CryptoQuant sees an Ethereum price primed for growth amid increasing demand and onchain activity

Quick Take Ethereum’s price could surpass $5,000 if current supply-and-demand trends and rising investor interest continue, CryptoQuant analysts said. Ethereum’s on-chain activity has increased, with daily transactions and dApp usage driving higher network fees and slowing supply growth due to increased Ethereum burning, they added.

Ethereum's price could see substantial growth if the current supply-and-demand dynamics hold — driven by on-chain valuation metrics and a resurgence of investor interest in Ethereum-based financial products — according to analysts at CryptoQuant.

"Based on valuation metrics, Ethereum could be heading above $5,000 if current demand and supply dynamics continue," CryptoQuant analysts told The Block.

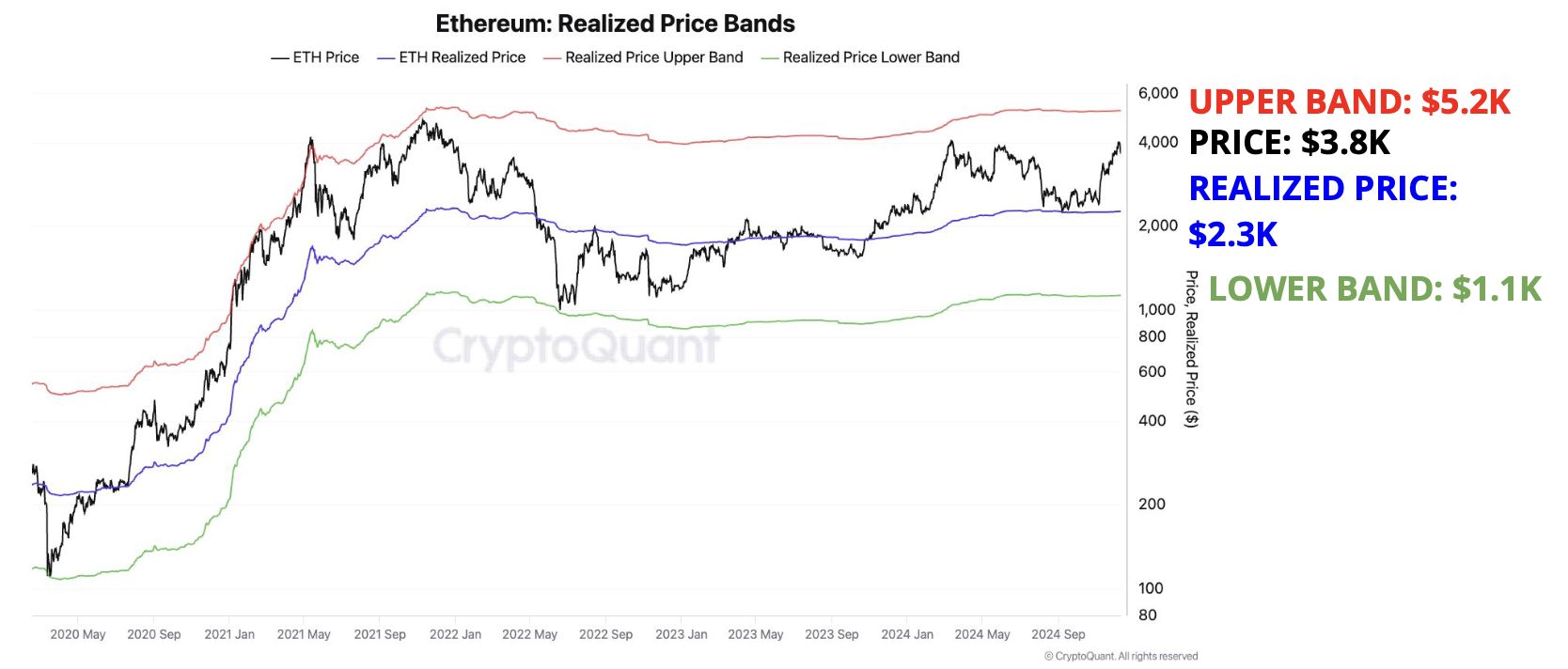

They highlighted Ethereum’s realized price bands as a key indicator in their assessment. The realized price represents the average price at which Ethereum has changed hands. The current upper limit of the realized price bands stands at $5,200 — reflecting the peak of Ethereum’s price during the 2021 bull run. CryptoQuant analysts noted that as new buyers purchase Ethereum at higher prices, this upper price band will continue to rise, signaling further upward potential in the current market cycle.

The current upper limit for Ethereum's realized price stands at around $5,200. Image: CryptoQuant.

