ON–298: StablecoinsStablecoins 💰Ethena 💵Sky Dollar 🟡f(x) Protocol 🔵First Digital USD 🌐Tether 🍐

From ournetwork xyz

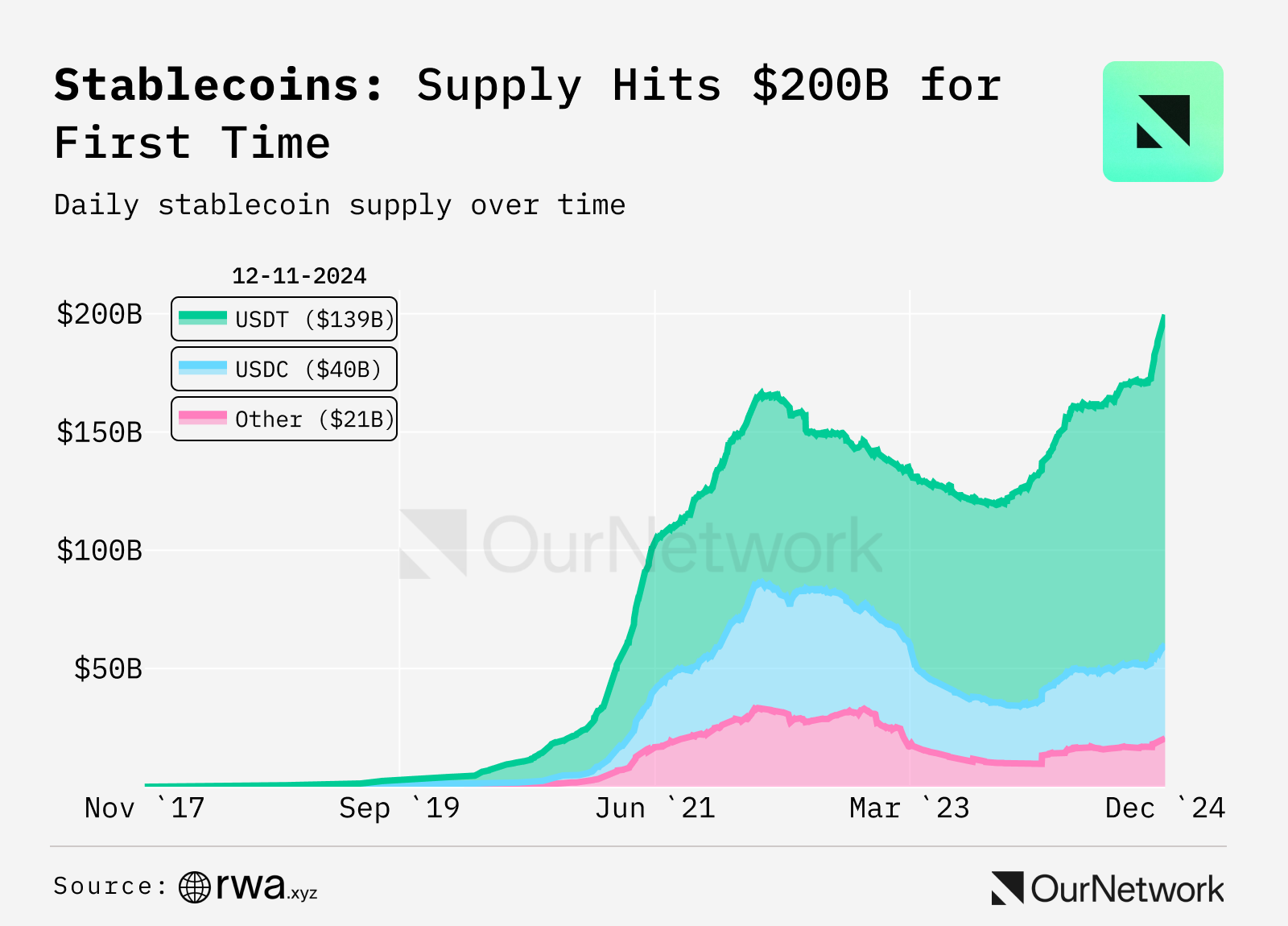

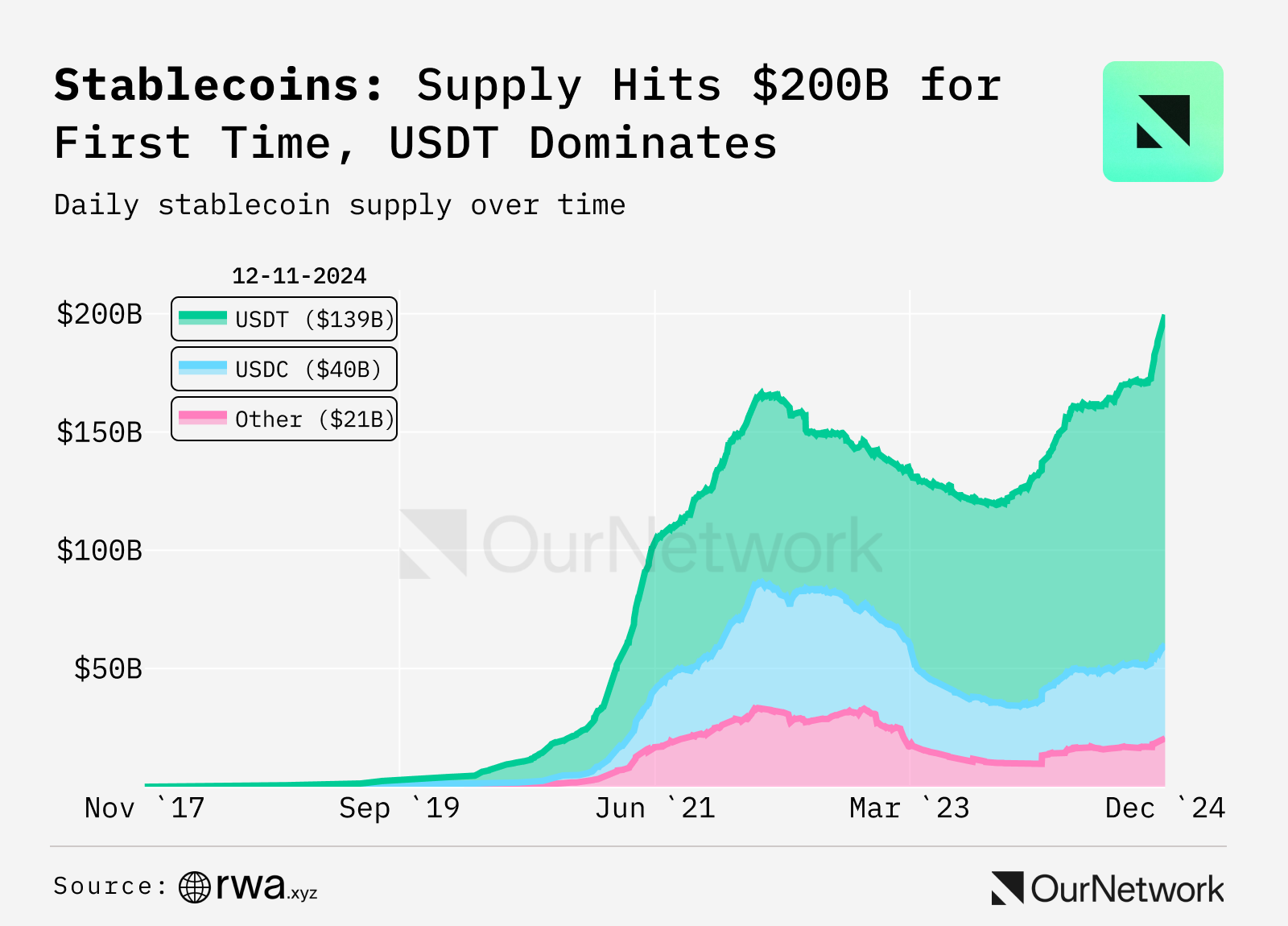

In a major milestone for crypto this week, stablecoin supply has passed $200B. That means we have more dollar-pegged assets than ever being used for payments in personal and institutional contexts, as well as stablecoins' increasing usage in DeFi.

rwa.xyz

Widespread proliferation of stablecoins pose major downstream ramifications, not just for the payments industry, but our economy at large. On a micro level, stablecoins has the potential to bring payment costs to below a cent. On a geopolitical level, easy access to US dollars may threaten countries who have less-than-stable currencies.

It's a still-unfolding story, but if in the past five years stablecoins went from a strange corner of crypto to a major industry, the next five appear likely to imbue our daily lives with their usage.

With that, let's check out the onchain latest for these digital assets.

