Bitget’s BGB Sees 24% Leap, Climbs to New All-Time High

BGB’s surge to a new all-time high of $3.15 is fueled by strong momentum indicators like the ADX and MACD, suggesting the token could continue its upward trajectory.

Bitget’s BGB token has continued its bullish momentum, reaching a new all-time high of $3.15 during Wednesday’s early Asian session. However, it has since experienced a 3% pullback, trading at $3.10 at the time of writing.

Despite this slight retracement, BGB remains poised to reclaim and rally past this all-time high. This analysis explains why.

Bitget’s Uptrend Is Strong

BGB’s Average Directional Index (ADX) confirms that its current rally is strong and may continue in the mean term. As of this writing, it is at 56.24 and in an upward trend.

This indicator measures the strength of a trend, whether upward or downward, on a scale from 0 to 100. An ADX reading of 56.24 indicates a very strong trend, as values above 50 suggest strong momentum in the market.

BGB ADX. Source:

TradingView

BGB ADX. Source:

TradingView

BGB’s Moving Average Convergence Divergence (MACD) supports this bullish outlook. As of this writing, the token’s MACD line (blue) rests significantly above its signal line (orange).

An asset’s MACD indicator identifies trends and momentum in its price movement. It helps traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

As in BGB’s case, when the MACD line is above the signal line, it indicates bullish momentum, suggesting that the asset’s price may continue to rise. Traders often see this crossover as a potential buy signal, fueling increased token accumulation, which drives up prices.

BGB MACD. Source:

TradingView

BGB MACD. Source:

TradingView

BGB Price Prediction: Token May Surge Past New All-Time High

On a daily chart, BGB’s Chaikin Money Flow (CMF) reflects the high demand for the token. As of this writing, the indicator rests above the zero line at 0.28.

The CMF indicator measures the cumulative flow of money into or out of an asset over a specific period. It combines price and volume to show the buying and selling pressure in the market. When the CMF is positive, it indicates buying pressure, with more money flowing into the asset, suggesting that the asset may experience upward momentum.

BGB Price Analysis. Source:

TradingView

BGB Price Analysis. Source:

TradingView

If this uptrend continues, BGB will reclaim its all-time high of $3.15 and attempt to rally past it. On the other hand, a surge in profit-taking activity will cause BGB’s price to drop to $2.59, invalidating this bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

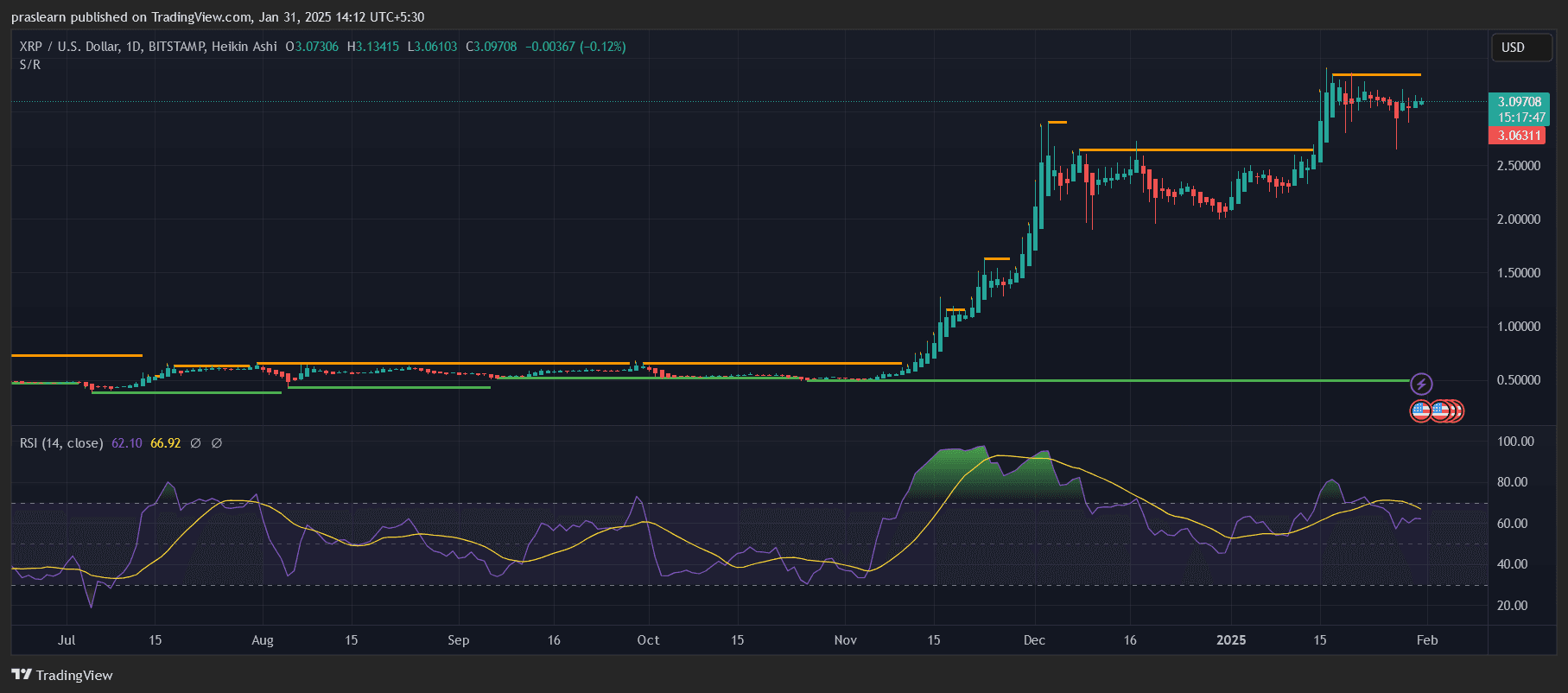

Ethereum (ETH) and XRP (XRP) Price Action Signals Key Breakouts: Is a Rally Incoming?

Dogecoin (DOGE) Supporter Elon Musk's Father Takes Action Before Him! He Will Earn $200 Million Using Musk's Name!

Errol Musk, father of Tesla CEO Elon Musk, said he plans to raise between $150 million and $200 million through a token project called Musk LT.

50-Year Analyst Peter Brandt Says He's Bullish on XRP, Reveals Price Targets!

Peter Brandt shared that he expects a rise in the Ripple (XRP) price.

Will XRP Price Reach $5 in February 2025?