Jetking Infotrain, an Indian IT training company, has become the first publicly listed company in India that has adopted Bitcoin as a primary treasury asset.

On December 9, 2024, the 77-year-old tech company purchased 12 bitcoins worth approximately $1.2 million. The company is now valued at approximately $4.5 million.

However, this investment in bitcoin is relatively small, which represents over 26% of its market capitalization. Jetking’s action follows a rising trend among tech companies to incorporate Bitcoin into their financial plans.

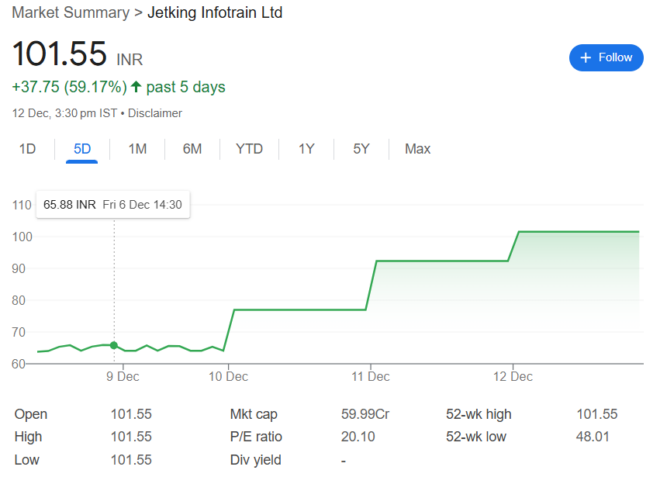

Following this announcement, the stock price of Jetking surged by 30%, reaching a five-year high.

Jetking Infotrain was established in 1947 as a company that specializes in IT training and talent development. Beginning with electronics and technology, it eventually extended to include networking, cybersecurity, and cloud computing. Jetking has trained over 700,000 students, assisting them in establishing successful professions in technology.

The company now holds Bitcoin as the most revered asset, joining a global trend of tech firms embracing crypto for financial gains. Despite modest annual sales of $2 million, the decision has drawn attention from both investors and financial analysts.

However, replicating Jetking’s move might be challenging for other Indian firms. India’s cryptocurrency policies remain strict, with a 30% tax on crypto gains, not to forget regulatory uncertainties.

India has taken a cautious stance on cryptocurrency compared to the United States, where prominent companies like MicroStrategy, Tesla, and Coinbase have incorporated Bitcoin into their corporate reserves.