Stablecoins 💰

USD0 | USDe | USDS | fxUSD | FDUSD | USDT

👥 Charlie You | Dashboard

📈 Stablecoin Supply Reaches $200B, Growing the Fastest Since 2021

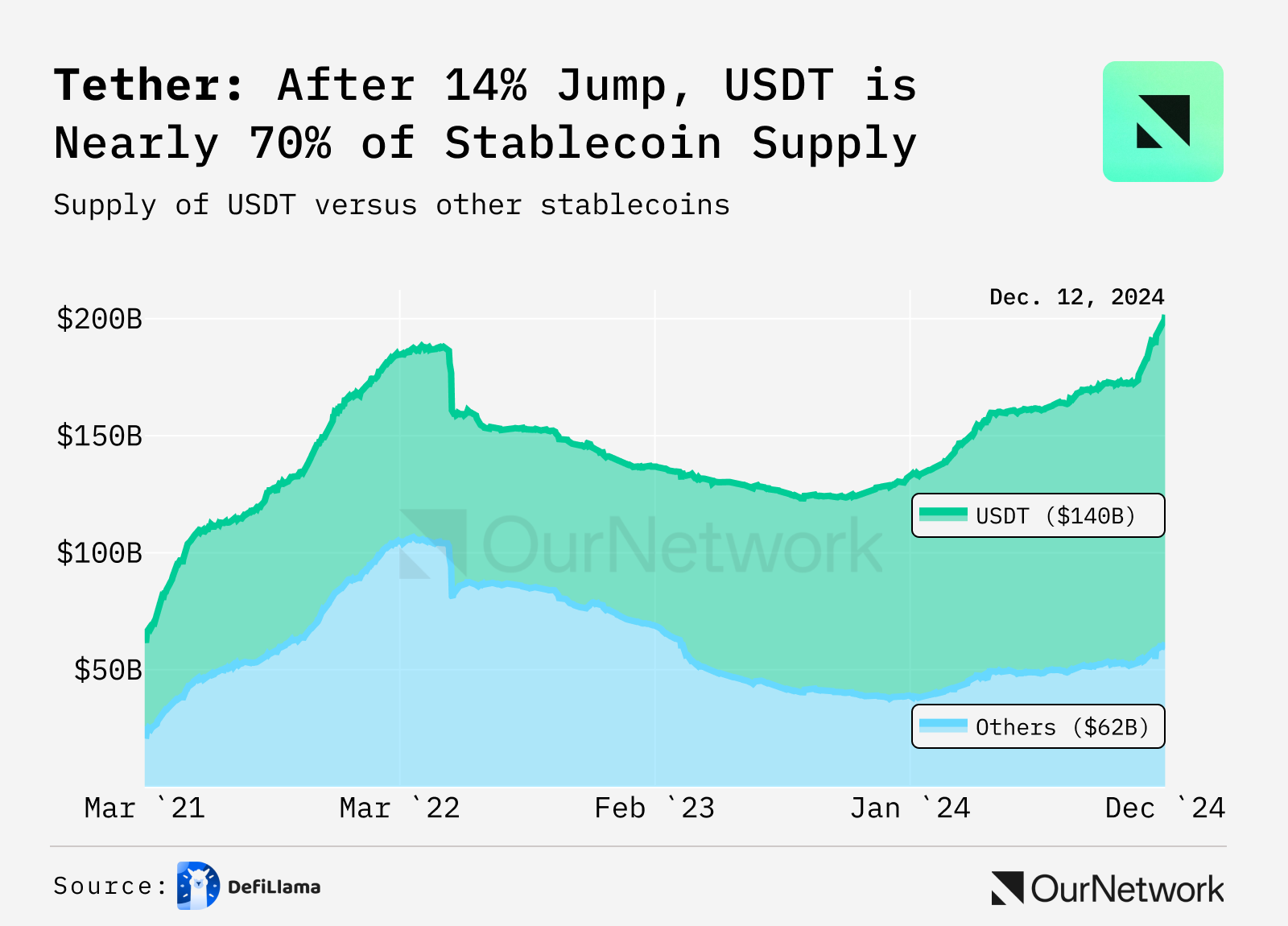

- The stablecoin market breaks $200B, setting a new all-time high. Growing $30B in just 40 days post-election (from $170B), this marks the fastest surge since 2021. Tether led the charge, adding $20B to reach $140B. Circle's USDC followed, growing $6B to $41B, while Ethena's USDe more than doubled from $2.5B to $5.5B.

rwa.xyz

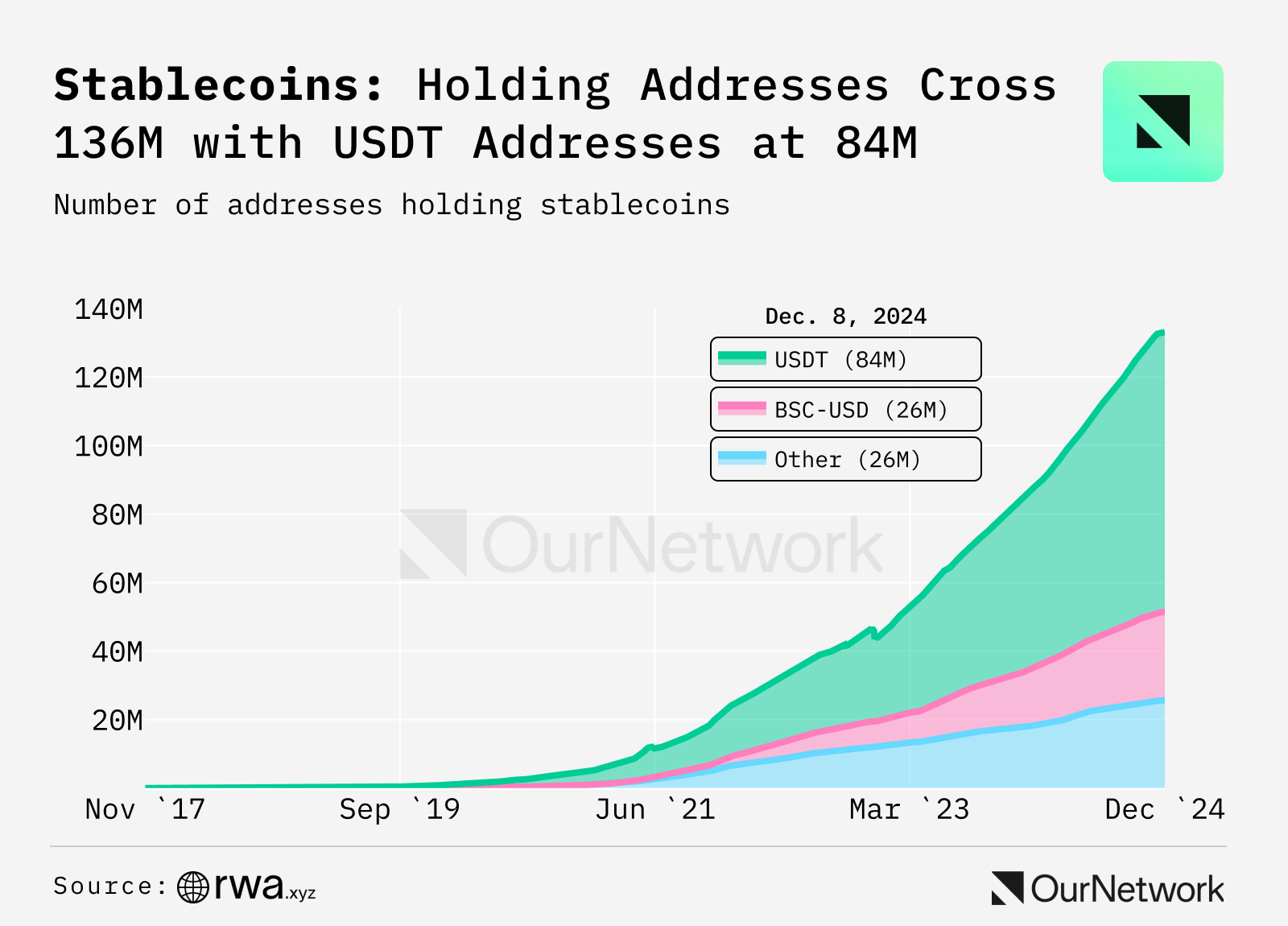

- The number of stablecoin holders continues to rise, now sitting at 133M, led by USDT (81.7M holders) and BSC-USD (25.8M). While USDC has had slower growth with 18M holders, smaller stablecoins like PYUSD and USDe continue to build momentum, showing growing market diversity.

