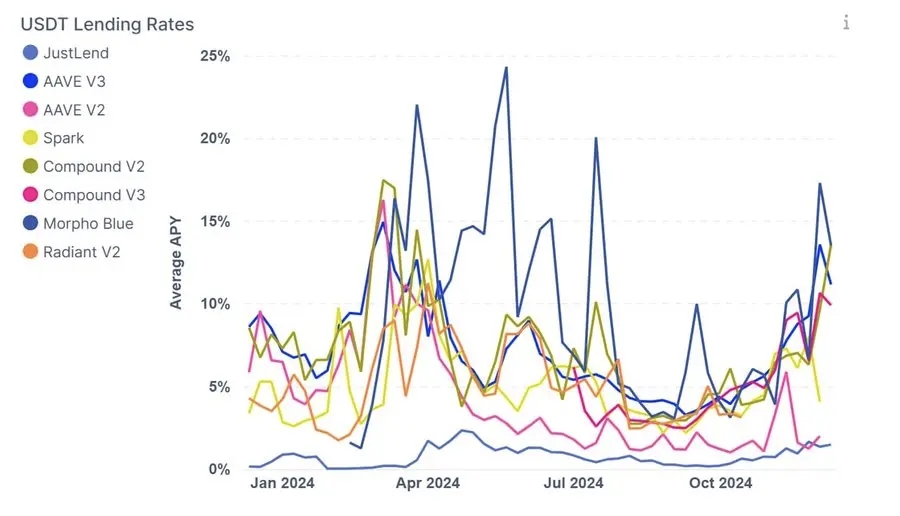

Data: The lending rate in the DeFi market has reached a new high since 2022, with Aave seeing a net inflow of funds reaching 500 million US dollars this week

According to IntoTheBlock data, with users extensively using WBTC and WETH as collateral for borrowing stablecoins, the DeFi lending market has welcomed a new wave of popularity. The lending rate has broken through 10%, with some projects reaching up to 40%, setting a new high since the bull market in 2022. The largest lending protocol on Ethereum, Aave, had a net inflow of funds reaching $500 million this week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SpaceX Agrees to Invest $2 Billion in xAI

Bitwise CIO predicts Bitcoin will reach $200,000 by year-end

Google agrees to pay approximately $2.4 billion for technology licensing from AI programming startup Windsurf

SpaceX to Invest $2 Billion in Elon Musk’s xAI