Analysts say altcoins’ resilience amid heightened Bitcoin volatility signals potential decoupling

Quick Take According to analysts, altcoins are showing greater stability as Bitcoin experiences sharp volatility, retreating below the $100,000 mark.

Major altcoins are outperforming Bitcoin across both weekly and monthly metrics, showing greater stability despite Bitcoin’s recent volatility. After reaching a record high of over $103,000, Bitcoin has dropped over 5% in the past 24 hours, slipping below the $100,000 mark. In contrast, leading altcoins like Ethereum and Solana have weathered the downturn with only minor retracements of about 1%.

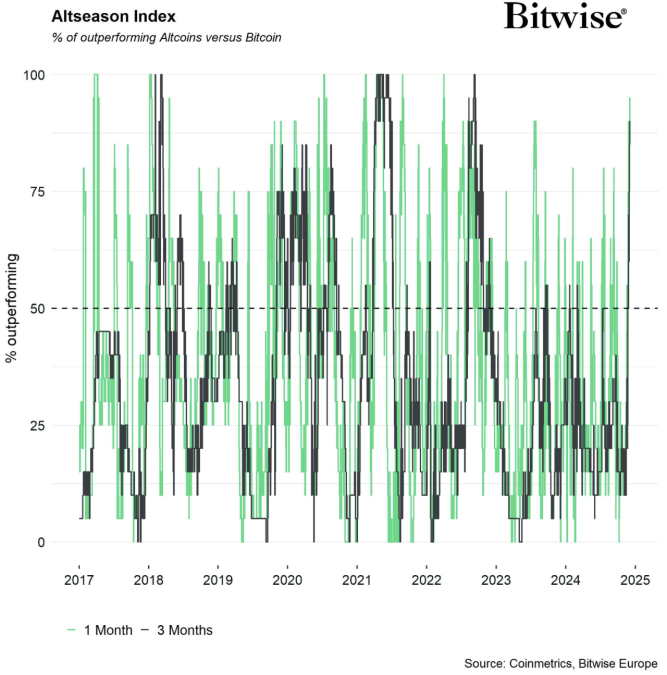

According to Bitwise European Head of Research Europe André Dragosch, an increasing number of altcoins have outperformed Bitcoin since the U.S. election in early November. "Our own altseason index indicates that 85% of our tracked set of altcoins managed to outperform Bitcoin over the past 30 days," Dragosch told The Block. "What is more is that altcoins appear to be driven by a larger variety of different investment narratives as they are exhibiting an increasing performance dispersion amongst each other."

Dragosch noted that Bitwise's data shows a growing decoupling between Bitcoin and major altcoins . "Performance correlations between altcoins and Bitcoin have come down considerably," he explained. "Less correlation implies that there is more potential for alpha/outperformance in altcoins than before the U.S. election."

Altcoins are showing greater price stability amid a sharp pullback by bitcoin. Image: Bitwise

He added that performance dispersion among altcoins has reached its highest level since March 2024, which "highlights the diversification of investment narratives driving the market."

Dragosch also pointed to record inflows into crypto exchange-traded products as a sign of increasing investor interest. "Weekly inflows into global crypto ETPs just hit the highest level on record, with $3.98 billion having flowed into global crypto ETPs over the past 5 days," Dragosch said. He added that Ethereum ETP inflows also set a new daily record high on Thursday.

Bitcoin price volatility increases after reaching new all-time high

After breaking above $103,000, Bitcoin experienced heightened volatility over the past 24 hours, sharply retracing to $92,000 during U.S. trading hours, before stabilising at around $98,000. This drop triggered over $487 million in Bitcoin liquidations and a total of $893 million across the crypto market, according to Coinglass data . "Volatility is expected to remain elevated in the coming weeks, and the release of U.S. job reports later on Friday that could further heighten market volatility," BRN analyst Valentin Fournier told The Block.

Cryptocurrency market participants will be closely watching the upcoming U.S. jobs report for signs that could influence the Federal Reserve's monetary policy decision on Dec. 18. “Economists anticipate around 200,000 new jobs in November, rebounding from October’s weak numbers caused by hurricanes and labor strikes,” Bitfinex Head of Derivatives Jag Kooner told The Block. "A robust jobs report could lead the Federal Reserve to reconsider the pace of interest rate cuts, potentially opting for a more gradual approach, a scenario that might strengthen the U.S. dollar and apply downward pressure on risk assets."

"A disappointing report may intensify concerns over recurring inflation, while strong economic data would support expectations for additional rate cuts," Fournier added.

The Federal Reserve's next Federal Open Market Committee (FOMC) meeting in December will likely play an essential role in shaping the crypto market trajectory. According to the CME FedWatch tool , there is currently a 72.1% probability of a 25-basis-point rate cut at the meeting. "A rate cut is a development that could provide further support for digital assets," Fournier said. Lower interest rates generally benefit Bitcoin by reducing borrowing costs, increasing market liquidity, and weakening the U.S. dollar.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — SAHARA/USDT!

SAHARAUSDT now launched for futures trading and trading bots

New spot margin trading pair — H/USDT!

Bitget x BLUM Carnival: Grab a share of 2,635,000 BLUM