rwa.xyz

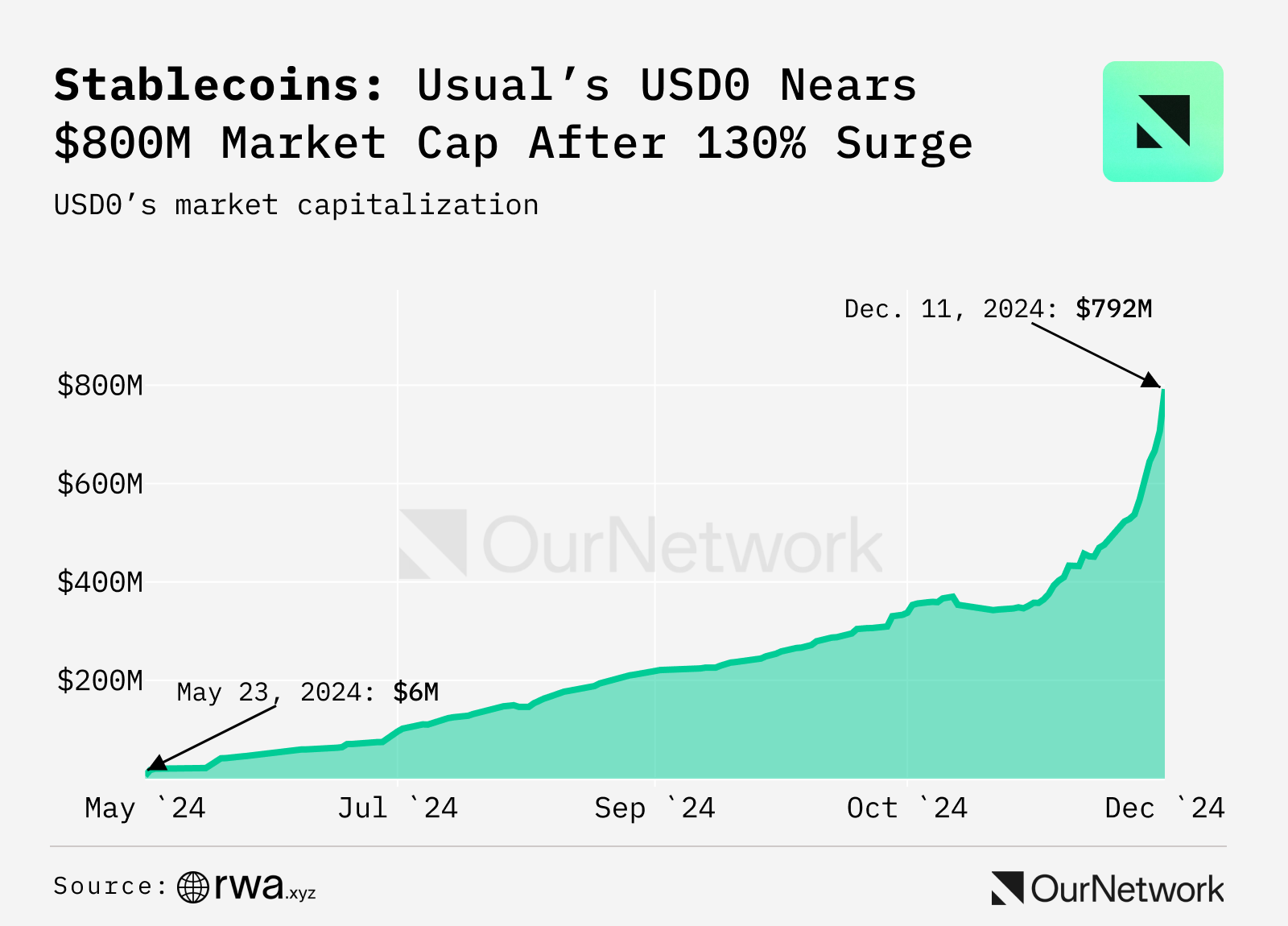

- USD0, a stablecoin backed by Hashnote's tokenized U.S. Treasury asset USYC, has surged over 130% in the past month, reaching a market cap of nearly $800M. This growth elevates USD0 to the position of the seventh-largest stablecoin, driven by staking rewards exceeding 30%.

rwa.xyz 🔦Transaction Spotlight:In the last 5 days, Tether has pre-minted 4B of USDT on Ethereum, in clips of 1B or 2B at a time. This transaction is the latest of those pre-mints, and brings the Tether Ethereum Treasury balance up to 1.5B. Over the next few days we can expect these tokens to be sent out of the wallet, and brought into circulation, driving further growth in the stablecoin leader's supply.

Ethena 💵

👥 Matt Casto | Website | Dashboard

📈 sUSDe Total Value Locked Surpasses $4B

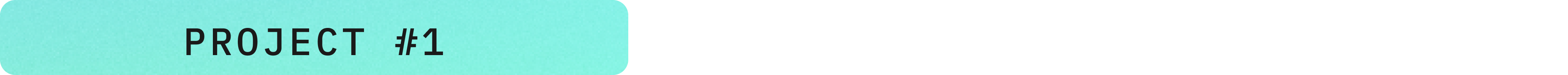

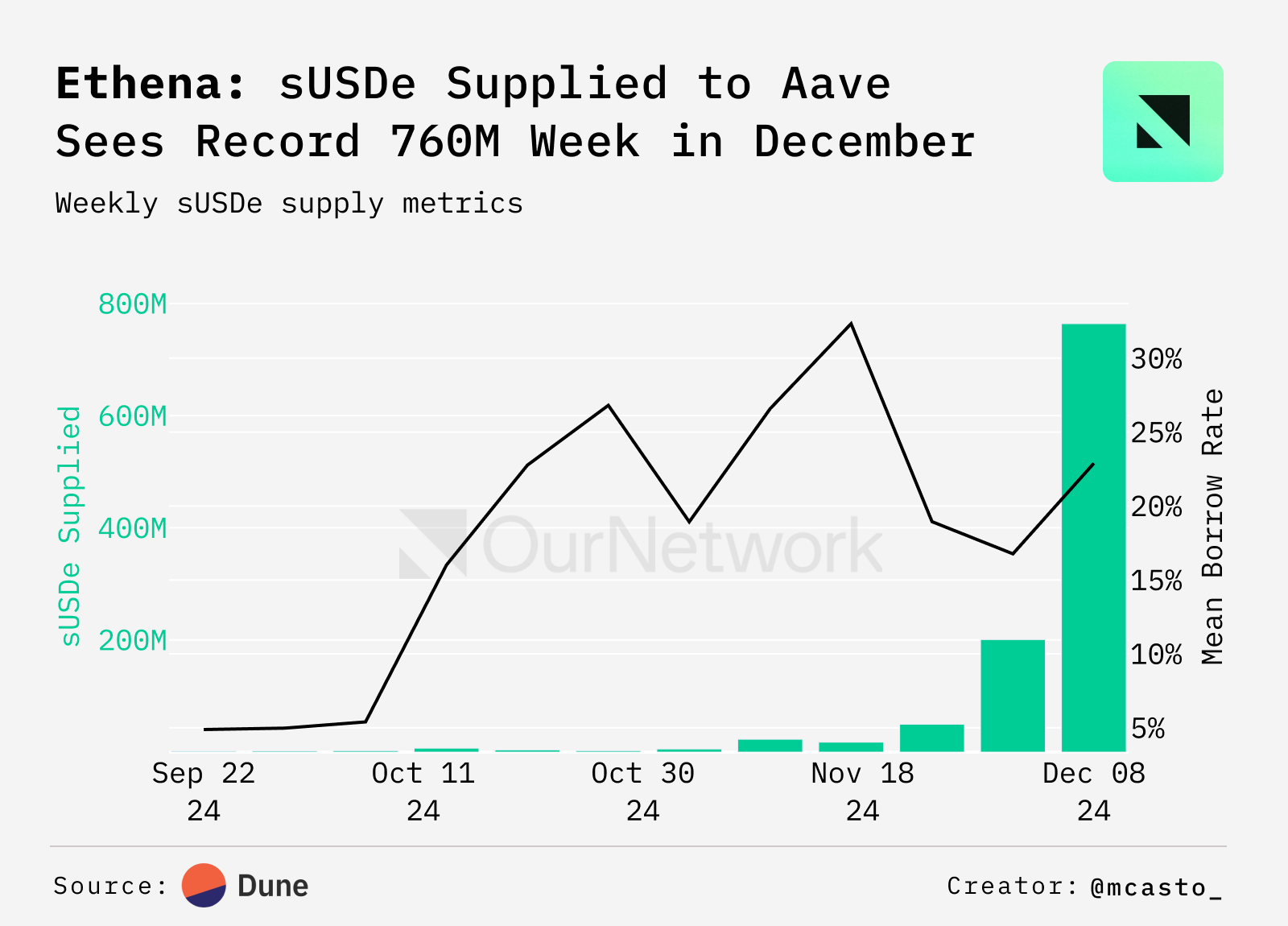

- The Ethena stablecoin complex has observed significant growth over the past month as the protocol has capitalized on highly advantageous funding rates. For nearly the past month, sUSDe has surpassed 20% APY with large quantities of supply heading to Aave and Pendle. Providing context to the recent growth, over 50M USDe has been distributed to sUSDe stakers in the past month, while the sUSDe supply has more than doubled. USDe is currently the third largest stablecoin, only behind USDT and USDC.

