Bitcoin's path to $100,000 requires new buyers absorbing long-term holder sell pressure, analysts say

Quick Take Bitfinex analysts suggested that bitcoin’s path to $100,000 hinges on rising short-term demand balancing long-term holder profit-taking. Strong demand for spot bitcoin ETFs could be a catalyst pushing bitcoin’s price to $100,000, Copper.co head of research said.

Bitfinex analysts see bitcoin's upward momentum as being dependent on balancing short-term holder (STH) demand with long-term holder (LTH) supply.

The analysts said STH supply is nearing its cycle high of 3.28 million bitcoin—a level historically associated with the onset of bull market peaks. "This indicates rising retail interest but also underscores the need for incoming demand to absorb LTH profit-taking," the analysts told The Block.

Increased profit-taking by long-term holders is putting pressure on bitcoin's upward momentum, Bitfinex noted, potentially hindering further gains for the leading digital asset by market capitalization.

"Supply entering the bitcoin market from the LTH cohort has remained sustained over the past two weeks and a lack of spot demand to absorb this supply could result in a further pullback in price," they said.

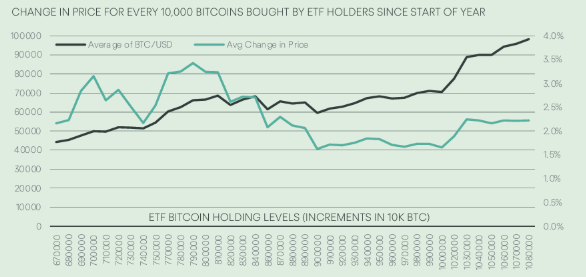

Change in price for every 10,000 bitcoins bought by ETF holders. Image: Copper.co

Bitcoin ETF inflows suggest $100k milestone within reach

As crypto investors speculate on the possibility of bitcoin reaching the $100,000 milestone, one analyst suggested that spot exchange-traded fund inflows could be the catalyst to push the digital over the line.

Copper.co Head of Research Fadi Aboualfa highlighted the potential impact of ETF-driven demand on bitcoin's price, noting that recent ETF inflow data paints an optimistic picture, suggesting the $100,000 milestone may be within reach.

"Every 10,000 bitcoin added by ETFs has historically increased bitcoin’s price by 2.2%,” Aboualfa said in an email to The Block. “Given current holdings of 1.08 million bitcoin, ETF inflows of around $1.9 billion would be enough to purchase an additional 20,000 bitcoin, and could lead to a $100,000 bitcoin within as little as a week or two.”

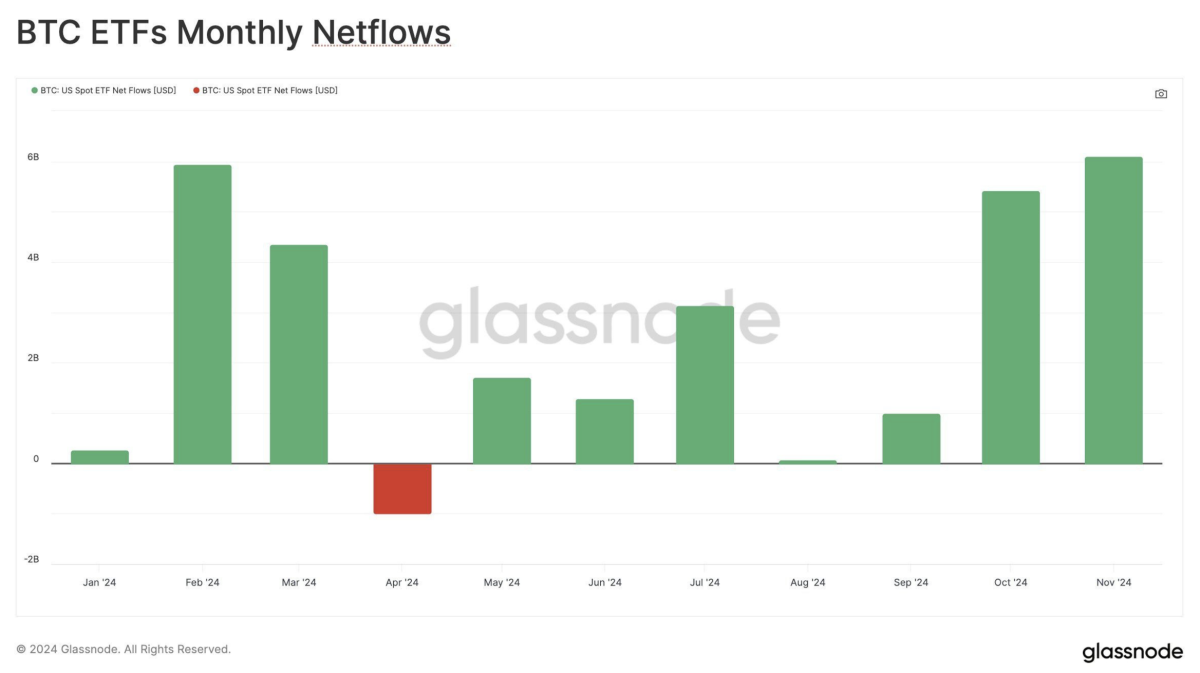

Bitcoin spot ETFs see record monthly inflows in November. Image: Glassnode.

Spot bitcoin ETF inflows remained strong on Wednesday, accumulating another $676 million worth of the digital asset. "These significant inflows underscore growing institutional interest and suggest solid support levels," BRN analyst Valentin Fournier told The Block.

Fournier predicts bitcoin will benefit from these continued institutional inflows. "We anticipate that bitcoin will benefit from sustained institutional inflows and could attempt a breakout in the coming week," Fournier said.

According to Glassnode data, November set a new record for spot bitcoin ETFs. Bitcoin ETFs saw inflows totaling $6.1 billion over the past month, with $5.4 billion inflows into BlackRock's IBIT fund.

Meanwhile, the bitcoin market faced headwinds this week with reports of significant bitcoin movements linked to the U.S. government. According to an X post from Arkham on Tuesday, authorities transferred approximately 19,800 BTC (worth $1.9 billion) to a Coinbase Prime wallet. These funds were seized in the Silk Road investigation.

Amid increased ETF inflows, bitcoin's price increased by about 2% over the past 24 hours, now trading above the $96,000 mark, according to The Block’s Bitcoin Price Page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ETF Surges with $970M Inflow: Can this Propel BTC to Greater Heights?

Institutional Investments on the Rise: Can Bitcoin Harness the Momentum Amid Debatable Fundamentals?

Ripple and SEC File Motion to End Lawsuit

Israel’s Strike on Iran Raises Oil Prices, Crypto Volatility

Amazon and Walmart Consider Launching Stablecoins