Bitget Daily Digest | Political turmoil in South Korea sparks panic, ETH on-chain trading volume hits new yearly high (December 4)

Market highlights

1. South Korea's President Yoon Suk Yeol declared emergency martial law in response to growing unrest, leading to a sharp decline in token prices on South Korean exchanges. Yoon accused opposition parties of undermining national order, pledging to eliminate "anti-state forces." Market panic ensued, with Bitcoin's trading pair against the Korean Won on Upbit briefly dropping to $63,300.

2. The TikTok-inspired $Chillguy token showed signs of recovery. Meanwhile, $TETSUO, a Solana-based token, surged to a $50 million market cap within just 8 hours. New AI agent projects $SERAPH and $CHAOS, within the Virtual Protocol ecosystem, also saw price increases.

3. Vitalik Buterin outlined his vision for crypto wallets, focusing on cross-Layer-2 transactions and enhanced privacy protection. Ethereum's on-chain trading volume soared to $183.7 billion in November, its highest point this year. Additionally, the Blast community proposed using $36 million in annual revenue to buy back $BLAST tokens, fueling speculation on the token's future value.

4. Legacy coin resurgence: Tokens such as $XRP, $HBAR, and $TRX saw a resurgence, ranking among the top assets by trading volume on South Korean exchanges like Upbit. Monitoring trading leaderboards on South Korea-based exchanges could offer insights into abnormal capital movements and identify promising tokens.

Market overview

1. Bitcoin briefly dipped to 93,500 USDT before rebounding, sparking an overall market uptick. Several sectors posted significant gains, with Justin Sun-associated tokens leading the way.

2. The Nasdaq and SP 500 reached new highs, while the Dow Jones and small-cap stocks experienced declines. Chinese concept stocks showed positive momentum.

3. Currently priced at 95,651 USDT, Bitcoin faces significant liquidation risks. A 1000-point drop to around 94,651 USDT could result in over $240 million in cumulative long position liquidations. Conversely, a rise to 96,651 USDT could trigger more than $1.71 billion in cumulative short position liquidations. With short liquidation volumes far surpassing long positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

4. Over the past day, Bitcoin saw $4.14 billion in spot inflows and $4.48 billion in outflows, resulting in a net outflow of $340 million.

5. In the last 24 hours, tokens like $BNB, $RSR, $NEIRO, $XVG, and $ZKJ led in net inflows in futures trading, signaling potential trading opportunities.

Highlights on X

1. Sleeping in the Rain: December outlook on Thread

AI agents are set to surpass memecoins, focusing on differentiated content and behavior patterns. Ethereum is poised for an uptrend, driven by growing institutional participation and the integration of real-world assets (RWA). A major battle for dominance among public blockchains is anticipated, with Fantom and Avalanche expected to take center stage. Technologies enabling chain abstraction, such as Particle and NEAR, will simplify blockchain applications and promote cross-chain interactions.

X post: https://x.com/0xSleepinRain/status/1863822602013454691

2. @Mtyl_7th: Memecoin trading insights — From 10 SOL to 1000 SOL in 2 months

From personal trading experience, the author outlines key strategies in the memecoin market, emphasizing that understanding "who you're earning from" is crucial for profitability. Two main strategies include capitalizing on market sentiment-driven hype and profiting from strong narratives that trigger bottom breakouts.

X post: https://x.com/Mtyl_7th/status/1863849191283548406

3. @yuyue_chris: Memecoin selection and market strategies

Controversy stirred as speculation mounted around Paul Atkins possibly becoming the next SEC Chair, with rumors linking him to crypto projects like $RSR and $DTF. This news caused price volatility for $RSR but was later debunked as clickbait. While there remains a chance Atkins could be appointed, the current market sentiment is driven by emotional speculation, making it crucial to carefully manage risk and employ solid trading strategies.