Dune - @mcasto_

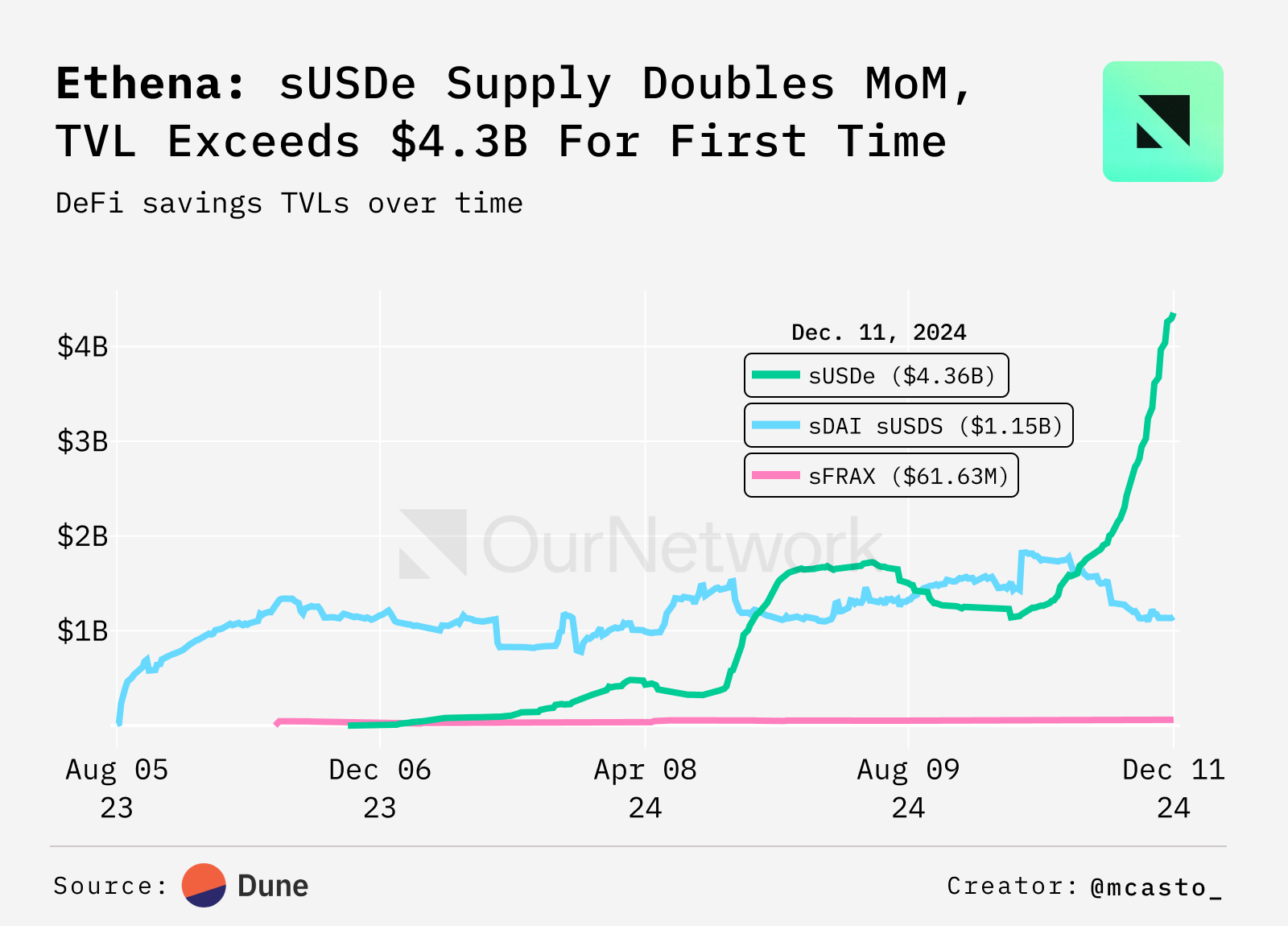

- The impact of sUSDe on the lending environment will be touched upon soon, and it is observable that users are moving stables into USDe/sUSDe as can be seen in the sUSDe-USDT pool on Uniswap, the largest total value locked (TVL) Uniswap pool for the asset. This past day saw the largest net buying of sUSDe in the pool.

Dune - @mcasto_

- There is strong demand for sUSDe within the lending environment which is a byproduct of the stablecoin's high yield over the past month. Aave has increased the supply cap several times in December and the cap is hit immediately. There is strong borrow demand for USDC/USDT following cap raises.

Dune - @mcasto_ 🔦Transaction Spotlight:This was the largest amount in a single transaction of sUSDe supplied to Aave, where 66.68M sUSDe was supplied. The address which triggered the transaction is the third largest borrower on Spark and has been observed buying large amounts of Dec. 26 PT-sUSDe lately. They used 31M sUSDe to buy more PTs over the past couple of days and will likely deposit them in Morpho, which they have done in the past. After supplying sUSDe on Aave, they borrowed $32M of wBTC.

Sky Dollar 🟡

👥 Seoulcalibur.eth | Website | Dashboard

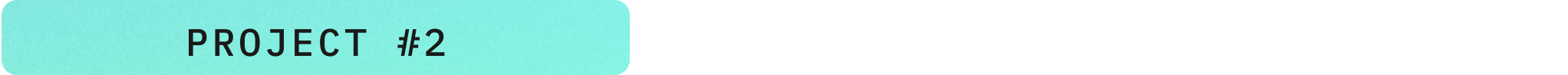

📈 USDS Gains Momentum, Reaches $1.2B Circulating Supply with Multi-Chain Growth Post-Rebranding

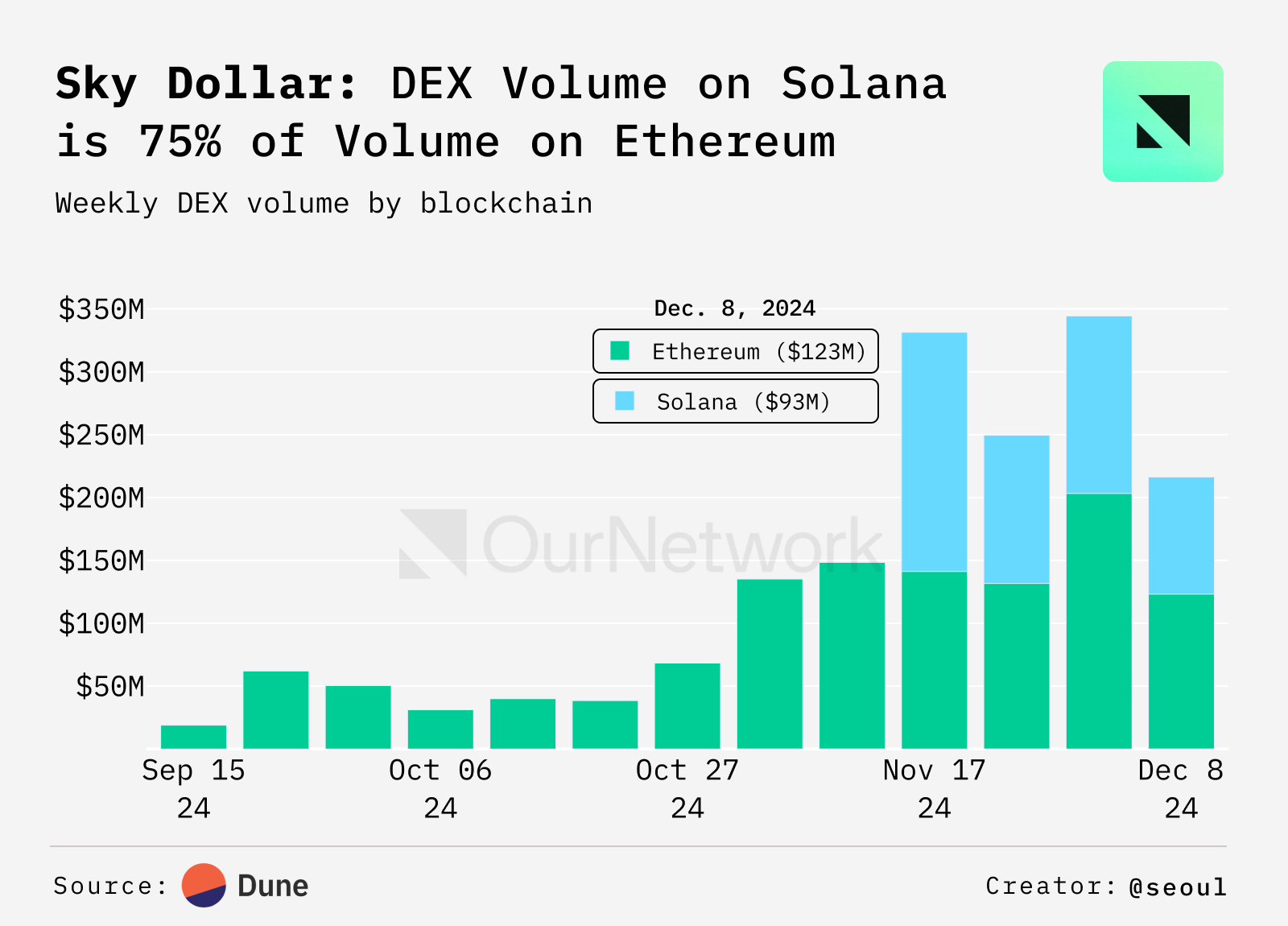

- With its rebranding to Sky Ecosystem on Sept. 18, 2024, USDS (Sky Dollar, formerly DAI) initially launched on Ethereum and quickly reached a circulating supply of $1B peaking at $1.2B in mid-November. Since then, USDS has expanded to Solana with plans to launch on Base soon. DEX trading volume has grown steadily reaching $1.2B in lifetime trading volume on Ethereum and $542M on Solana. While Ethereum still holds 94% of the total supply, USDS adoption on Solana has been increasing rapidly.

