- Bitcoin ETFs gained $10B post-election, raising total assets to $113B with institutions.

- Pro-crypto regulatory shifts hint at supportive policies under the new administration.

- Bitcoin hits $100K, while Ether ETFs see $2B inflows, outpacing Bitcoin gains.

Following the U.S. presidential election, Bitcoin exchange-traded funds (ETFs) experienced a surge in capital inflows, signaling increased institutional interest in these investment products. Data compiled since Election Day, November 5, reveals nearly $10 billion in net subscriptions into Bitcoin ETFs.

According to information acquired by Bloomberg, top issuers like BlackRock Inc. and Fidelity Investments contributed to these inflows, with Bloomberg reporting a combined net inflow of $9.9 billion since the election outcome. The influx pushed the sector’s total assets to $113 billion, underscoring Bitcoin ETFs’ growing significance.

Record-Breaking Inflows Highlight Institutional Interest

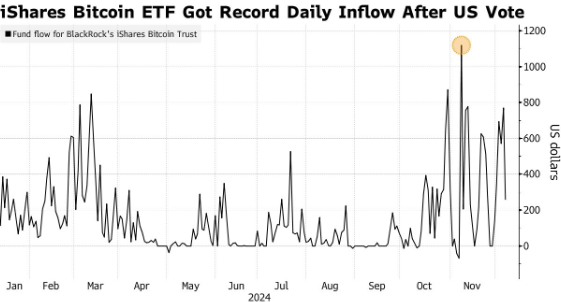

Daily flows into BlackRock’s iShares Bitcoin ETF hit record-breaking levels in November, with $1.2 billion in single-day inflows, as shown in Bloomberg’s tracking chart. Smaller inflow spikes occurred earlier in the year during March, July, and October, reflecting a consistent upward trajectory in institutional engagement.

Source: Bloomberg

Source: Bloomberg

Market observers interpret these peaks as evidence of growing confidence in Bitcoin ETFs and broader cryptocurrency adoption.

Policy Shifts Boost Optimism for Digital Assets

The election also brought regulatory optimism, as the president-elect nominated Paul Atkins, a pro-crypto advocate, to head the U.S. Securities and Exchange Commission (SEC).

Additionally, the new administration created a White House role dedicated to artificial intelligence and digital assets, signaling a more supportive stance toward cryptocurrencies. Reports also revealed discussions about establishing a strategic national Bitcoin reserve, which could further bolster institutional adoption.

Bitcoin and Ether ETFs Gain Ground

Despite Bitcoin reaching a historic six-figure valuation, market volatility dragged its price back to $92,000. Analysts, including FalconX’s David Lawant, suggest that additional catalysts will be needed for Bitcoin to sustain a decisive move beyond the $100,000 threshold.

Read also: Trump’s Crypto-Friendly Stance Sparks $6.2B ETF Inflows in November

Meanwhile, spot Ether ETFs, approved by U.S. regulators, have drawn $2 billion in net inflows since the election. Ether’s strong performance relative to Bitcoin highlights its growing appeal among investors.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.