X post: https://x.com/yuyue_chris/status/1864019687505568098

4. @Michael_Liu93: Memecoin types, and PvP vs. manipulated market

Before investing in memecoins, it’s crucial to identify whether you are engaging in a PVP (player-vs-player) market or a manipulated market. A PVP market is a short-term, emotion-driven game that requires rapid responses, while manipulated markets are dominated by whales, offering higher potential rewards but also greater risks. Methods to identify this include analyzing whether top wallets belong to whales, observing their trading patterns, and avoiding blind imitation. Understanding the fundamental rules of the market is essential for achieving long-term success in the memecoin space

X post: https://x.com/Michael_Liu93/status/1863902813241426237

Institutional insights

1.CryptoQuant: This altcoin season lacks new liquidity, with only a few projects standing out.

X post: https://x.com/ki_young_ju/status/1863799907649507357

2.BitMEX: High FDV and low circulation models struggle to meet investor demands, suggesting that ICOs are a more equitable and promising way of capital formation.

X post: https://x.com/CryptoHayes/status/1863723833393623277

3.CryptoQuant: Bitcoin exchange reserves have dropped to their lowest levels in years.

News updates

1. South Korea's National Assembly passes a request to lift the martial law order.

2. South Korean regulator says it is ready to mobilize a 10 trillion-won ($7 billion) stock market stabilization fund.

3. South Korea’s largest opposition party urges President Yoon Suk-yeol to resign immediately or face impeachment.

4. South Korean government: South Korea will inject unlimited liquidity to the market when necessary.

5. Celsius founder Alex Mashinsky pleads guilty to two counts of fraud.

6. Cambodia blocks 16 cryptocurrency trading websites, including Binance and Coinbase.

Project updates

1. Orderly Network: The ORDER token is now live on the Solana network.

2. Lista DAO puts forward a new proposal to provide 1 million lisUSD to Avalon Labs and streamline the governance process.

3. Kakarot abandons the deployment of Starknet and plans to launch an EVM proof engine in 2025.

4. SynFutures announces the airdrop rules for its F token, which will be available for claiming starting December 6.

5. pump.fun sets new revenue record of $93 million in November.

6. XRP Ledger slashes reserve requirements from 10 to 1 XRP to lower adoption barriers.

7. ai16z's eliza codebase has been updated, with improvements including optimized X content generation.

8. MOODENG becomes Wintermute's largest memecoin holding, valued at approximately $35.39 million.

9. Spectral: Vulnerabilities in the Syntax contract have been identified and fixed. Operations will resume after the audit is completed.

10. A new proposal from the Blast community suggests buying back BLAST tokens with its annual yield of $36 million.

Token unlocks

Ethena (ENA): 12.86 million tokens valued at $10.5 million (0.45% of circulating supply)

EigenLayer (EIGEN): 1.29 million tokens valued at $4.9 million (0.69% of circulating supply)

Recommended reads

DeSci at the crossroads: return to value-driven approach or follow the meme trend?

Scientific research, particularly in medicine, requires years or even decades of commitment—standing in stark contrast to the market's obsession with “quick profit” projects. So why did DeSci gain so much attention in November? Was it driven by record-high meme sentiment, leading to market corrections? Or is DeSci just a new meme trend disguised as altruistic innovation?

Read the full article here: https://www.bitgetapp.com/zh-CN/news/detail/12560604391826

Why did CRV rally? Which relevant tokens are worth paying attention to?

While Bitcoin stagnated near the psychological threshold of $100,000, altcoins surged, causing Bitcoin's market share to dip below 55% at one point. The DeFi sector performed notably, rising over 20% in the past 7 days. Curve Finance's token CRV led the way with a weekly increase of over 50%, outperforming most tokens in the Curve ecosystem, except for THE and Convex Finance (CVX), among large-cap DeFi tokens. What’s driving CRV’s rally? What's its potential, and which other tokens in the ecosystem are worth monitoring?