Dune - @seoul

Dune - @seoul

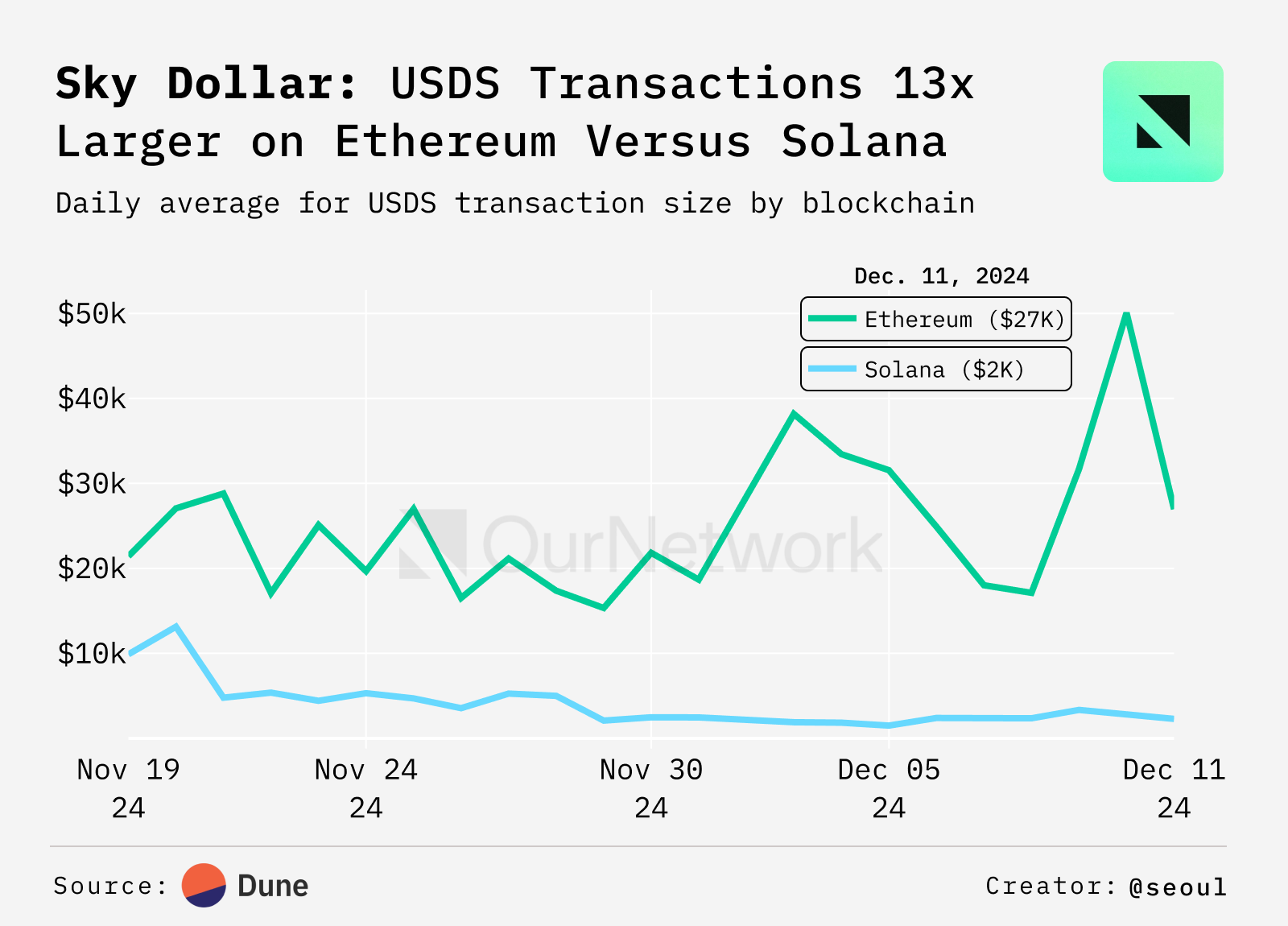

- USDS transactions show distinct patterns on Solana and Ethereum particularly in transaction size. Solana transactions average $3,000 highlighting its strength in fast, low-cost microtransactions. In contrast, Ethereum transactions average $24,000 indicating its use for higher-value activities.

Dune - @seoul

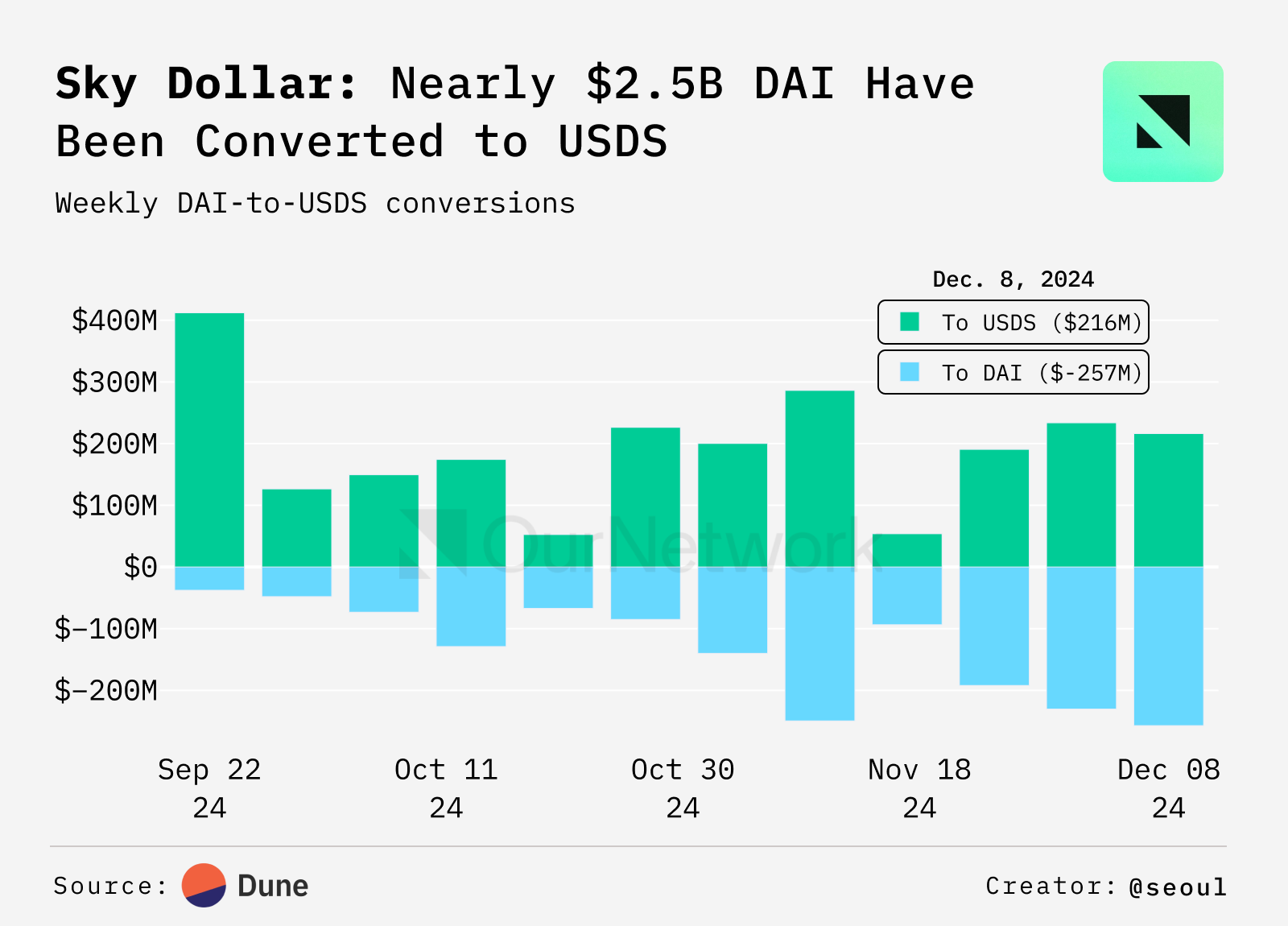

- After rebranding, DAI-to-USDS conversions reached $2.4B surpassing $1.7B in the reverse primarily driven by DEX trades. While MakerDAO's rebranding has sparked debate, USDS' growing adoption across multiple chains and its increasing supply position it as a competitor in the stablecoin market.

