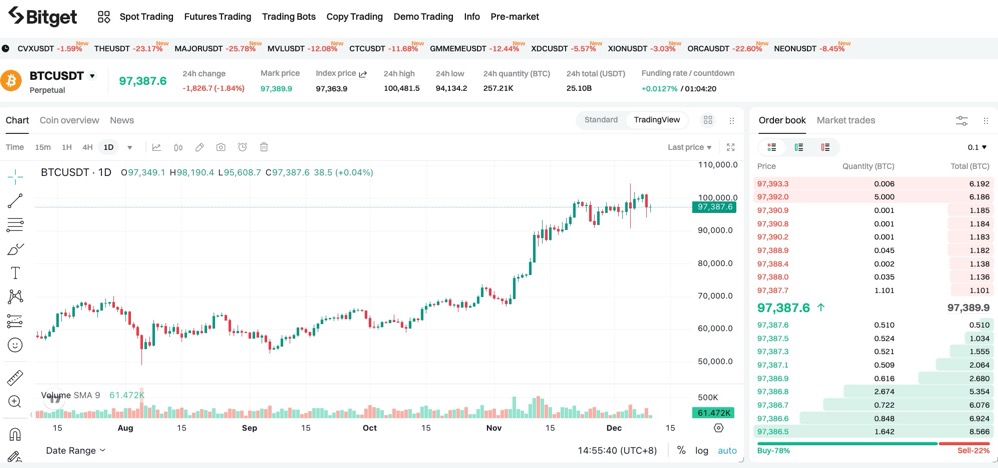

CryptoChan has released the latest analysis of the Bitcoin on-chain pricing model, covering multiple key bull market peak prediction lines. This model, known as the "Nine-Finger Capping Technique," has successfully captured several bull market highs in history. The latest data shows that the current price of Bitcoin has not yet broken through any of the capping lines, and the specific pricing is as follows:

🔴 Curve-Fitted MVRV Price:$128,715

🟠 Deviation-Corrected MVRV Price:$130,937

🟡 Fibonacci-Balanced Price:$139,431

🟢 Deviation-Corrected STH-MVRV Price:$142,622

🔵 Tradable Realized Price:$152,270

🟣 Fibonacci-Terminal Price:$170,671

🟤 Pow Top Price:$172,904

⚫️ Curve-Fitted Median MVRV Price:$174,516

⚪️ Thermocap Price:$187,534

Historical review: bull market peak breakthrough ceiling line situation

2011 bull market peak: Bitcoin price breaks through 6 caps.

The first peak of the bull market in 2013: breaking through 6 lines again.

The second peak of the bull market in 2013: this round is even more crazy, breaking through 8 lines.

At the end of 2017, the bull market reached its peak and broke through 9 lines.

The peak of the first half of 2021: Bitcoin broke through six ceiling lines.

As of now, the price of Bitcoin has not touched any ceiling line. This means that the market may not have reached the true peak of this bull market. Based on past bull market patterns, there is usually a significant price surge before the bull market peaks, even breaking through multiple ceiling lines.

Investors need to pay attention to:

Price Breaks Key Ceiling Lines: If Bitcoin starts to gradually break through these pricing lines, it may mean that the bull market is approaching its peak.

On-chain data changes: Market sentiment, on-chain active level, miner income and other indicators are also worth tracking continuously.

Historical reference: Reviewing the top characteristics of the bull market in 2011, 2013, 2017, and 2021 can help judge the market trend.

The bull market rhythm of Bitcoin seems to be continuing, with nine caps not yet broken and the top may not have appeared yet. The next market trend is worth every investor's attention.