Growing network activity and deflationary dynamics

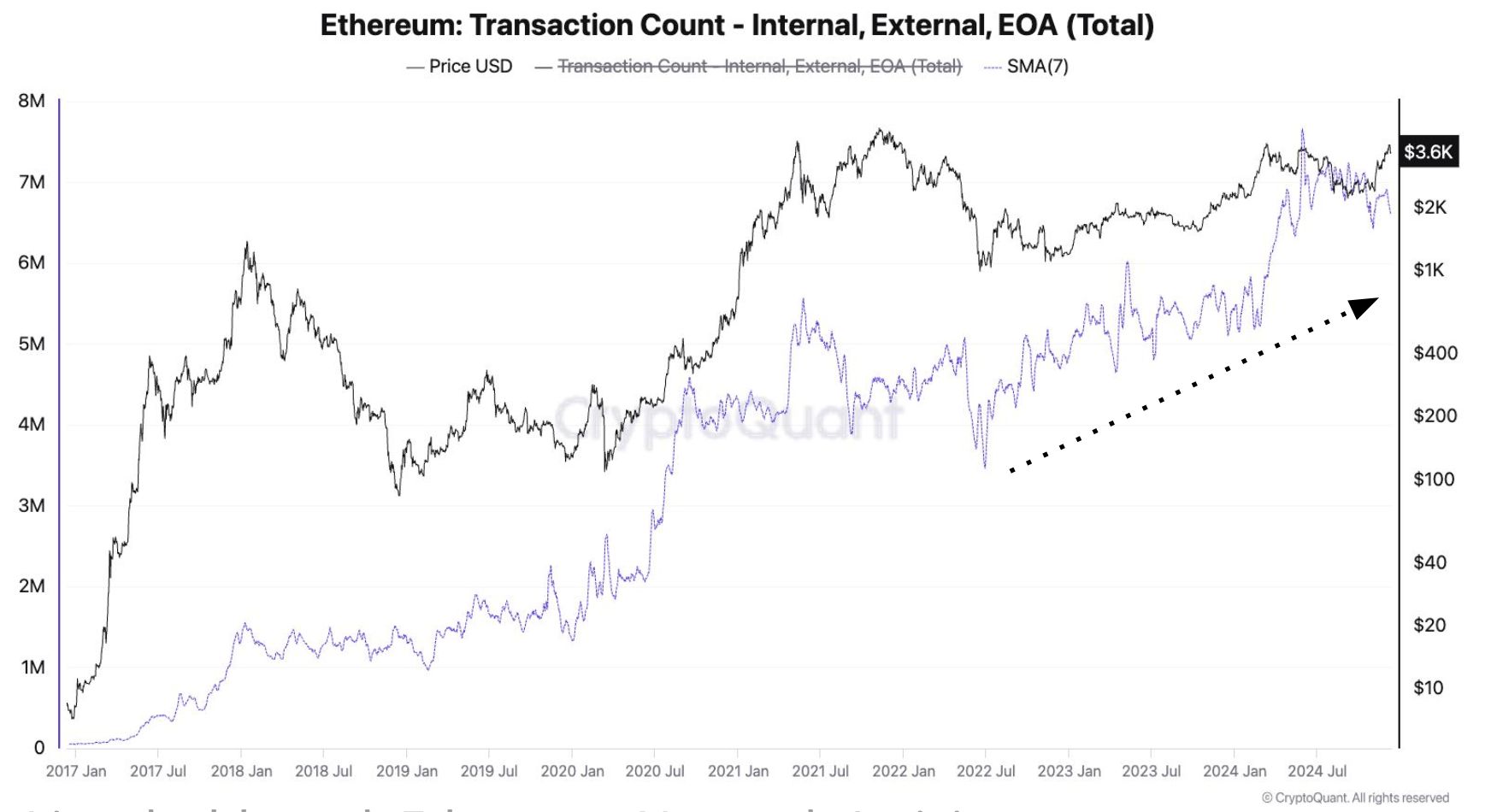

Ethereum’s on-chain activity has expanded significantly throughout 2024, the CryptoQuant analysts said. Daily transactions now range between 6.5 and 7.5 million, up from an average of 5 million in 2023. "Additionally, the number of daily contract calls—a proxy for decentralized application (dApp) usage—has grown to 6-7 million this year, compared to 5 million in 2023," the analysts said.

This increased activity has driven higher network fees, resulting in greater Ethereum being burned under Ethereum’s fee-burning mechanism. "The pace of supply growth has slowed in recent months as the amount of Ethereum burned via fees has increased since September, exerting some deflationary pressure on the digital asset," CryptoQuant analysts explained.

Ethereum daily transactions now range between 6.5 and 7.5 million, up from an average of 5 million in 2023. Image: CryptoQuant.

Institutional demand reflected in spot Ethereum ETFs gaining momentum

Renewed investor appetite is evident in the strong growth of U.S.-listed spot Ethereum exchange-traded funds. BlackRock’s ETHA ETF and Fidelity’s FETH ETF have led the charge in terms of inflows this week. BlackRock's and Fidelity's ETFs purchased $500 million worth of ether on Tuesday and Wednesday of this week, according to the crypto data tracking platform Arkham . These inflows highlight sustained institutional interest in Ethereum as a digital asset and investment vehicle.

On Wednesday, Ethereum spot ETFs saw a total net inflow of $102 million, marking the 13th consecutive day of net inflows. Over the 13-day period, Ethereum ETFs accumulated $1.95 billion in inflows, bringing total net assets to $13.18 billion. This represents 2.86% of Ethereum's market capitalization, according to SoSoValue data .

Ethereum was changing hands for $3,918 as of 7:00 a.m. ET, according to The Block's Prices Page shows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — H/USDT!

HUSDT now launched for futures trading and trading bots

New spot margin trading pair — NEWT/USDT!

NEWTUSDT now launched for futures trading and trading bots