Dune - @seoul

f(x) Protocol 🔵

👥 pauls | Website | Dashboard

📈 $65M in Organic TVL Proves f(x) Protocol's Sustainable Stablecoin Model

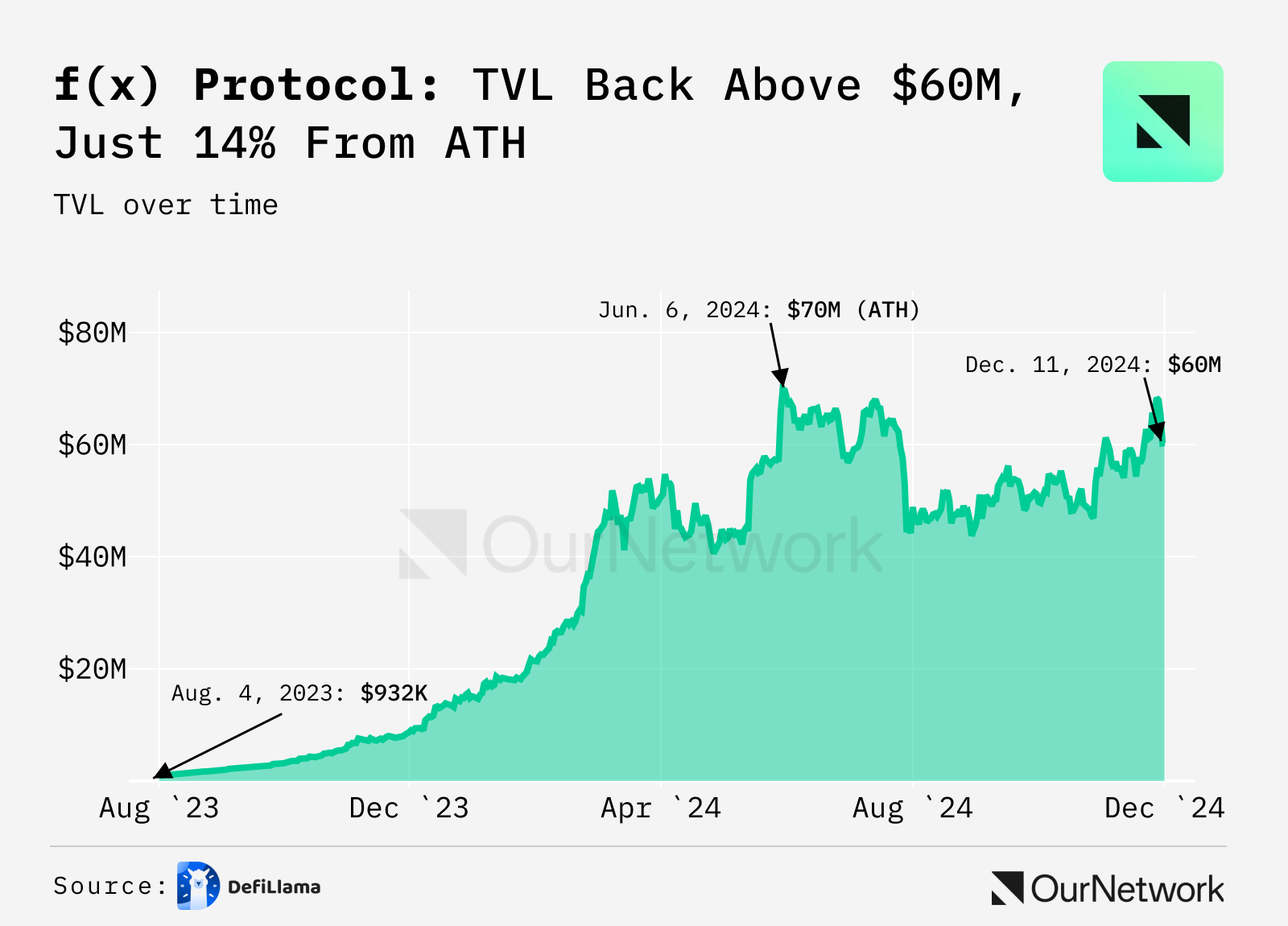

- Focused on sustainable stablecoin infrastructure, f(x) Protocol demonstrates how robust fundamentals drive real growth. As such, f(x) has grown to $65M in organic TVL while maintaining a rock-solid fxUSD peg. The upcoming v2 introduces the USD Delta-neutral Stability Pool, offering double-digit APY without inflationary token rewards - setting a new standard for sustainable DeFi yields.

DeFiLlama

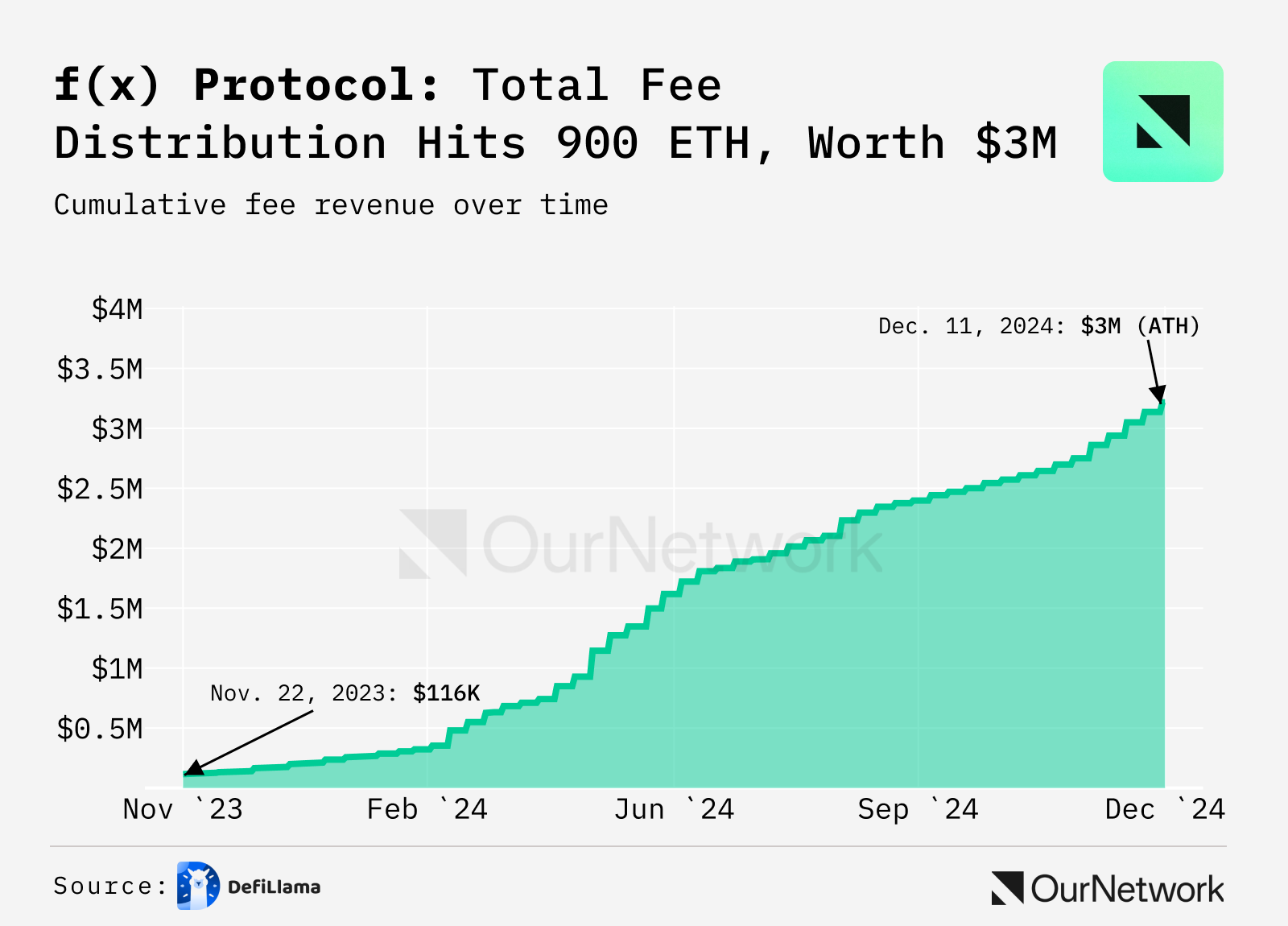

- In a testament to its sustainable design, f(x) has reached over 900 ETH distributed in protocol fees to users. This was driven by organic growth and real usage rather than token incentives.