Read the full article here: https://www.bitgetapp.com/zh-CN/news/detail/12560604392141

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ARK Invest Raises 2030 Bitcoin Price Target to as High as $2.4M in Bullish Scenario

XRP News: What's on May 19 for XRP?

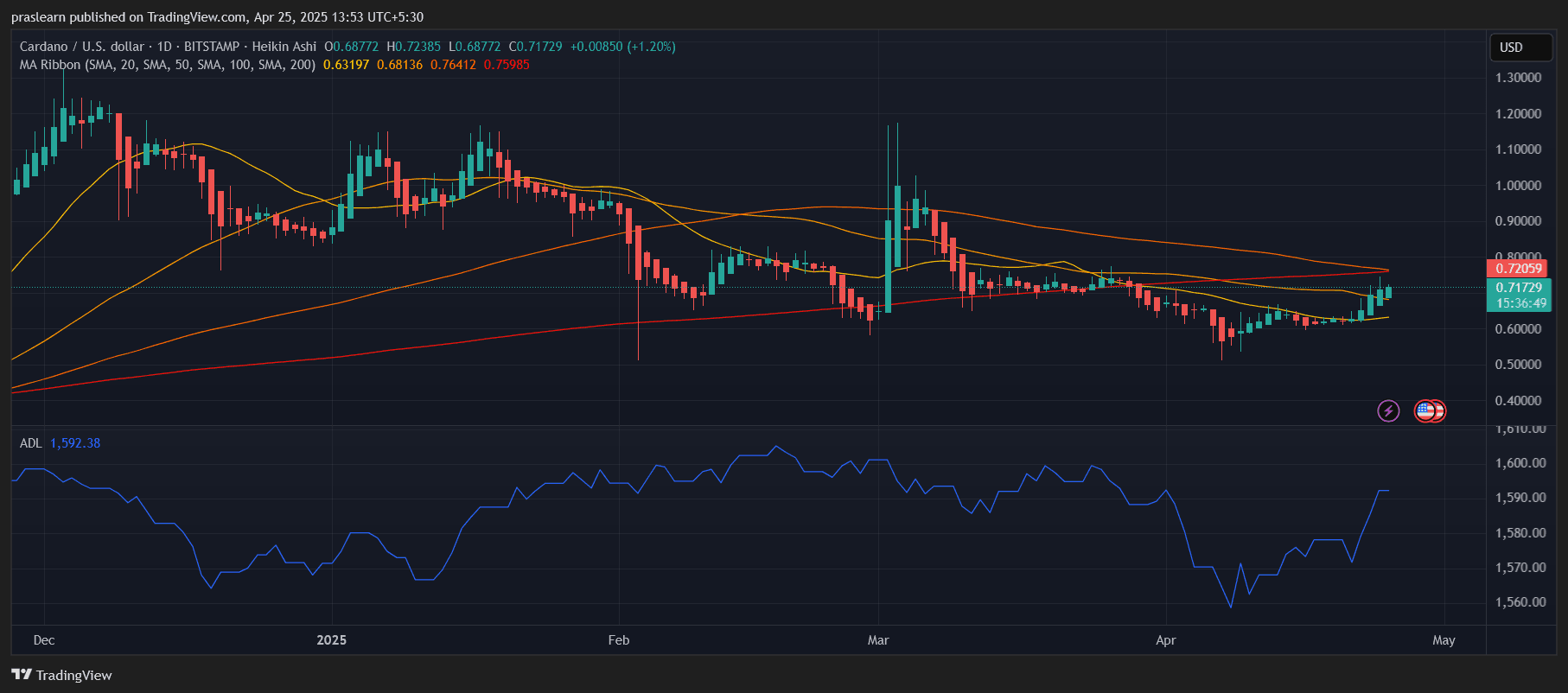

ADA Explodes Past $0.70 — What Now?

PEPE Dips Slightly – But Whales Are Still Accumulating. Should You Follow?

Pepe's funding rate has risen strongly in the past couple of days, one of several signals that more gains are coming.