Ethereum Hits 3-Year High as ETFs See Record $752 Million Weekly Inflows

Ethereum hits $4,089, a 3-year high, driven by record $428.4M ETF inflows. Institutional interest signals growing confidence in ETH.

Ethereum (ETH) surged to its highest price in nearly three years on Thursday, December 6, reaching $4,089.

The increase follows significant institutional interest, with US Ethereum ETFs seeing their largest single-day net inflow of $428.4 million on December 5.

A Revival of Institutional Investments in Ethereum ETFs

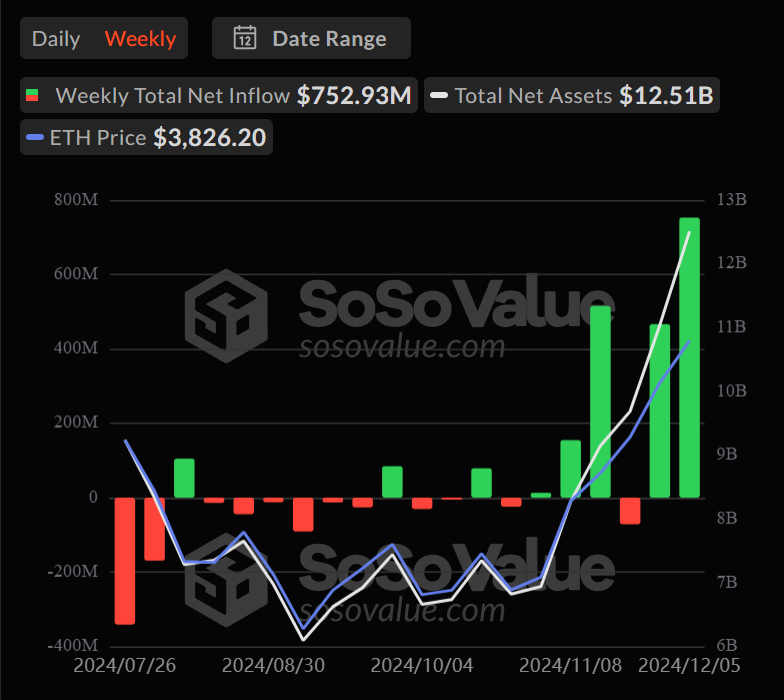

Leading the inflows was BlackRock’s ETHA fund, followed by Fidelity’s FETH. These contributions also pushed Ethereum ETFs to record their largest weekly net inflow since launching in July.

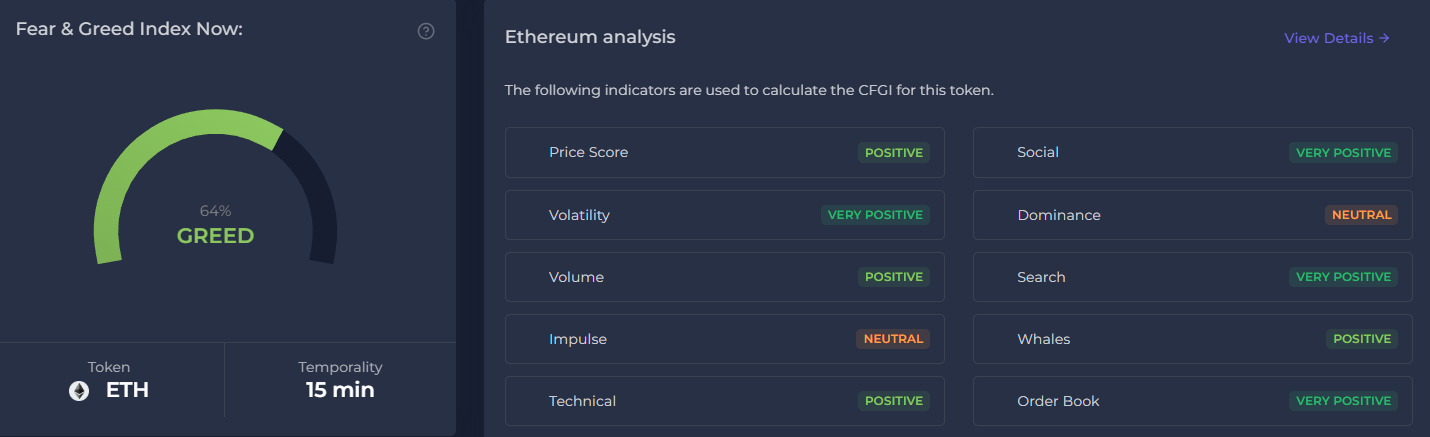

The total weekly inflow stands at $752.9 million in the first week of December. This is already a record weekly gain for the funds, even without the final figures for Friday. This wave of institutional investment spurred Ethereum’s price growth and shifted the fear and greed index to “greed,” currently at 65.

ETH Fear and Greed Index. Source:

CFGI

ETH Fear and Greed Index. Source:

CFGI

Ethereum ETFs have had a slower start in the US compared to Bitcoin ETFs. The first month of launch saw only one week of positive inflow. Currently, the total assets across nine ETFs stand at $12.5 billion. This accounts for roughly 2.7% of Ethereum’s total supply.

However, November marked a turning point, with monthly inflows exceeding $1 billion, signaling growing institutional interest despite earlier outflows.

Ethereum ETF Net Weekly Info from July to December 2024. Source:

SoSoValue

Ethereum ETF Net Weekly Info from July to December 2024. Source:

SoSoValue

A notable development came from the State of Michigan Retirement System (SMRS), which became the first US state pension fund to invest in an Ethereum ETF. SMRS now holds 460,000 Grayscale Ethereum shares and 110,000 ARK Bitcoin ETF shares as part of its diversified crypto portfolio.

Meanwhile, other altcoins are also entering the ETF race. Firms like VanEck, 21Shares, and Grayscale have filed for Solana ETFs. Also, WisdomTree and Bitwise are among four firms seeking approval for XRP ETFs.

As US regulations appear to adopt a more crypto-friendly stance, the ETF market for digital assets is likely to expand.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Gains Edge in ETF Race Over SOL and DOGE, Says Kaiko

Strive Pushes Intuit to Add Bitcoin to Treasury

Strive urges Intuit to hold Bitcoin in its treasury to hedge against AI-driven disruption risks.Bitcoin as a Hedge Against AI Disruption?Why Bitcoin, and Why Now?BTC in the Boardroom

JP Morgan Predicts Imminent Interest Rate Cuts

JP Morgan forecasts upcoming rate cuts, signaling a major shift in U.S. economic policy that could impact markets and crypto alike.JP Morgan Signals Upcoming Interest Rate CutsWhy Rate Cuts Matter for MarketsCrypto Could See Renewed Interest

Raydium launches Launch Lab, a token issuance platform