DefiLlama

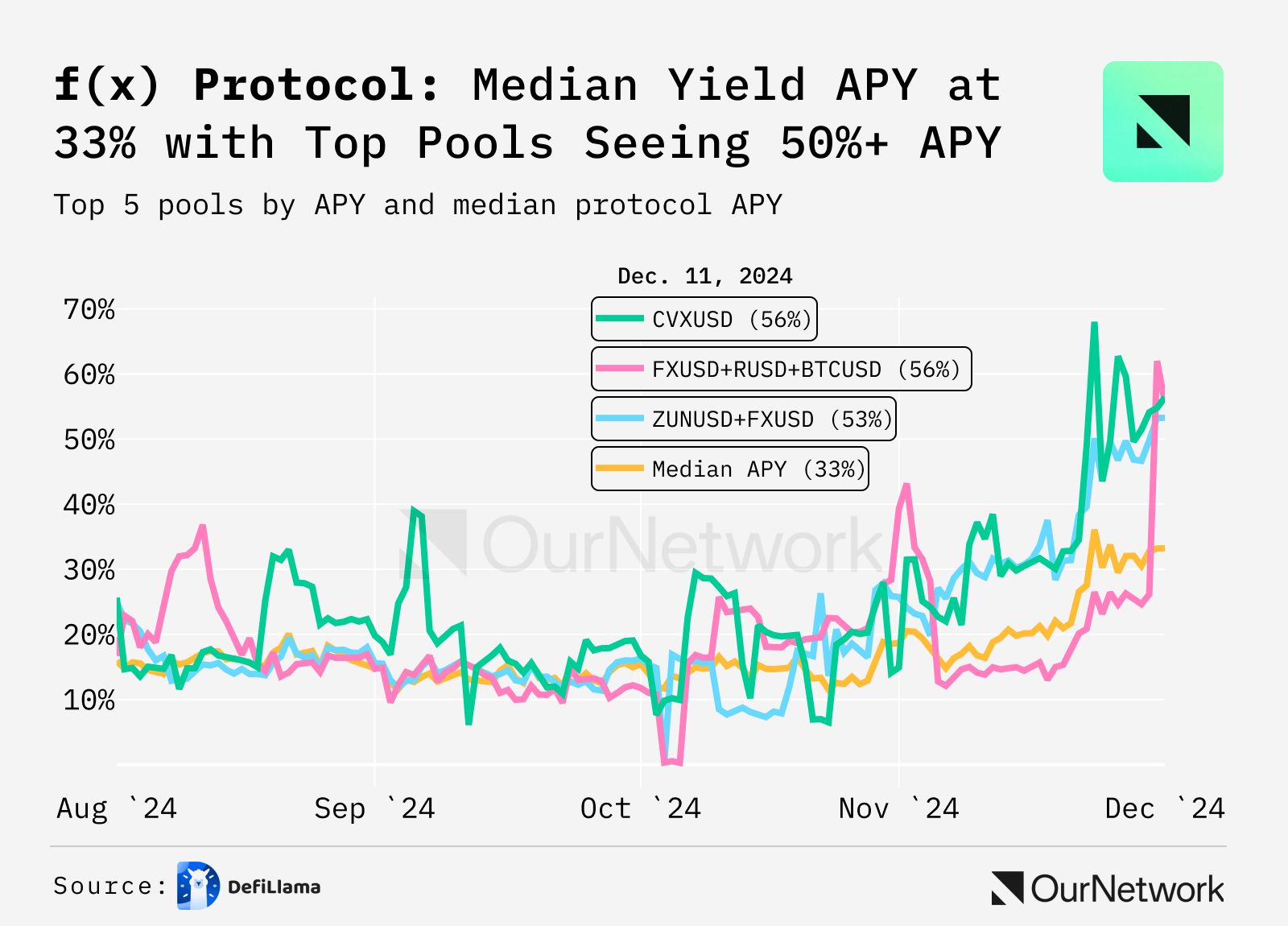

- f(x) Protocol's yield performance has climbed from 10% to over 30% APY in recent periods. These returns derive from protocol fees and trading volume, highlighting f(x)'s sustainable economic model.

DeFiLlama 🔦Transaction Spotlight:A DeFi user just deployed ~$1M USD in the fxUSD-GHO LP, chasing the protocol's compelling 30%+ APY yield from the f(x) gauge. This significant deposit demonstrates growing confidence in f(x) Protocol.

