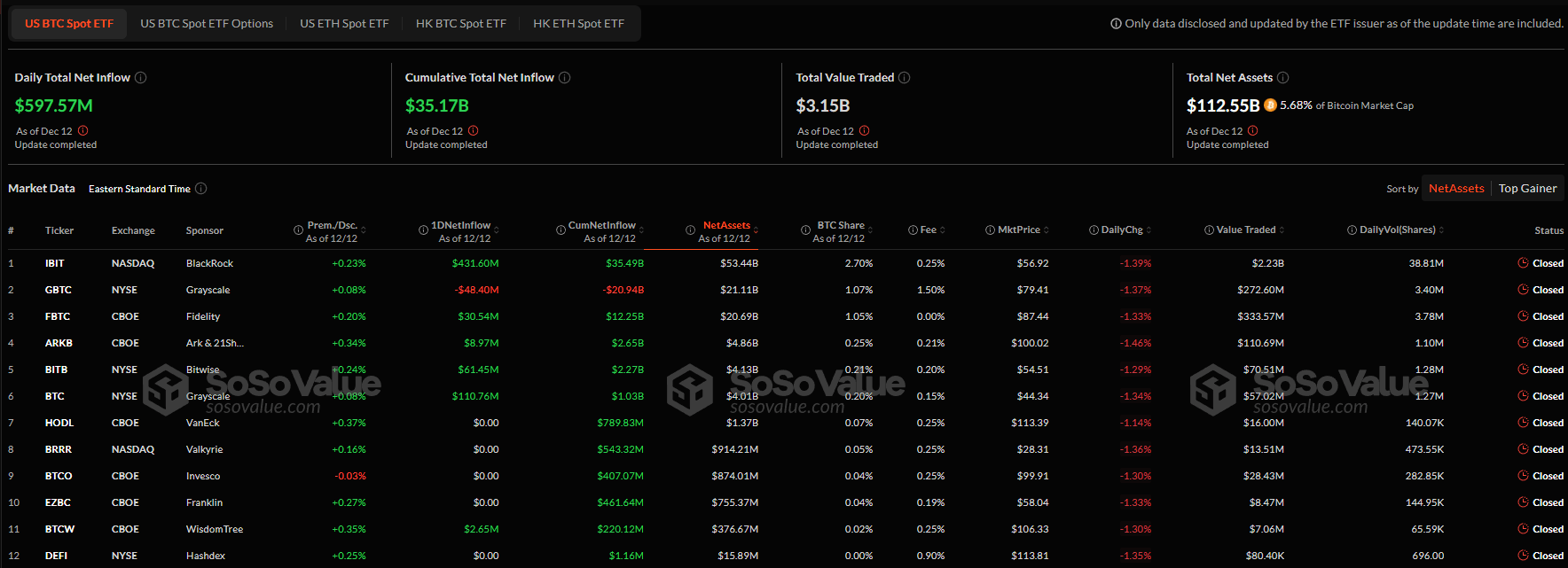

Inflows into U.S. spot currencies surged on Thursday, according to SoSoValue data. bitcoin ETF reached $597,57 million, which is significantly higher than the $223,03 million recorded the day before. The growth was almost 168%.

In just 11 trading days in a row, more than $4,4 billion has flowed into exchange-traded funds based on the flagship cryptocurrency. And since its launch, the total net capital inflow into bitcoin ETF reached $35,17 billion for the first time.

The leader in one-day capital inflow was the IBIT fund from BlackRock, which received $431,6 million. Grayscale Bitcoin Mini Trust investors invested $110,76 million, Bitwise’s BITB invested $61,45 million, and Fidelity’s FBTC invested $30,54 million. Funds from ARK , 21Shares and WisdomTree saw more modest inflows of $8,97 million and $2,65 million, respectively.

The only outsider on Thursday was ETF Grayscale's GBTC, which lost $48,4 million. The other five bitcoin ETF noted zero results.

Capital inflow from spot bitcoin ETF

On December 12, issuers of exchange-traded funds based on Ethereum also saw an influx of funds. They attracted $273,67 million on the day, up 168% from the $102,03 million recorded the day before. ETHA received the most funds from BlackRock ($202,31 million), followed by Grayscale Ethereum Mini Trust with $73,22 million. Fidelity and 21Shares raised $19,42 million and $1,55 million, respectively.