Step Finance aims to bring tokenized stocks, like Nvidia and Tesla, to Solana with latest acquisition

Quick Take Step Finance aims to become the first to bring tokenized trading of major stocks like Nvidia and Tesla to the Solana ecosystem. The project has acquired early-stage startup Moose Capital to facilitate its plans, including the regulatory licenses needed for a Q1 2025 launch.

DeFi platform Step Finance has acquired early-stage startup Moose Capital, which specializes in tokenizing traditional stocks — aiming to allow users to buy and sell shares of companies like Nvidia and Tesla directly on the Solana blockchain.

Step Finance is designed to serve as a portfolio management tool and analytics hub for Solana users. It is also the owner of media company SolanaFloor and Solana Allstars, a global events program active in over 50 cities.

In addition to acquiring the Moose Capital product, which it plans to rebrand to Remora Markets, Step Finance has also onboarded the startup’s team and its regulatory licenses in preparation for a Q1 2025 launch. "Moose Capital makes use of licenses across multiple jurisdictions including Canada, UAE and more and is currently expanding licensing to more jurisdictions for Q1," Step Finance co-founder George Harrap told The Block. Remora Markets will be available for KYC-verified clients in non-U.S. and non-EU territories.

“Tokenized stocks are an attractive investment for risk-averse traders who want to diversify their portfolios and bypass traditional barriers like high fees, slow settlement times, and limited geographic access to regional markets,” Harrap said in a statement. “No one else offers this on Solana, so we anticipate a high influx of traders coming to the platform because it’s faster, cheaper, and easier to trade tokenized stocks here than on any other chain.”

Tapping into the $14 billion RWA market

Tokenized stocks, which enable users to own fractional shares in real-world equities on the blockchain, have struggled to break through in the crypto space for several reasons, including regulatory uncertainty, custody and counterparty risks, lack of institutional support and competition from traditional platforms like Robinhood that already offer fractional shares.

Harrap agreed that regulatory uncertainty and obtaining suitable banking/broker connections were key barriers previously but said that recent political changes and growing demand for RWA tokenization, pioneered by tokenized Treasuries platforms, were changing the outlook.

Step Finance believes the acquisition can help it and the Solana ecosystem gain a significant share of the overall $14 billion real-world asset market, which includes private credit, U.S. Treasuries and corporate bonds, currently dominated by Ethereum. Excluding stablecoins, which recently topped $200 billion in assets, Ethereum commands a 76% share of total RWA value, according to data from RWA.xyz, with Solana currently accounting for just 3%.

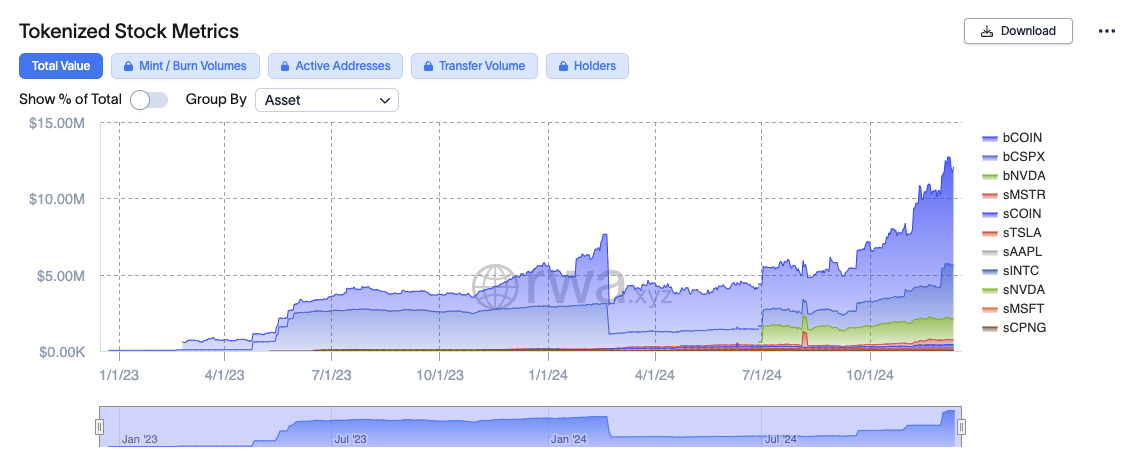

Onchain stocks specifically represent just $12 million of that figure, with $6 million on Ethereum, $5.3 million on Gnosis and $750,000 on Polygon, per RWA.xyz.

Tokenized stock metrics. Image: RWA.xyz .

“Just like Solana is the number one chain for token issuance, DEX volume and NFT volume, the same reasons that made it successful there will also apply to RWAs,” Harrap told The Block.

Moose Capital is Step Finance’s third acquisition since launching in March 2021, as part of its stated mission to enhance DeFi by bringing new liquidity and portfolio diversification to Solana’s ecosystem. “We’ve been building on Solana since 2021, so this acquisition is a natural fit into our suite of products,” Harrap said. “This also unlocks all licensed institutional activity for us at Step, be it MSTR style listings, launching ETFs and even more down the road.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report