First Digital USD 🌐

👥 Etimfon Bassey Ikpong | Website | Dashboard

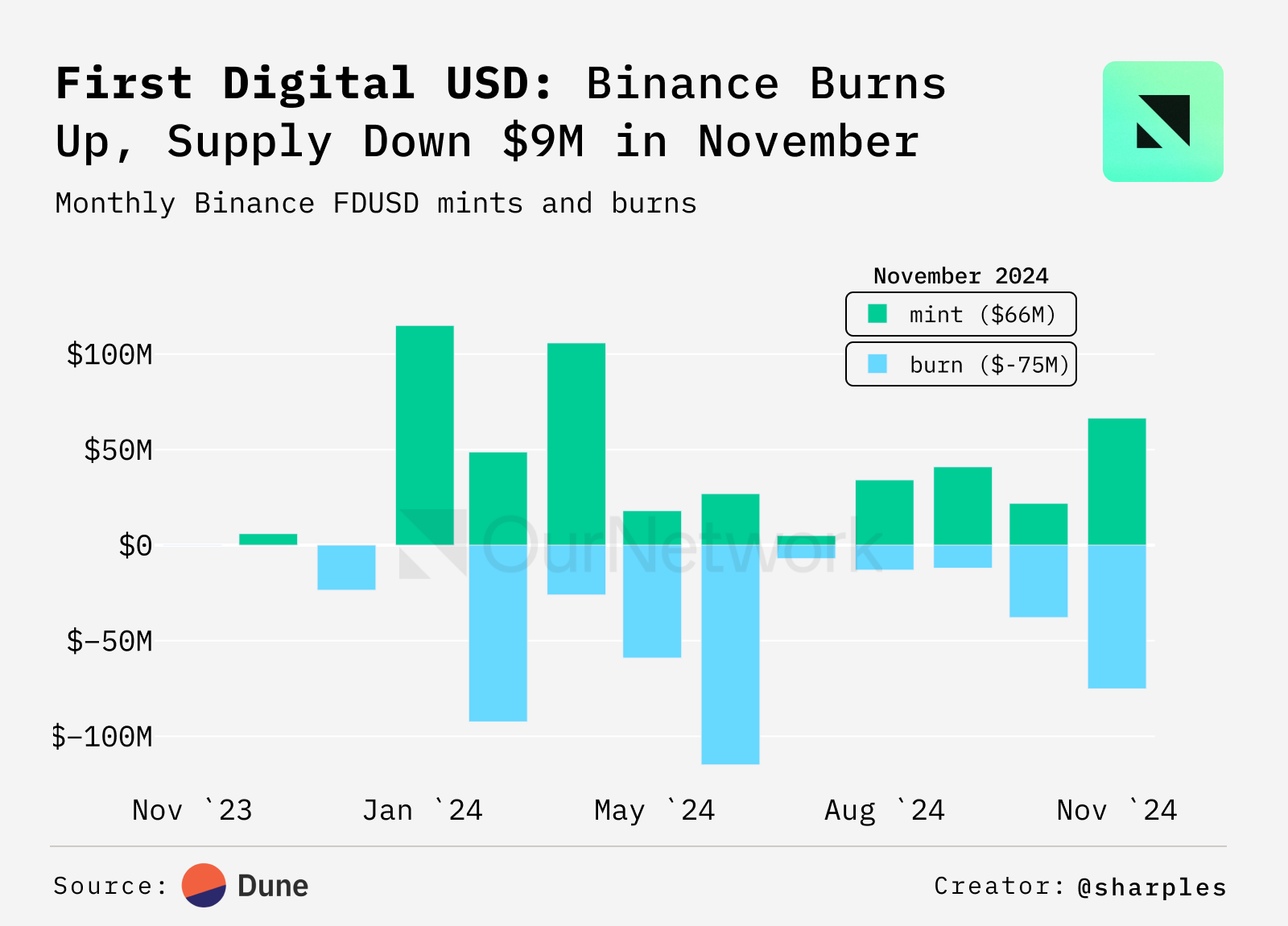

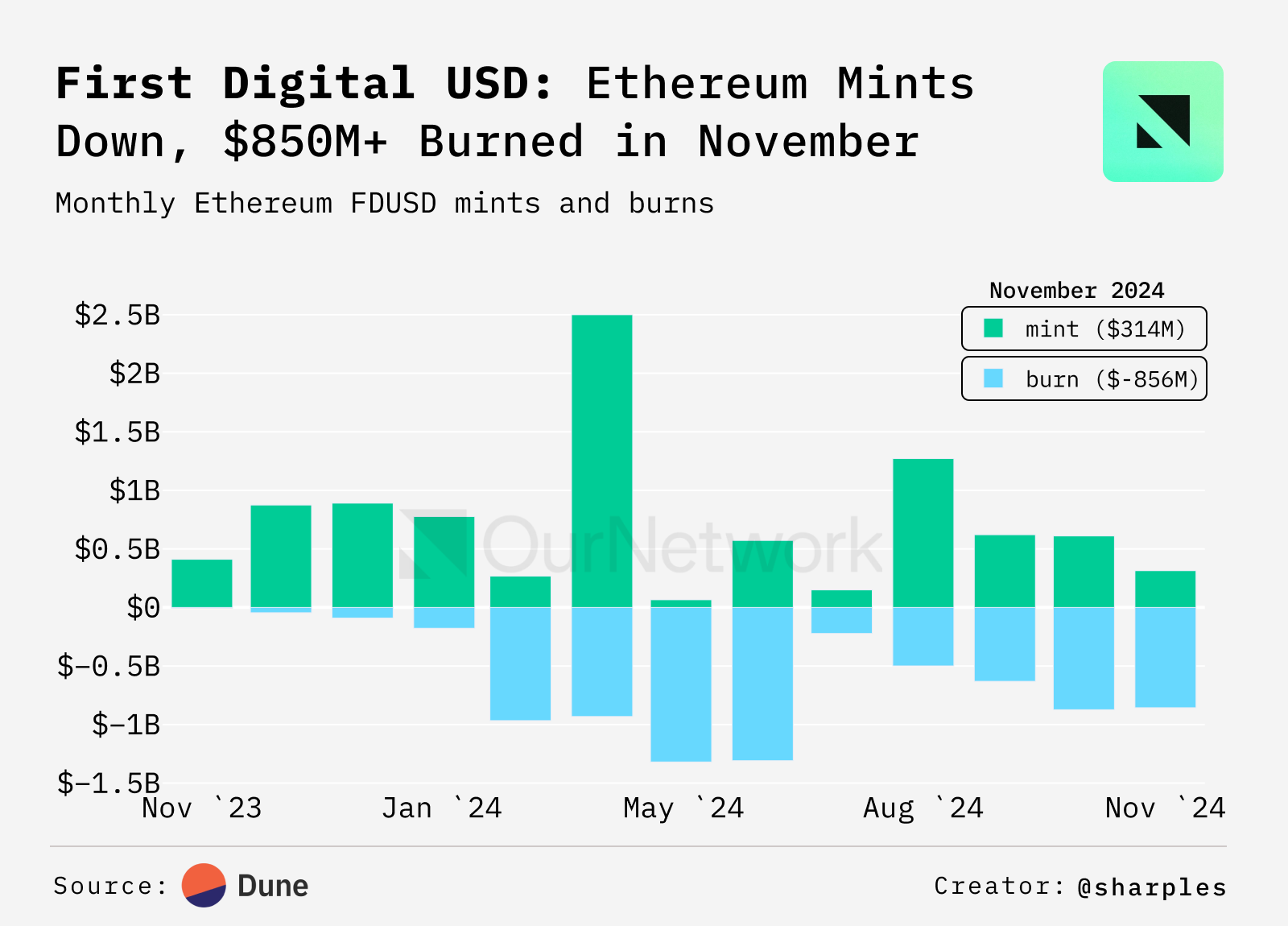

📈 16% of $FDUSD Trading Volume on Ethereum Remains on Centralized Exchanges with 40% of Transactional Volume on BNB Chain

- Historically, Ethereum has been the most dominant chain in terms of stablecoin marketcap, a trend which is also visible in the supply of FDUSD. Daily mints indicating demand, supply and usage of FDUSD on Ethereum is higher compared to BNB Chain. The supply of FDUSD on Ethereum recently jumped $993M+ with current supply at $1.93B in contrast to its $921.3M+ supply a year ago.

Dune - @sharples

- On Ethereum, FDUSD is mainly used for daily transactions such as swaps, etc as >95% supply is on Binance. On BNB chain FDUSD is used as a tool for DeFi yields.

Dune - @sharples

Tether 🍐

👥 Henry Child | Website | Dashboard

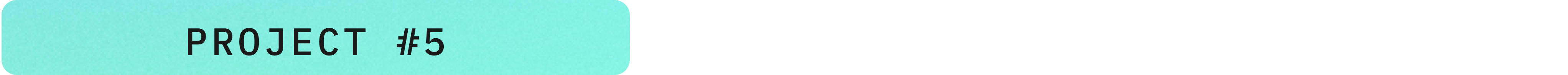

📈 USDT Transfer Volume Doubles as the Stablecoin Nears 70% Market Dominance

- Over the last year, USDT daily transfer volume has more than doubled, from $19B to $42B (using 14 day moving-average).

Artemis

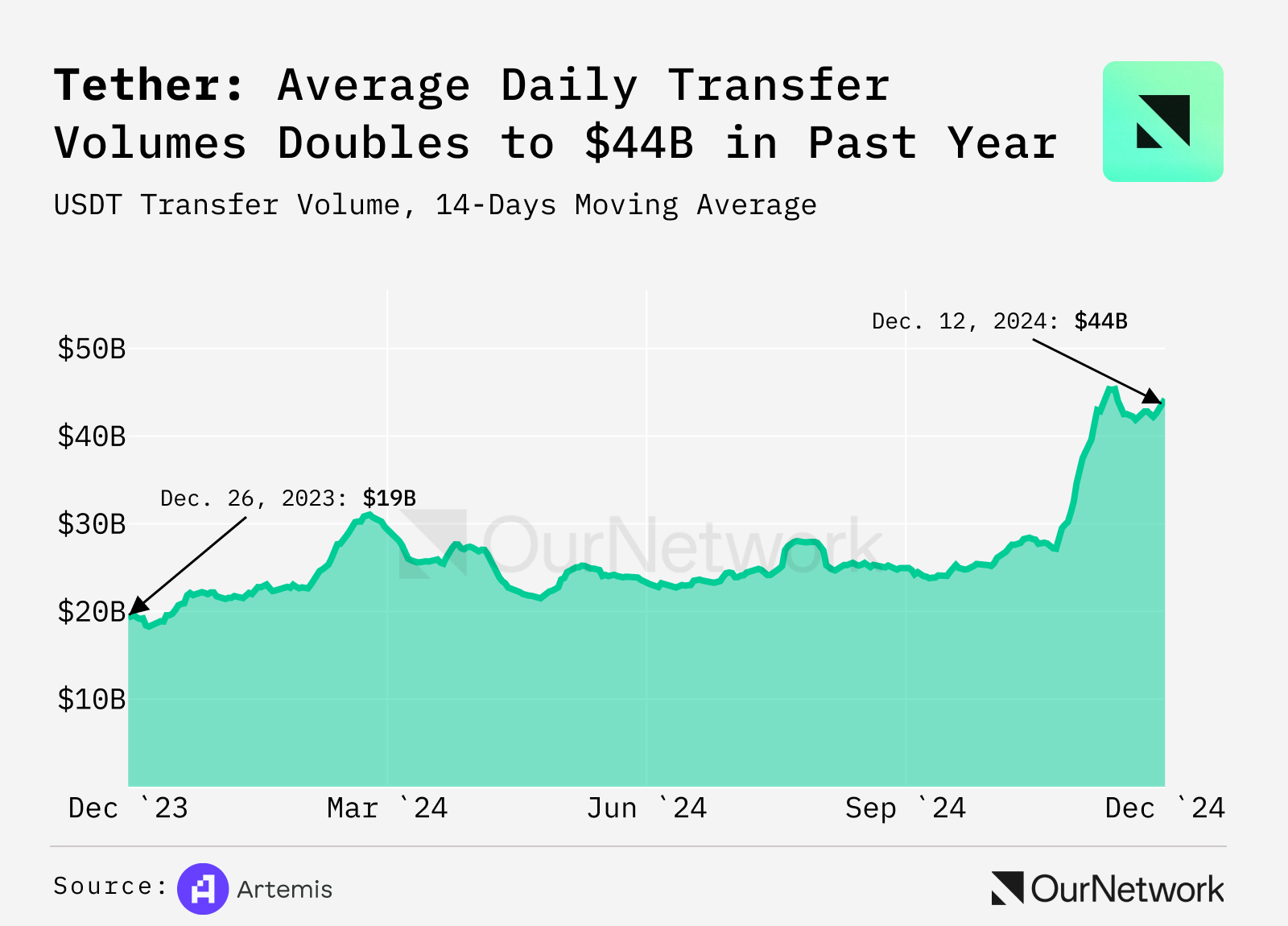

- Aptos is the Tether-supported chain with lowest transaction fees yet — it costs $0.0002 to send USDT on the blockchain.

gasfeesnow.com

- With $138B in circulation (up 14% over the last month), Tether maintains nearly 70% dominance of the stablecoin market share.

DeFiLlama

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.