Option Flow: Breach and Cascade

From deribit insight by Tony Stewart

In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

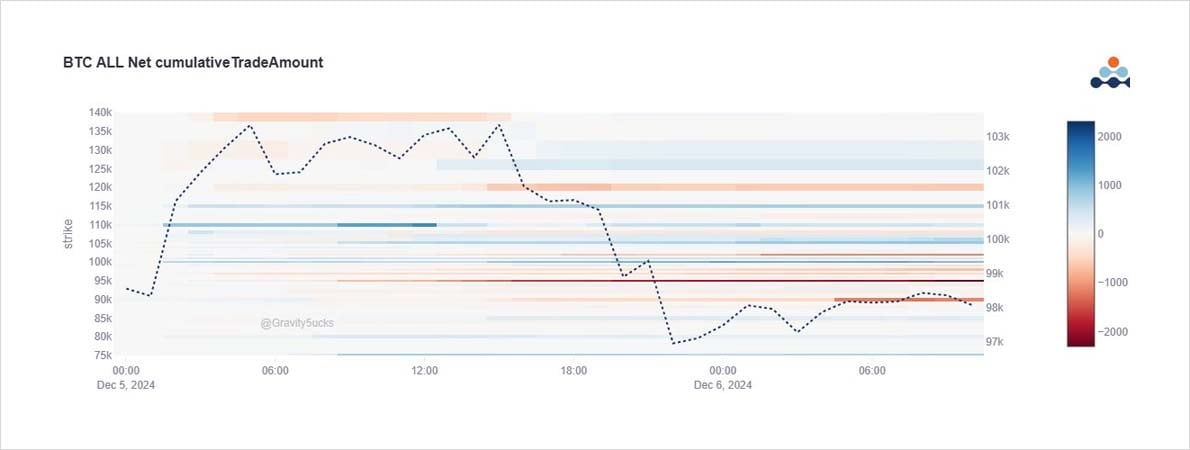

Quite a day.BTC breaches 100k asserting 103.6k ATH.Call buyers at first add, anticipating further upside, but as Spot stalls, sellers of Dec 95k+110ks hit the tape.Retrace below 100k remains controlled+orderly, funding+IV drifts lower.Sudden cascade flush <90k and bounce.

2) Chart shows:Initial buying of Dec 100+105+110k Calls on the breach of 100k.Followed by Jan 110-160k Call spreads.But as Spot stalls >103k, a seller of 95k Calls (odd data shows not a TP), and roll of 95k to 105ks, and then a fresh seller of Dec 110k Calls dominate the size.

3) IV and funding firmed as Spot pushed up, then drifted back as 100k didn’t hold.A rumored OKEX whale sold BTC post-US hours into a lower liquidity window which set off a violent cascade <90k.Option engines briefly turned off, IV raised higher, and little traded; BTC bounced.

4) BTC now knows its current bounds: 89k-103.6k.

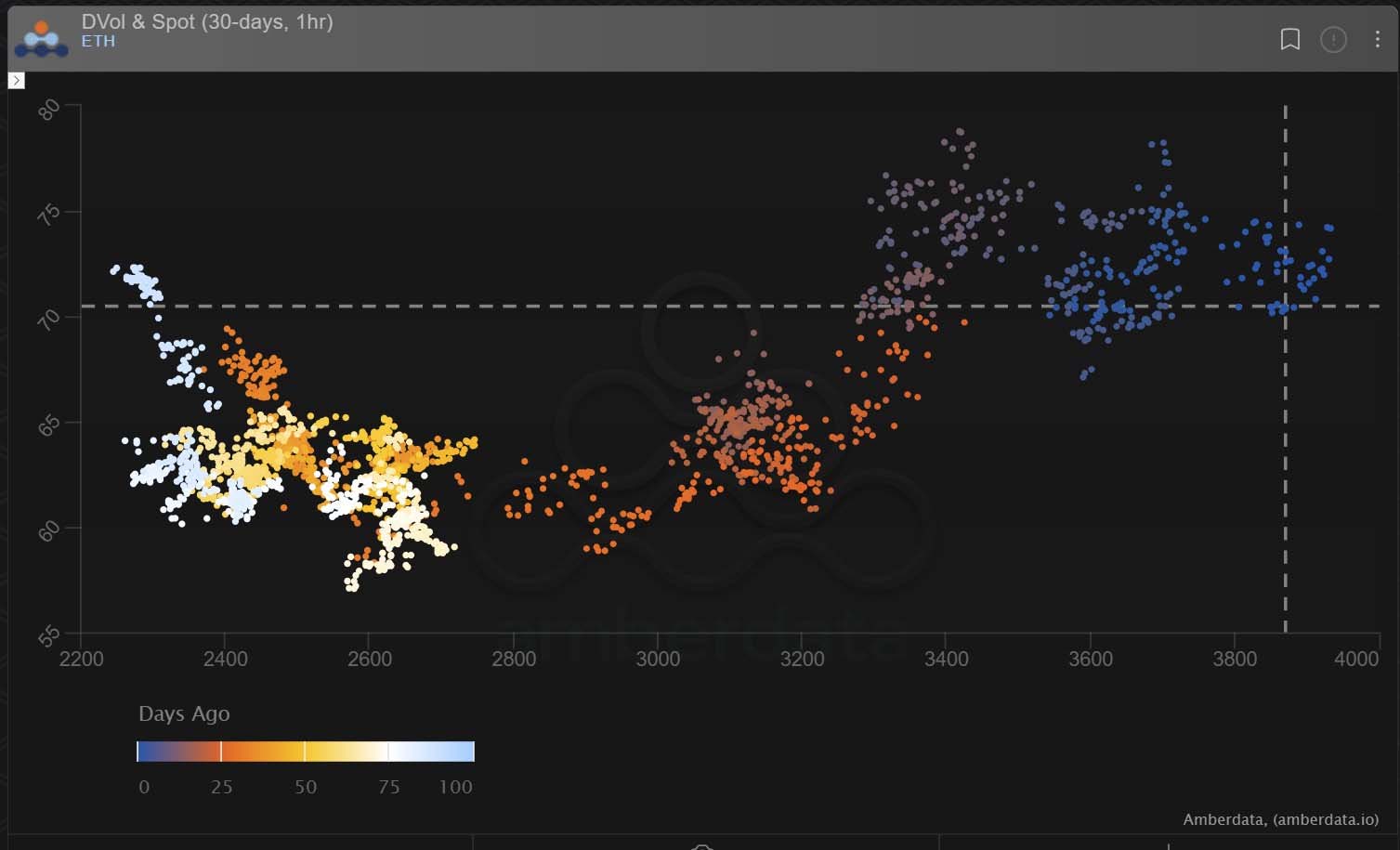

ETH doesn’t arguably yet -within its short-term range- being obviously well below ATHs.

ETH Option Funds are still long Calls (+spreads), and ETH IV has been firming relative to Spot on this rally and sits at >10% premium to BTC.

View Twitter thread .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.